Soldato

- Joined

- 4 Aug 2007

- Posts

- 22,024

- Location

- Wilds of suffolk

Payment holiday doesn't add extra time to the term length right?

You just have to make sure you pay it before your term length ends?

Again its lender specific

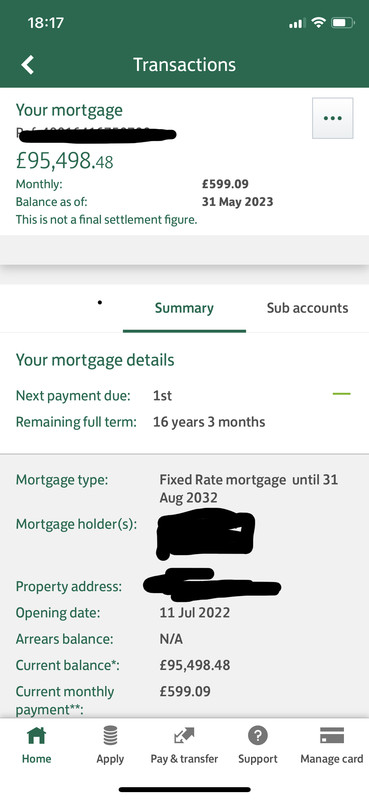

Nationwide have 3 scenarios, the default is to lower future payments and keep term the same

They also offer keep payments the same and reduce the term, or keep payments the same and do not reduce the term.

"The term" being when your committed to clearing the balance.