You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Premium Bonds - If you post to say how much you've won, please also say how much you have invested.

- Thread starter Feek

- Start date

More options

Thread starter's postsDepends how much money you have in tbh.

Associate

- Joined

- 10 Jul 2018

- Posts

- 556

- Location

- London.

£10k win on 19k saved,

So with 50k in you should expect £130 a month average.

That's not guaranteed though, is it? Asking as I was thinking of putting part of £100k I have to invest, into premium bonds. But don't really know enough about them to be honest.

Got an appointment with a financial adviser middle of this month to see what my options are, but I've always wondered about premium bonds. A return of £130 a month with £50k in sounds pretty good to me, but is it not pretty much down to 'luck' and as such, is it even possible to guestimate an 'average' return for a given investment amount?

Associate

- Joined

- 20 Nov 2013

- Posts

- 1,448

- Location

- leicestershire

Yes its not guaranteed at all and you could be well below their suggested payout % which is currently 3.14% i think.That's not guaranteed though, is it? Asking as I was thinking of putting part of £100k I have to invest, into premium bonds. But don't really know enough about them to be honest.

Got an appointment with a financial adviser middle of this month to see what my options are, but I've always wondered about premium bonds. A return of £130 a month with £50k in sounds pretty good to me, but is it not pretty much down to 'luck' and as such, is it even possible to guestimate an 'average' return for a given investment amount?

Its worth it if you pay higher rate taxes, if you pay lower taxes then fixed term saver will be better.That's not guaranteed though, is it? Asking as I was thinking of putting part of £100k I have to invest, into premium bonds. But don't really know enough about them to be honest.

Got an appointment with a financial adviser middle of this month to see what my options are, but I've always wondered about premium bonds. A return of £130 a month with £50k in sounds pretty good to me, but is it not pretty much down to 'luck' and as such, is it even possible to guestimate an 'average' return for a given investment amount?

Soldato

- Joined

- 4 Aug 2007

- Posts

- 22,594

- Location

- Wilds of suffolk

You have to think of premium bonds as a mid to low yield savings account, with a really poor chance of winning lottery type sums

I tend to think of £50k or more as life changing. £50k isn't going to radically change your life but to me its enough to make a material difference such as retire a year or so early etc

Should be remembered if you have £50k invested you cannot have any more so your capital is in effect fixed (and declining in real terms) with the cash wins sent to you

If you have below £50k and reinvest then it functions more closely to an interest bearing account

I tend to think of £50k or more as life changing. £50k isn't going to radically change your life but to me its enough to make a material difference such as retire a year or so early etc

Should be remembered if you have £50k invested you cannot have any more so your capital is in effect fixed (and declining in real terms) with the cash wins sent to you

If you have below £50k and reinvest then it functions more closely to an interest bearing account

| Prize band | Prize value | March 2023 draw | Estimated April 2023 draw |

|---|---|---|---|

| Higher value (10% of prize fund) | £1 million | 2 | 2 |

| £100,000 | 62 | 62 | |

| £50,000 | 124 | 125 |

This ^^^^^Its worth it if you pay higher rate taxes, if you pay lower taxes then fixed term saver will be better.

You have to think of premium bonds as a mid to low yield savings account, with a really poor chance of winning lottery type sums

I tend to think of £50k or more as life changing. £50k isn't going to radically change your life but to me its enough to make a material difference such as retire a year or so early etc

Should be remembered if you have £50k invested you cannot have any more so your capital is in effect fixed (and declining in real terms) with the cash wins sent to you

If you have below £50k and reinvest then it functions more closely to an interest bearing account

Prize band Prize value March 2023 draw Estimated April 2023 draw Higher value (10% of prize fund) £1 million 2 2 £100,000 62 62 £50,000 124 125

Thanks, so its a max of £50k you can put into premium bonds, is that what you mean? That's a great way to look at it - mid to low yield savings account.

Soldato

- Joined

- 4 Aug 2007

- Posts

- 22,594

- Location

- Wilds of suffolk

Thanks, so its a max of £50k you can put into premium bonds, is that what you mean? That's a great way to look at it - mid to low yield savings account.

You can only have a total of £50k in so if you win anything it has to be withdrawn if you put in £50k or win enough to get to you £50k

You can only have a total of £50k in so if you win anything it has to be withdrawn if you put in £50k or win enough to get to you £50k

Ah, right - that makes sense, ta.

Soldato

- Joined

- 26 Aug 2012

- Posts

- 4,539

- Location

- North West

Hope there is an issue this morning. £0 this morning for first time ever.

Do you not get the results 2 days after the draw? I usually get something but nothing this Month yet

40,500 invested,

Anyone else checked ? bit gutting i was hoping for a little to put towards something.

Quick question, if i get to near the max you can hold, and then not pay in any more in to this account, but open a new one, will the first one i hold (keep getting included in the prize draws and have a high change of winning even though im not paying in to that one anymore?)

Or do you generally only win prizes if you buy new bonds each time.

40,500 invested,

Anyone else checked ? bit gutting i was hoping for a little to put towards something.

Quick question, if i get to near the max you can hold, and then not pay in any more in to this account, but open a new one, will the first one i hold (keep getting included in the prize draws and have a high change of winning even though im not paying in to that one anymore?)

Or do you generally only win prizes if you buy new bonds each time.

Last edited:

Soldato

- Joined

- 26 Aug 2012

- Posts

- 4,539

- Location

- North West

It shows now. £200 and £250 for me and wife. £50k each in.Hope there is an issue this morning. £0 this morning for first time ever.

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,510

- Location

- Birmingham

£50 here off £10k invested.

Soldato

- Joined

- 26 Aug 2012

- Posts

- 4,539

- Location

- North West

You can only have one account. Needs to be in a new name.Do you not get the results 2 days after the draw? I usually get something but nothing this Month yet

40,500 invested,

Anyone else checked ? bit gutting i was hoping for a little to put towards something.

Quick question, if i get to near the max you can hold, and then not pay in any more in to this account, but open a new one, will the first one i hold (keep getting included in the prize draws and have a high change of winning even though im not paying in to that one anymore?)

Or do you generally only win prizes if you buy new bonds each time.

You can only have one account. Needs to be in a new name.

I read on the website you can have more than one account,

whats to stop you creating one with a different name ?

It shows now. £200 and £250 for me and wife. £50k each in.

Let me login and check again

Edit still nothing for me this morning

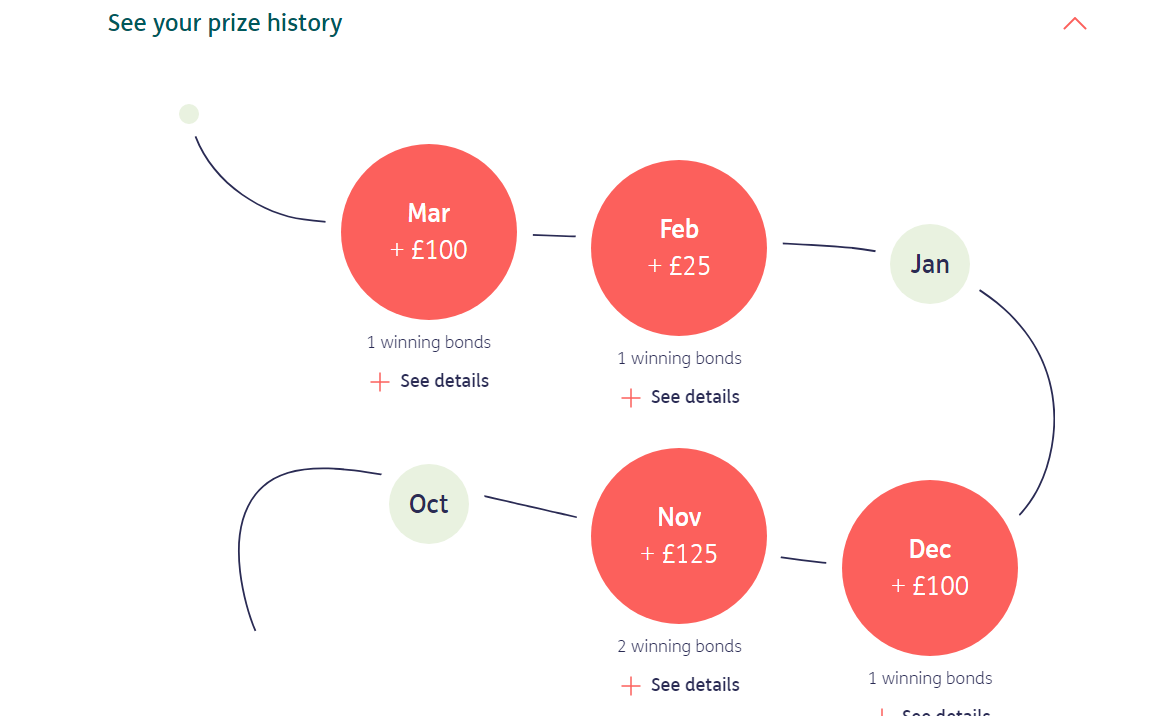

my prize history is

April 2023 - £25

March 2023 - £50

Feb 2023 - 25

Dec 2022 - 25

Nov 2022 - 75

Sept 2022 - 75

Aug 2022 - 50

Jan 2022 - 25

i have previous years but thats generally the last year or so's winnings £350, pretty low luck concidering i have what i have in there

Last edited:

If you can claim a winning amount of a false name set to your account / random other named account you set up in sure you'll have a visit from someone regarding fraud / tax related issues.whats to stop you creating one with a different name ?

Last edited: