How much would you say is needed on a £225k mortgage to make a decent dent in 20 years?

I'm not sure without some more details its possible to even give a semi guesstimate.

But lets look at a simple example

Say you invest £250 for 20 years. At 2% gain per year thats worth @2% annual (all rounded) £370 in 20 years, @3% its £450, 4% its £550, 5% its £660, 6% its £800, 7% is £970

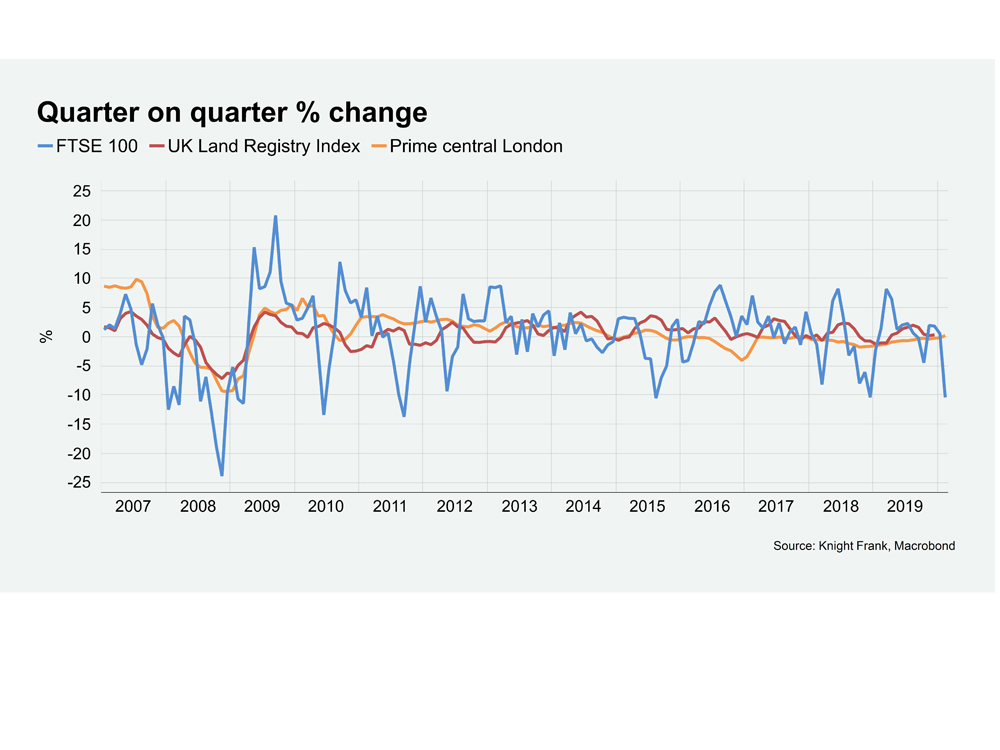

The FTSE seems to keep returning to around the 7% mark over many timespans. Now you can never rely on past performance, but the point in taking a medium/long term approach without a hard end date (unlike endowments) is that you can time the withdrawl.

£250 a year deposited at 7% would be worth circa £10.25k basically doubling the £5k invested.

I don't know for longer term mortgages, but a 25 year mortgage hits just under half repayment at 15 years (51% roughly outstanding)

A worked example, taking £225k over 25 years, paying £21 (to match the £250 a year above), after 20 years the outstanding capital would be just over £7k less. This was at 3.5% interest.

Then again, compound interest on your mortgage payments works the other way. Any overpayments we make affect our interest from the day we make them so it's worth drip feeding say £400/month into it rather than waiting to put a lump sum in every few months. I'd always be inclined to overpay a mortgage when there's spare cash but I know many disagree. I guess a bit of both is ideal.

Deffo on shorter term mortgages or if your rate is somewhat close, otherwise early on I would invest and also you then have that as a safety blanket.

Once you hit the middle I would certainly switch to eroding the mortgage capital.

The key point of using a FTSE tracker or something similar is being able to ride it out and time the exit. We all know the markets have ups and downs, once your well into a up you would probably see more than 7%.

The shorter the term, and the higher the repayment the more I think it swings to logically going the pay down the existing mortgage route. I am doing this, heavy repayment (circa an additional 140% per month compared to my monthly agreed repayment).

I will pay mine off somewhere around 7.5 years into a 20 year mortgage term, so the investment angle isn't worth the risk, time period too short to really benefit from compounding.

A split approach can certainly work, I would be tempted to ratchet up the risk portfolio in that case, and again, apply timing to my benefit, maybe switching back to normal risk levels over time.