Nice symbolic milestone.

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

Besides satisfying the basic shareholders' need, the different companies have different missions and very different approaches - some are relatively loyal to their customers like AMD, while Intel is very hateful with its customers.

AMD tried to cut support for 400 series boards with the aim of making those users have to buy new boards even though they were using the same socket And only back pedalled after a backlash.

It does have better performance per watt currently thanks to TSMCs fabs.

Intel got lost trying to get onto 10nm and allowed AMD to overtake but if anything AMD has given them the kick up the backside they needed and I'm sure they will come back strongly in the not to distant future.

I don't think the average person cares much about power consumption though else no one would have brought ampere etc.

Why?

This is all a very good news for the PC industry, enabling the best-in-class products and technology to many more customers.

This is what we all need - real innovation and more productive PC systems in the ecosystem - from entry PC desktops to supercomputers...

Cloudflare has picked AMD EPYC Milan over Intel's Ice Lake Xeons for its new 11th-gen servers

https://blog.cloudflare.com/the-epy...n-in-cloudflares-11th-generation-edge-server/

https://www.tomshardware.com/uk/news/intel-ice-lake-inefficient-for-cloudflare

Power efficiency likely plays a big factor for this large tech company, and according to their own testing with 48, 56 and 64-core servers, Intel's power consumption was several hundred watts higher per server!

We evaluated Intel’s latest generation of “Ice Lake” Xeon processors. Although Intel’s chips were able to compete with AMD in terms of raw performance, the power consumption was several hundred watts higher per server - that’s enormous. This meant that Intel’s Performance per Watt was unattractive.

We previously described how we had deployed AMD EPYC 7642’s processors in our generation 10 server. This has 48 cores and is based on AMD’s 2nd generation EPYC architecture, code named Rome. For our generation 11 server, we evaluated 48, 56 and 64 core samples based on AMD’s 3rd generation EPYC architecture, code named Milan. We were interested to find that comparing the two 48 core processors directly, we saw a performance boost of several percent in the 3rd generation EPYC architecture. We therefore had high hopes for the 56 core and 64 core chips.

So, based on the samples we received from our vendors and our subsequent testing, hardware from AMD and Ampere made the shortlist for our generation 11 server. On this occasion, we decided that Intel did not meet our requirements. However, it’s healthy that Intel and AMD compete and innovate in the x86 space and we look forward to seeing how Intel’s next generation shapes up.

the power consumption was several hundred watts higher per server - that’s enormous

Must be more given the absolute Processors market domination and the superior products/technology.

Still the market is rotten with corruption, though.

Intel is 220 Billion Dollars and has been lagging for years already!!!!

Intel can't have 100 Billion Dollars debt

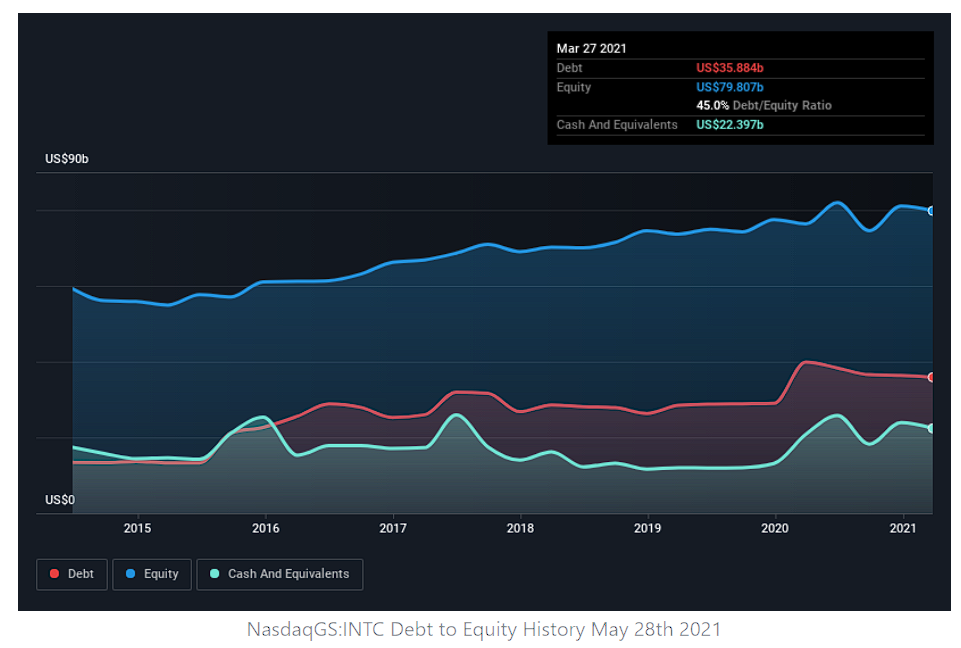

It is actually *only* 35 Billion Dollars.

How Much Debt Does Intel Carry?

You can click the graphic below for the historical numbers, but it shows that Intel had US$35.4b of debt in March 2021, down from US$39.9b, one year before. However, because it has a cash reserve of US$22.4b, its net debt is less, at about US$13.0b.

Intel (NASDAQ:INTC) Seems To Use Debt Quite Sensibly - Simply Wall St News