The difference between an Intel CPU or AMD CPU in an average gaming build in use for 4 hours a day probably works out at 2p per day.Untrue. The average consumer cares about it only when Intel tells them to do so. When AMD is in the lead, suddenly nobody cares...

-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMD on the road to recovery.

- Thread starter humbug

- Start date

More options

Thread starter's postsThe difference between an Intel CPU or AMD CPU in an average gaming build in use for 4 hours a day probably works out at 2p per day.

Gaming is a very bad example for stressing a CPU. Modern games are coded not to utilise the modern CPUs properly, hence most of the available cores are kept idle or at very low load levels.

Yeah but it's gamers that are buying most of these enthusiast CPUs.Gaming is a very bad example for stressing a CPU. Modern games are coded not to utilise the modern CPUs properly, hence most of the available cores are kept idle or at very low load levels.

I don't think the average person cares much about power consumption though else no one would have brought ampere etc.

Power consumption is becoming a huge point of contention especially now the US has rejoined the Paris agreement. Power prices will increase globally.

Tbf all these companies are the same and all are looking out for their shareholders. I'll just buy what's best for me at the time.

Fair enough, but what if something is, for example, best value because it is part of a dumping exercise designed to drive out the competition and the next time you need to buy the price will have risen more than you saved?

A consumer can shrug off dirty tricks as being none of their concern, but longer term it could easily be their concern.

The biggest problem with the "they are all the same bad as each other", is what it leads to.

For consumer goods, that might be some short-term advantage probably leading long-term harm.

A similar argument is often used for politicians. If they are all as bad as each other, I might as well get amusement from my vote. Before you know it you have "a good laugh" in number ten, or an toddler in the White House.

My approach is to say least take past behaviour into account. That doesn't mean I won't be disappointed, but it does lessen the chances.

There is nothing wrong with power consumption but it's the way the power is generated that causes the issues.Power consumption is becoming a huge point of contention especially now the US has rejoined the Paris agreement. Power prices will increase globally.

A car probably puts out more CO2 in a day than a CPU does in a year but how many people are buying electric or hydrogen cars?

Last edited:

There is nothing wrong with power consumption but it's the way the power is generated that causes the issues.

I agree, but all we have that can generate base load power at reasonable economic value is nuclear and that is only available to handful of nations and even then its topical. This side 2050 we must all learn to live in fuel poverty metering ever watt of power.

Tell that to the Chinese who are knocking up coal plants every week.I agree, but all we have that can generate base load power at reasonable economic value is nuclear and that is only available to handful of nations and even then its topical. This side 2050 we must all learn to live in fuel poverty metering ever watt of power.

In the grand scheme of things the power a CPU uses is very small and most of the time it's idling or just uses a couple of cores bursting especially in a gaming rig, in those scenarios Intel and AMD chips both use similar power and it's only under heavy all core loads that the power gap opens up.

Tell that to the Chinese who are knocking up coal power plants every week.

I know, not only China but the rest of the world also. The fist world nations will pay the price.

The world can't sustain population growth at its current rate so something has to give to bring back balance and climate change maybe the natural way for the earth to reclaim its ecosystem.I know, not only China but the rest of the world also. The fist world nations will pay the price.

Wind, solar and we will have Hinkley point when that finally is operational. I don't think it is possible to go 100% green, now we have more electric use than ever before, on one hand we have LED lighting and other energy efficient electrics then we have electric cars, showers , cookers and possibly a mass of inefficient electric boilers installs in future due to net zero carbon ban on oil and gas boilers.I agree, but all we have that can generate base load power at reasonable economic value is nuclear and that is only available to handful of nations and even then its topical. This side 2050 we must all learn to live in fuel poverty metering ever watt of power.

Power consumption is becoming a huge point of contention especially now the US has rejoined the Paris agreement. Power prices will increase globally.

Yup.

"Dell has stopped selling its Alienware Aurora R10/R12 systems to customers in six US states as they cannot meet the requirements of California's Energy Consumption Tier 2 implementation. These new energy efficiency regulations which became active on July 1st in California, Colorado, Hawaii, Oregon, Vermont, and Washington limit the maximum kilowatt-hour usage of select devices. The maximum power usage allowed by this regulation for new desktop systems is calculated with a base limit and incorporates various additional allowances for discrete GPUs, high-speed memory, and certain storage mediums. Dell has confirmed that select versions of their Alienware Aurora R10/R12 systems cannot meet these requirements and as a result the effected models have been removed from sale for customers in these states."

Dell Cannot Ship Select Alienware Aurora R10/R12 Systems to Several US States Due To New Power Regulations | TechPowerUp

AMD 106.33 3.38 3.28% : Advanced Micro Devices, Inc. - Yahoo Finance

This is getting a little silly now...

Why?

This is all a very good news for the PC industry, enabling the best-in-class products and technology to many more customers.

This is what we all need - real innovation and more productive PC systems in the ecosystem - from entry PC desktops to supercomputers...

Why?

This is all a very good news for the PC industry, enabling the best-in-class products and technology to many more customers.

This is what we all need - real innovation and more productive PC systems in the ecosystem - from entry PC desktops to supercomputers...

That's not how i meant it, Yahoo Finance, which unlike Seeking Alpha updates the market cap live, they currently have AMD valued at $145 Billion, Intel are valued at $215 Billion.

At this point if or when AMD hoovers up Xilinx that cap will jump to about $180 Billion, with Xilinx it would take AMD's revenue from $20 Billion in 2022 to about $30 Billion in 2023, with the predicted growth. AMD are growing about 30% annually on their own.

AMD's rapid value growth is generated obviously by their success, every quarter they are beating their own estimates which you could argue they are deliberately underestimating their growth, but in fact they are beating recognised analysts estimates by even wider margins, consistently.

These people see AMD consistently delivering on promises, executing their roadmaps always on time and with better than predicted results, they see AMD innovating new technology left right and centre, expanding their business all over the place and constantly defying the few pundits who still dare to say AMD are just a flash in the pan.

Meanwhile their only rival as far as these people are concerned, Intel, are failing to execute their roadmaps, consistently, Intel over promise and under deliver in every metric, their margins are falling because they are having to increase the amount of sugar they bake in to their cakes to keep OEM's from using AMD and still failing to prevent that.

People are starting to drink the AMD coolaid which is great but with it comes expectation, they are starting to see AMD a bit like an Apple or an Nvidia, these people will expect AMD to keep this up and that becomes a problem because if AMD can't keep getting fatter at this rate these people will get upset.

It would be wise for AMD not to touch too much of this mountain of money people are investing in to them, they have already tapped in to $35 Billion of it at $85 a share, if it goes wrong for AMD and these people pull too much of their money out of AMD that money starts to become a debt, currently AMD are debt free, but they are still recovering, right now by this financial statement they have $2.7 Billion in cash, that's actual cash savings, next year that is expected to grow to $5 Billion, that's not a lot, total dissolvable assets today is about $11 Billion, again not a lot. They need a free cash flow of about $20 Billion to be strong, at this rate it will take another 5 years to get there.

So they are still vulnerable. As i said as long as they don't tap too much in to that mountain of investment money they will be good, but they are about to tap in to $35 Billion of it, its a risk but you don't get ahead without taking them.

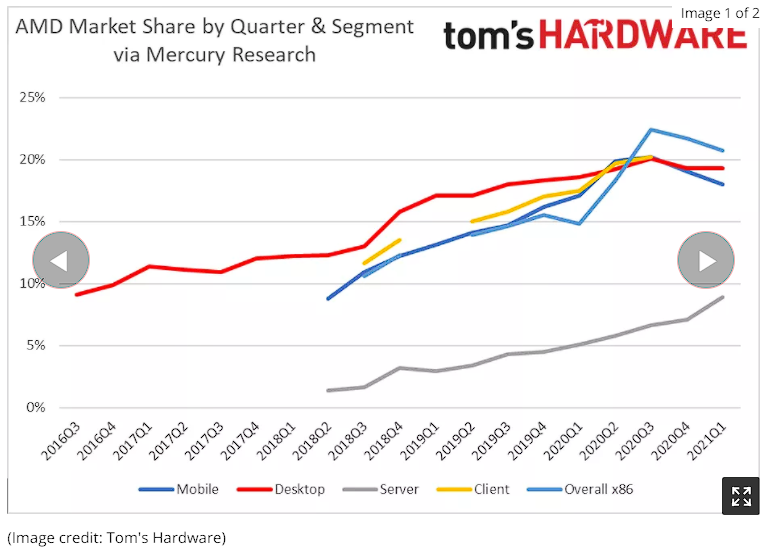

AMD Desktop x86 Market Share 3Q 2020 = 22.4%

Desktop exclud. IoT 3Q 2020 = 20.1%

Notebook exclud. IoT 3Q 2020 = 20.2%

Client x86 exclud. IoT 3Q 2020 = 20.2%

AMD Desktop Unit Market Share 3Q 2020 = 20.1%

AMD Mobile Unit Market Share 3Q 2020 = 20.2%

AMD Server Unit Market Share 3Q 2020 = 6.6%

AMD Reaches Highest CPU Market Share Since 2007, Q3 2020 Report (Updated)

https://www.tomshardware.com/news/amd-vs-intel-q3-2020-cpu-market-share-report

Mercury Research: AMD Achieves 22.4% Share Of The X86 Market, A High Not Seen Since 2007

https://wccftech.com/mercury-resear...of-the-x86-market-a-high-not-seen-since-2007/

AMD Server Unit Market Share 2Q 2021 = 11.6%

AMD Hits Highest CPU Market Share Since 2006, According to Mercury Research | TechPowerUp

AMD has a CPU market share of 16.9%, the highest since 2006 (guru3d.com)

CPU Market Q1 2021: AMD's Fastest Growth in Servers Against Intel in 15 Years | Tom's Hardware (tomshardware.com)

Cloudflare has picked AMD EPYC Milan over Intel's Ice Lake Xeons for its new 11th-gen servers

https://blog.cloudflare.com/the-epy...n-in-cloudflares-11th-generation-edge-server/

https://www.tomshardware.com/uk/news/intel-ice-lake-inefficient-for-cloudflare

Power efficiency likely plays a big factor for this large tech company, and according to their own testing with 48, 56 and 64-core servers, Intel's power consumption was several hundred watts higher per server!

https://blog.cloudflare.com/the-epy...n-in-cloudflares-11th-generation-edge-server/

https://www.tomshardware.com/uk/news/intel-ice-lake-inefficient-for-cloudflare

Power efficiency likely plays a big factor for this large tech company, and according to their own testing with 48, 56 and 64-core servers, Intel's power consumption was several hundred watts higher per server!

Cloudflare has picked AMD EPYC Milan over Intel's Ice Lake Xeons for its new 11th-gen servers

https://blog.cloudflare.com/the-epy...n-in-cloudflares-11th-generation-edge-server/

https://www.tomshardware.com/uk/news/intel-ice-lake-inefficient-for-cloudflare

Power efficiency likely plays a big factor for this large tech company, and according to their own testing with 48, 56 and 64-core servers, Intel's power consumption was several hundred watts higher per server!

We evaluated Intel’s latest generation of “Ice Lake” Xeon processors. Although Intel’s chips were able to compete with AMD in terms of raw performance, the power consumption was several hundred watts higher per server - that’s enormous. This meant that Intel’s Performance per Watt was unattractive.

We previously described how we had deployed AMD EPYC 7642’s processors in our generation 10 server. This has 48 cores and is based on AMD’s 2nd generation EPYC architecture, code named Rome. For our generation 11 server, we evaluated 48, 56 and 64 core samples based on AMD’s 3rd generation EPYC architecture, code named Milan. We were interested to find that comparing the two 48 core processors directly, we saw a performance boost of several percent in the 3rd generation EPYC architecture. We therefore had high hopes for the 56 core and 64 core chips.

So, based on the samples we received from our vendors and our subsequent testing, hardware from AMD and Ampere made the shortlist for our generation 11 server. On this occasion, we decided that Intel did not meet our requirements. However, it’s healthy that Intel and AMD compete and innovate in the x86 space and we look forward to seeing how Intel’s next generation shapes up.

the power consumption was several hundred watts higher per server - that’s enormous

No kidding......