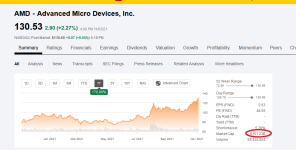

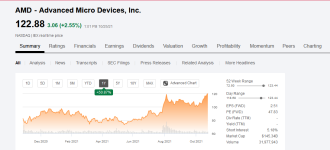

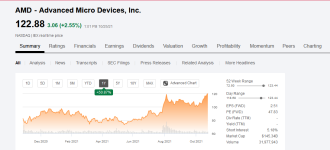

oh that's right AMD hit $122 today, market cap of $145 Billion.

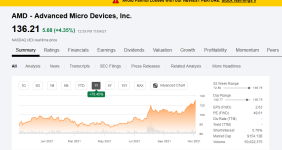

A strong outlook for 2022.

Tying It All Up

Based on how the quarter has proceeded, it is exceedingly likely that AMD will ship $300M-$400M incremental EPYC revenues in enterprise and datacenter, $100M to $200M incremental revenues in GPUs, and about $50M incremental console sales between the new Steam Deck console, and existing PS5 and Xbox consoles. In other words, AMD could potentially ship between $450M to $650M in incremental revenues compared to Q2.

On a $3.85B Q2 baseline, this suggests revenue potential between $4.3B to $4.5B in revenues as opposed to $4.1B in guidance. As such, it is possible that AMD had much more demand, and ship more, especially on the data center CPU and client GPU fronts. The challenge for AMD is not product demand but if AMD has the supply to meet the demand.

A nice revenue beat is only half the story. The other half of the story is gross margins. Keen readers may have noticed that much of the incremental Q3 revenue discussed above comes with juicy margins. AMD’s margins on EPYC and MI200 GPU are much higher than the corporate average. Thanks to insatiable crypto demand and elevated GPU prices, GPU margins are also likely to be healthy. Considering the mix involved, Q3 gross margin is likely to be at least 100 basis points above guidance.

Guidance For 2022 And Beyond

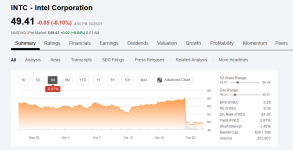

As strong as Q3 likely was, AMD’s strong product offerings for servers, clients, and consoles mean that AMD is likely to continue to grow rapidly – especially in the data center where its products are most advantaged. This will drive strong revenues and strengthen margins for the foreseeable future. Note also that the Xilinx (NASDAQ:XLNX) acquisition is expected to close before the end of the year and all future estimates will have to include Xilinx contributions. And Xilinx’s average margins are much higher than AMD’s and could push up AMD’s combined gross margin by a few hundred basis points. Thanks to organic margin growth and a kicker from Xilinx, AMD should comfortably deliver 50%+ gross margins in 2022. As such, in 2022, it is highly likely that AMD’s gross margins will surpass Intel’s gross margins. If Xilinx acquisition closes before the end of the month, it is possible that AMD’s gross margin could cross Intel’s gross margin in Q4 itself.

In summary, AMD is set to deliver a strong beat and raise. AMD is in a period of explosive revenue and gross margin growth, and the Company’s valuation should continue to expand meaningfully going forward.

https://seekingalpha.com/article/4461703-amd-q3-earnings-beat-and-raise-ahead

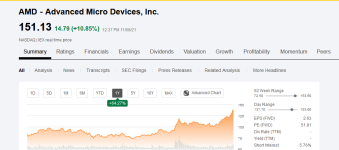

A strong outlook for 2022.

Tying It All Up

Based on how the quarter has proceeded, it is exceedingly likely that AMD will ship $300M-$400M incremental EPYC revenues in enterprise and datacenter, $100M to $200M incremental revenues in GPUs, and about $50M incremental console sales between the new Steam Deck console, and existing PS5 and Xbox consoles. In other words, AMD could potentially ship between $450M to $650M in incremental revenues compared to Q2.

On a $3.85B Q2 baseline, this suggests revenue potential between $4.3B to $4.5B in revenues as opposed to $4.1B in guidance. As such, it is possible that AMD had much more demand, and ship more, especially on the data center CPU and client GPU fronts. The challenge for AMD is not product demand but if AMD has the supply to meet the demand.

A nice revenue beat is only half the story. The other half of the story is gross margins. Keen readers may have noticed that much of the incremental Q3 revenue discussed above comes with juicy margins. AMD’s margins on EPYC and MI200 GPU are much higher than the corporate average. Thanks to insatiable crypto demand and elevated GPU prices, GPU margins are also likely to be healthy. Considering the mix involved, Q3 gross margin is likely to be at least 100 basis points above guidance.

Guidance For 2022 And Beyond

As strong as Q3 likely was, AMD’s strong product offerings for servers, clients, and consoles mean that AMD is likely to continue to grow rapidly – especially in the data center where its products are most advantaged. This will drive strong revenues and strengthen margins for the foreseeable future. Note also that the Xilinx (NASDAQ:XLNX) acquisition is expected to close before the end of the year and all future estimates will have to include Xilinx contributions. And Xilinx’s average margins are much higher than AMD’s and could push up AMD’s combined gross margin by a few hundred basis points. Thanks to organic margin growth and a kicker from Xilinx, AMD should comfortably deliver 50%+ gross margins in 2022. As such, in 2022, it is highly likely that AMD’s gross margins will surpass Intel’s gross margins. If Xilinx acquisition closes before the end of the month, it is possible that AMD’s gross margin could cross Intel’s gross margin in Q4 itself.

In summary, AMD is set to deliver a strong beat and raise. AMD is in a period of explosive revenue and gross margin growth, and the Company’s valuation should continue to expand meaningfully going forward.

https://seekingalpha.com/article/4461703-amd-q3-earnings-beat-and-raise-ahead