Permabanned

- Joined

- 29 Jul 2008

- Posts

- 198

- Location

- Brisbane Australia

there are many sources.

aggregate sales data isn't always easy to find. always assumptions about this that or the other "source" being accurate.

so called "market research" organisations.

peddies for example.

going by the current hype, here elsewhere, toober sentiments. regardless it has been about spruiking the latest hardware releases...for decades.

pick your search engine. google isnt the only one.

Peddies:

JPR predicts that iGPUs will dominate the PC segment, with penetration expected to reach 98% within the next five years.

I can surmise from this that there are a **** tonne of pc's being churned out compared to the number which have AIB's in them.

market hype is powerful. just look at the ETH mining craze and gpu's. even now there are people still offloading multiple gpu's.

=

in the past ive sold a bunch of stuff, pc stuff, that is still relevant in the hype circus. also i have a bunch of defunct e-waste, yesterday's merch. sitting in my cupboards. i know others who have done this at a scale multiple times more than myself. gets a bit old. the habit.

aggregate sales data isn't always easy to find. always assumptions about this that or the other "source" being accurate.

so called "market research" organisations.

peddies for example.

going by the current hype, here elsewhere, toober sentiments. regardless it has been about spruiking the latest hardware releases...for decades.

pick your search engine. google isnt the only one.

Peddies:

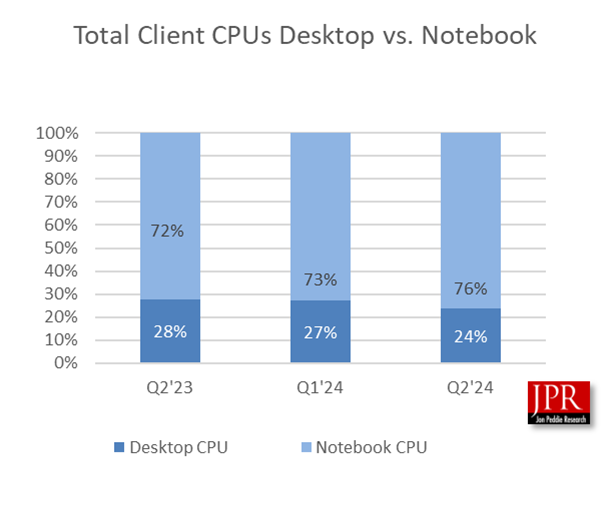

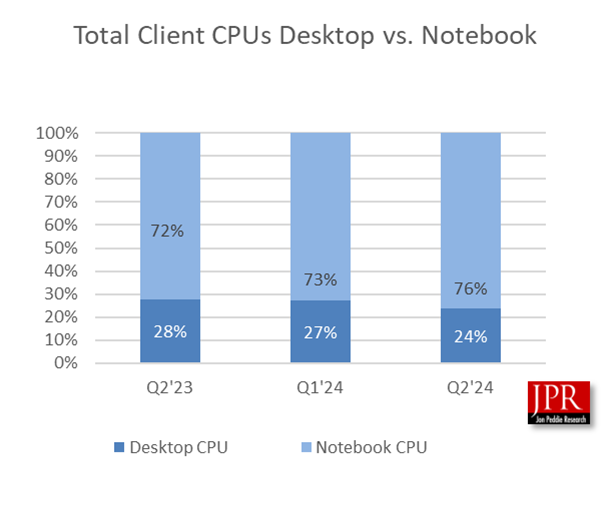

- Q1 2024

PC CPU shipments decreased by 9.4% sequentially, but increased by 33% year over year. JPR suggests that this may indicate the market has stabilized and returned to its normal cyclic behavior.

JPR predicts that iGPUs will dominate the PC segment, with penetration expected to reach 98% within the next five years.

I can surmise from this that there are a **** tonne of pc's being churned out compared to the number which have AIB's in them.

market hype is powerful. just look at the ETH mining craze and gpu's. even now there are people still offloading multiple gpu's.

=

in the past ive sold a bunch of stuff, pc stuff, that is still relevant in the hype circus. also i have a bunch of defunct e-waste, yesterday's merch. sitting in my cupboards. i know others who have done this at a scale multiple times more than myself. gets a bit old. the habit.

Last edited: