Says view only for me, can't change anything.

If you're signed in to a Google account you should get a button to 'use template'.

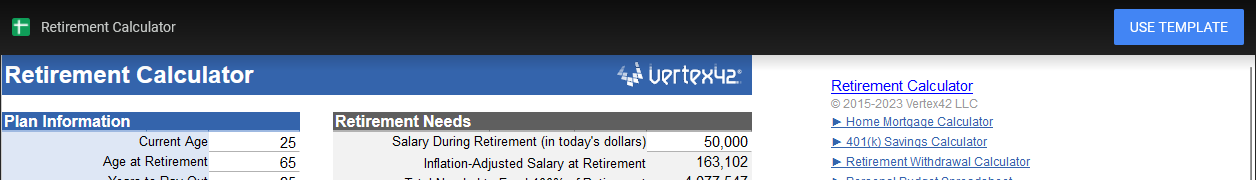

How are you managing your pension pots? I have a small pension being managed by SJP at a cost of 2% per year. Granted the pot is low but surely there has to be a cheaper way to manage it myself?

2%?? That can't be right.

It's SJP, it's going to be right.

St James’s Place shares fall 30% as it takes £426mn provision for client refunds

UK wealth manager under fire from regulators over fee structure

www.ft.com

www.ft.com

Don't use SJP is the easy answer.

Last edited: