I have do admit I don't really understand bonds. One of those things I've just ignoredthanks guys, kinda got it now. Bond funds will have their own criteria, and also because investors will be selling their holdings at any particular time, then that means the fund has to sell bonds to pay the investors, and the bond might not have a great price anymore because interest rates go up.

But buying individual bonds and holding to maturity gives guaranteed return (assuming the bond's issuer doesn't have problems). Depending on the coupon locked in, if inflation increases over the life of the bond, the real value of the return might be negative.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Pension fund performance - do you monitor yours, how is it doing, do you actively change it?

- Thread starter danlightbulb

- Start date

More options

Thread starter's postsReally clear thanks!bonds are basically IOUs from a government or company.

For example

Say they borrow £1000 from you, they will promise to pay you back in a certain way. The two methods are:

110 pounds for the next 10 months = 10% or

100 pounds for 10 months then a 100 extra at the end, they are taxed differently...

You can don't "lose" money on holding the bond for the whole life cycle and you will know what you get in return as long as that government/company don't file for bankruptcy, or some other form of debt restructuring.

Say you brought a bond that gives 5% rate of return, then the interest rates changes so that it's lower and the new bonds are only offfering 4%... in theory you can sell your bond to someone else for 4.5% (as an example) and pocket the money now to spend/re-invest rather than have to wait till the whole life cycle ends.

but if the interest rates goes up to 6% for new bonds, you may have to sell your bonds at much lower rate to cash in quickly.

the other thing is inflation, say you brought a bond with the rate of return for 3% and banks are offering 5%, then you're basically lossing 2% per year.

The rate of return and lenght matters, some companies will offer a high rate of return if they don't have the "credit" status to borrow money at lower rates.

Government bonds have lower rates as it's basically the government and they will get you your money.

There are times were a company like vodafone, who have brought back some of their bonds at higher rate to get rid of the debt.

Then there's the whole FX trading, where you by another countries bonds... say if the pound is stong vs the dollar at 1 pound vs 1.30 dollar, you buy 1300 dollars of bonds..you can wait till the dollar is stronger and sell the bond at some loss but make the profit on the exchange rate.

When I opened my SIPP (having used HL for S&S ISA for a while) it was an easy decision that Vanguard was better (Vanguard was widely recommended for low fees). I didn't hit the fee cap so it was 0.15% vs 0.45%. Some years later I do now hit the fee cap, so it's £375 vs £200. That makes me think I should be switching my SIPP to HL.

a) am I understanding it right?

b) is there a better third option?

Edit: I own 100% VHVG ETF (Developed World)

ii could be an option?

Open a Self-Invested Personal Pension (SIPP) Today - ii

Open a SIPP (Self-Invested Personal Pension) account in minutes. Get a low cost & flexible SIPP account with flat monthly fees.

www.ii.co.uk

When I opened my SIPP (having used HL for S&S ISA for a while) it was an easy decision that Vanguard was better (Vanguard was widely recommended for low fees). I didn't hit the fee cap so it was 0.15% vs 0.45%. Some years later I do now hit the fee cap, so it's £375 vs £200. That makes me think I should be switching my SIPP to HL.

a) am I understanding it right?

b) is there a better third option?

Edit: I own 100% VHVG ETF (Developed World)

A J Bell are 0.25% for Share account charge, Maximum of £10 per month... so the way I read that is £120 a year.

App is excellent.

£5 dealing charge

question... are the management rates for vanguard funds the same for SIPPs as it is for ISAs?

my L&G pension has over twice the amount of my ISA, similar funds but the mangement fees on my vanguard ISA is over 40 times the cost the one on my pension.

my L&G pension has over twice the amount of my ISA, similar funds but the mangement fees on my vanguard ISA is over 40 times the cost the one on my pension.

Soldato

- Joined

- 24 Jun 2021

- Posts

- 4,155

- Location

- Oxon

Might be of interest that HL's recent negative reviews are almost all related to drawdown taking ages.

uk.trustpilot.com

uk.trustpilot.com

Hargreaves Lansdown is rated "Great" with 4.2 / 5 on Trustpilot

Do you agree with Hargreaves Lansdown's TrustScore? Voice your opinion today and hear what 12,702 customers have already said.

Soldato

- Joined

- 25 Nov 2007

- Posts

- 5,581

- Location

- London

question... are the management rates for vanguard funds the same for SIPPs as it is for ISAs?

my L&G pension has over twice the amount of my ISA, similar funds but the mangement fees on my vanguard ISA is over 40 times the cost the one on my pension.

Yes, the vanguard account fee also covers both, 0.15%

I dont get what you are saying, vanguard is costing 40 times your L&G pension??

question... are the management rates for vanguard funds the same for SIPPs as it is for ISAs?

my L&G pension has over twice the amount of my ISA, similar funds but the mangement fees on my vanguard ISA is over 40 times the cost the one on my pension.

Fees on the funds/EFT should be the same....

Assuming it's the exact same funds you have invested in. Check the SEDOL code/Fund Codes etc

You will have fund costs and wrapper cost (ISa / pension etc)

Not sure where your getting 40x figure from.

Last edited:

Soldato

- Joined

- 24 Jun 2021

- Posts

- 4,155

- Location

- Oxon

I kinda like ii's approach of having a flat fee, never liked the percentages.

I also like the idea of having sipp+isa+gia in the same place - anyone use them for all three and can comment on if they're all good?

I also like the idea of having sipp+isa+gia in the same place - anyone use them for all three and can comment on if they're all good?

it's should have said 4 times more... I think it's the platform fees that I'm looking at on vanguard and the managment fess on L&G... the platform fees are still yet to come for this year.Fees on the funds/EFT should be the same....

Assuming it's the exact same funds you have invested in. Check the SEDOL code/Fund Codes etc

You will have fund costs and wrapper cost (ISa / pension etc)

Not sure where your getting 40x figure from.

When I opened my SIPP (having used HL for S&S ISA for a while) it was an easy decision that Vanguard was better (Vanguard was widely recommended for low fees). I didn't hit the fee cap so it was 0.15% vs 0.45%. Some years later I do now hit the fee cap, so it's £375 vs £200. That makes me think I should be switching my SIPP to HL.

a) am I understanding it right?

b) is there a better third option?

Edit: I own 100% VHVG ETF (Developed World)

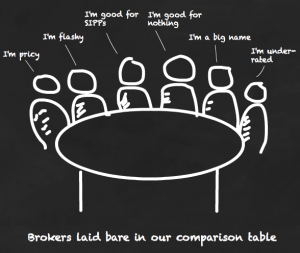

Just use this to compare brokers.

Broker comparison: cheap investment platforms UK

Our broker comparison page reveals the cheapest investment platforms in the UK and tells you how to pick the best one for you.

it's should have said 4 times more... I think it's the platform fees that I'm looking at on vanguard and the managment fess on L&G... the platform fees are still yet to come for this year.

Platform fees are usually taken every quarter / monthly... rarely ever taken annually in one lump.

I still think your misreading something somewhere....

Most platforms/providers are very similar charging structure - there are a few differences here and there but overall there's usually very little in it.

If your pension is a works group pension etc - the "pension" cost (excluding the fund your invested in) is likely to be extremely low if it's a big employer that you work for. They get massive discounts usually due to scale of contributions etc.

yub 45k uk staff members 92k staff members around the world... I'm sure we would get some sort of discount, as it maybe a case of we are doing some sort of work for them as well.Platform fees are usually taken every quarter / monthly... rarely ever taken annually in one lump.

I still think your misreading something somewhere....

Most platforms/providers are very similar charging structure - there are a few differences here and there but overall there's usually very little in it.

If your pension is a works group pension etc - the "pension" cost (excluding the fund your invested in) is likely to be extremely low if it's a big employer that you work for. They get massive discounts usually due to scale of contributions etc.

yub 45k uk staff members 92k staff members around the world... I'm sure we would get some sort of discount, as it maybe a case of we are doing some sort of work for them as well.

That would make sense.

So even though Vanguard is cheap in the grand scheme of things, the L&G has the potential to be literally penauts in terms of ongoing costs for the "wrapper" - I've seen as low as 0.06% ongoing in some schemes over the years due to the size of them

The actual fund costs will be the same assuming you have the same funds in both.

InvestEngine's 0% platform fee SIPP is now here. I did setup Trading 212 account earlier this year and hoping they follow rather than having to jump ship.

Main SIPP is with Vanguard still for now as there is no transfer functionality.

Main SIPP is with Vanguard still for now as there is no transfer functionality.

Last edited:

Ugh, not impressed with Vanguard introducing a new monthly account fee on top of the engagement fees from Jan 31 2025! A nice little £48 a year bonus for every account held with them for them!

Includes all investments, SIPP and S&S ISAs.

e: oh no, I'm a doofus; this change seemingly only collects customers who have less than 32k total across investments (I think).

Includes all investments, SIPP and S&S ISAs.

e: oh no, I'm a doofus; this change seemingly only collects customers who have less than 32k total across investments (I think).

Last edited:

Ugh, not impressed with Vanguard introducing a new monthly account fee on top of the engagement fees from Jan 31 2025! A nice little £48 a year bonus for every account held with them for them!

Includes all investments, SIPP and S&S ISAs.

Yep just had the email too, very annoying.

Soldato

- Joined

- 13 Sep 2005

- Posts

- 4,364

Annoying. Move to t212 possibly?