And this!

I only skimmed it, so maybe something I missed, but why the rip-off of nVidia's presenting style LOL...

Last edited:

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

And this!

Due to been the Nvidia of the CPU market?I only skimmed it, so maybe something I missed, but why the rip-off of nVidia's presenting style LOL...

Plenty of speculation that Qualcomm might be buying large parts of Intel or purchasing them outright which is driving that increase. Given the troubles their having with ARM at the moment it's only adding fuel to the rumours.There stock just jumped over 10%, you need to warn us before predicting doom so I can load up!

Didn't they also announce more layoffs? Stock market speculators always take perverse pleasure in layoffs.There stock just jumped over 10%, you need to warn us before predicting doom so I can load up!

Nothing to do with that and they didn’t announced new layoffs. The company just beat expectations and outlook is better than what was expected.Plenty of speculation that Qualcomm might be buying large parts of Intel or purchasing them outright which is driving that increase. Given the troubles their having with ARM at the moment it's only adding fuel to the rumours.

Didn't they also announce more layoffs? Stock market speculators always take perverse pleasure in layoffs.

Or they think the huge write-downs imply they intend to get the worst over with quickly, or Intel is about to get more corporate welfare.

However, even if Intel "18A" (whose specs currently sound a lot more like what Intel had initially promised for Intel 20A) is a success Intel's own volumes isn't enough to pay for it and they have no real external customers.

ARL is a disaster, and while their current server parts are a lot closer to AMD's their costs are a lot higher for worse performance. Plus they have nothing for the AI hype while AMD - who where also later to the AI party - now get around 50% DC revenue from Instinct.

Stock markets behave strangely but I see no grounds for optimism for Intel.

They may lay off some employees but they will always retain their 'creative accountants' - they are the bestSaw this quoted in another forum:

"Here is a tidbit from Intel 10Q, related to client, QoQ numbers from Q2 to Q3:

Desktop: - $457m ( - 18%)

Notebook: + $408m ( + 9%)

What also happened in Q3: reports of instability / silicon degradation of Intel Raptor Lake CPUs, 13 + 14 gen (especially on desktop), followed up by multiple microcode revisions to address the issue.

It seems like nearly half a billion of business evaporating would be worth mentioning by Intel management in the earning report or conference call. Especially if it leads permanent loss of commercial desktop monopoly for Intel."

I guess only Intel themselves know how much of this is due to the RPL failures but that handling an issue poorly can eventually cost hugely in terms of perception was always obvious to many of us.

'.

'.

That Lunar Lake is a one off has been rumoured for a while now. Possibly even official or semi official roadmap have shown no follow up.They may lay off some employees but they will always retain their 'creative accountants' - they are the best'.

some things I didn't know

Intel CEO Says Lunar Lake Will be Its Only CPU With On-Package Memory

Though the design provides many benefits, the downsides are too much to bear for Intel's margins.www.extremetech.com

Intel Reportedly Lost a Steep Discount at TSMC With Dismissive Comments About Taiwan

CEO Pat Gelsinger made comments that allegedly offended TSMC.www.extremetech.com

had to happen. how relevant are intel now?Nvidia to join Dow Jones Industrial Average, replacing rival chipmaker Intel.

slightly relevant? lolhow relevant are intel now?

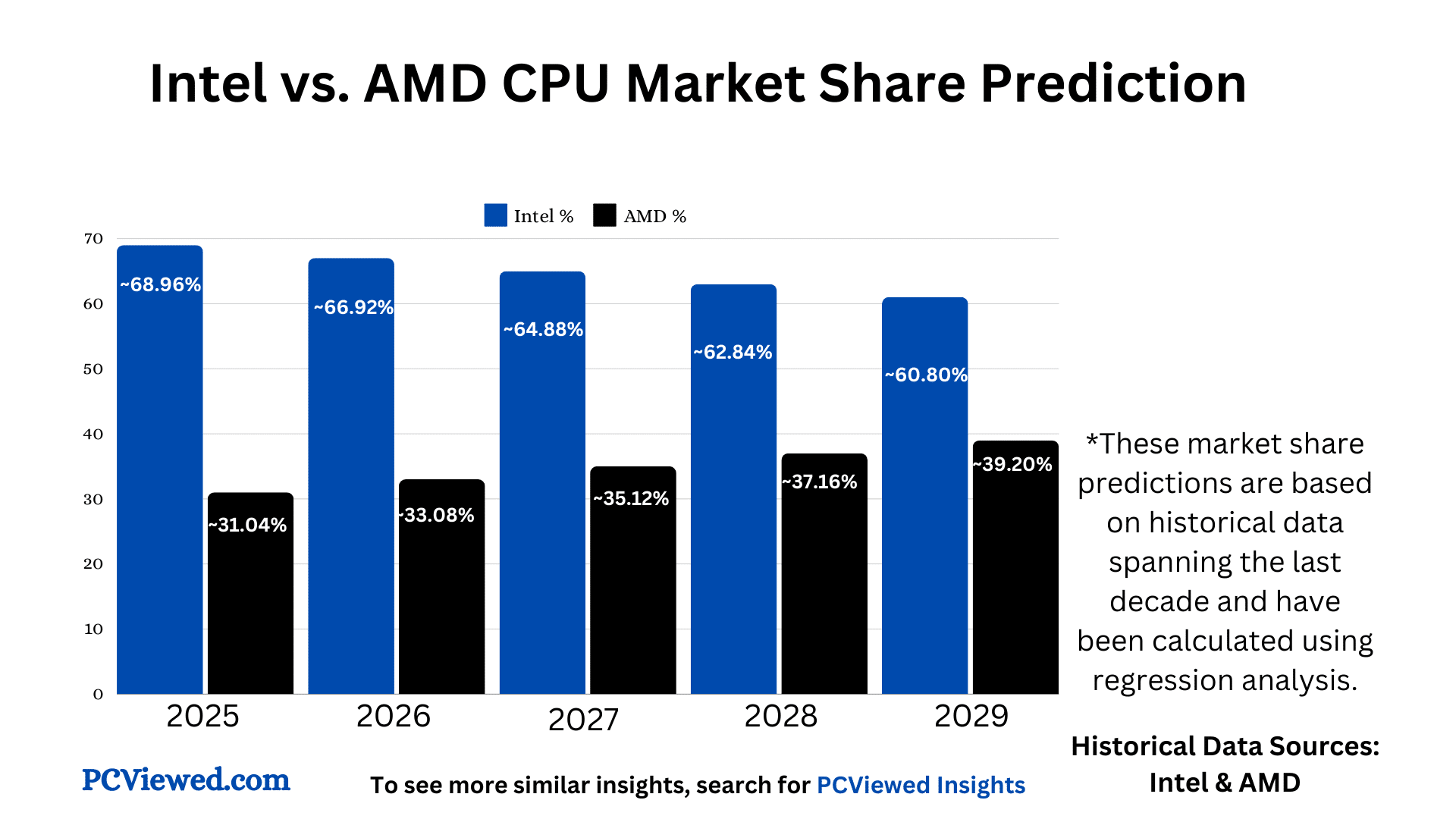

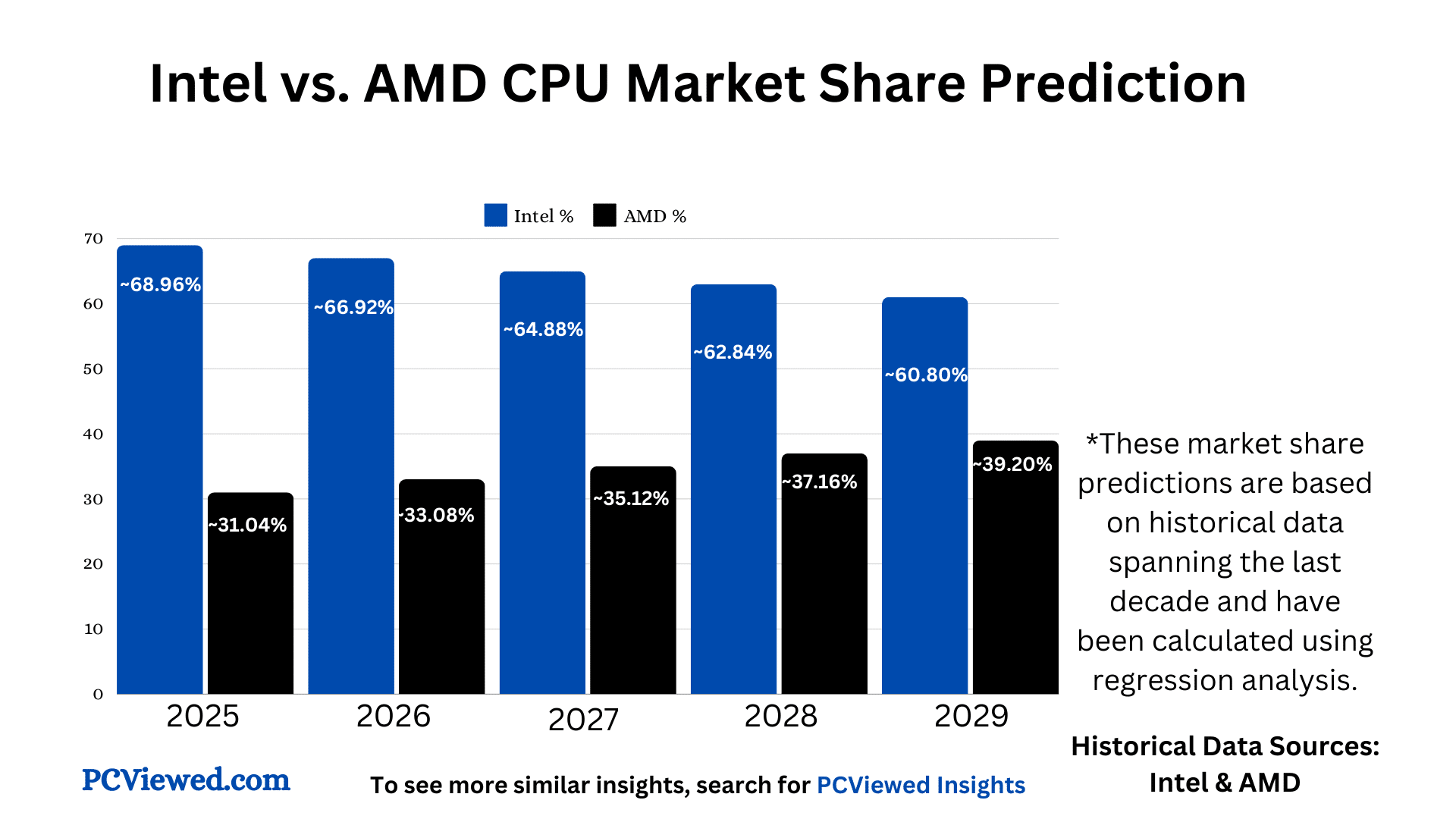

so AMD lost 5% market share 2024.slightly relevant? lol

AMD vs. Intel CPU Market Share: History and Prediction

Discover Intel and AMD CPU market share trends and predictions from 2012 to 2029, based on a decade of historical data and regression analysis.pcviewed.com

<3

the web is awash with stories. some or many of them AI generated I reckon.

nvidia could blow amd and intel out of the water completely (developing its own ARM cpu's for PC). that is IF regulators dont step in to stop a monopoly.

yeh. bit suss.so AMD lost 5% market share 2024.

how relevant is pcviewed i wonder

well those figures are an estimate but with that in mind 60 / 40 split by then end of 2024 maybe. 2025 50 /50 who knows? not Patyeh. bit suss.

- Desktop CPUs

In the first quarter of 2024, Intel had a 76.1% share of the desktop market, while AMD had 23.9%.

- Overall x86 computer CPUs

In the third quarter of 2024, Intel processors made up 63% of x86 computer CPUs, while AMD processors made up 33%.

what google AI tells me. but hey, im just an aristocrat. i expect others to do all the work as well as give me the money to profit from it.

Nvidia PC. (toy for gaming)

never going to happenbuying large parts of Intel or purchasing them outright which is driving that increase.

whats it source thoughwhat google AI tells me