Too late Intel, that ship is long gone.

haha, certainly has!

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

Too late Intel, that ship is long gone.

Intel continues to hold a commanding position in this space, with deep, many-year relationships with key datacenter players and server vendors, and it presents customers with hardware as one part of the server solution rather than focus on pure silicon.

To that end, with thousands of engineers fine-tuning myriad datacenter applications to run as efficiently as possible on Intel Architecture, the decision to switch a server installation from Xeon to Epyc isn't, in the real world, immediately straightforward. Things move slow, usually on a multi-year cycle. Rival Intel will also claim that the latest Xeon processors are better-suited for emerging workloads such as AI, and that related products such as Optane memory and upcoming accelerators alter the overall performance dynamic more into its favour. Then there's the just-announced Cooper Lake architecture that promises up to 56 socketed cores, multi-chip implementation, and greater memory bandwidth - leading to Xeon and Epyc becoming more alike than ever before.

In other Xeon news Intel recalls boxed Xeon E-2274G processors due to inadequate stock cooler effectiveness

https://www.techpowerup.com/261168/...-due-to-inadequate-stock-cooler-effectiveness

Na, it's not the same. Intel updated the sticker.I think you are actually right Panos!

Standard Core 2 Duo/Quad LGA-775 CPU Fan

Xeon E-2274G CPU Fan

Wells Fargo analyst Aaron Rakers joined the crowd and increased his price target to $48 from $40, citing the chip maker’s gains in the server market.

https://www.barrons.com/articles/am...m-rating-51574182239?siteid=yhoof2&yptr=yahoo

"Meanwhile, Mizuho Securities’ Vijay Rakesh sees the intense competition from Intel as a steep hurdle for AMD to overcome. Even with its new graphics cards, the five-star analyst argues that AMD is being undercut by Intel’s Cascade Lake price reduction. He adds that Intel has also been aggressive in terms of offering software support. To this end, he reiterated his Hold rating and $38 price target, indicating 8% downside. (To watch Rakesh’s track record, click here)"

https://finance.yahoo.com/news/street-watch-amd-surged-product-133745245.html

I think you are actually right Panos!

Standard Core 2 Duo/Quad LGA-775 CPU Fan

Xeon E-2274G CPU Fan

Na, it's not the same. Intel updated the sticker.

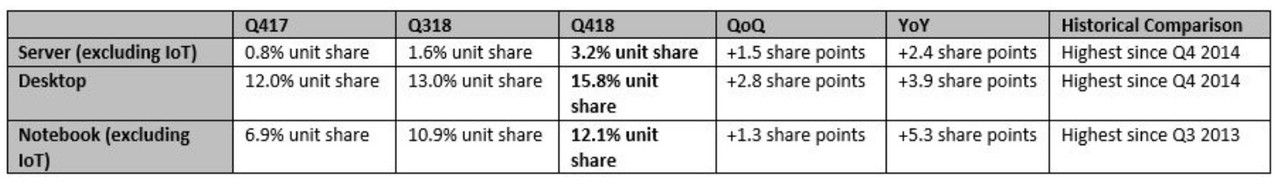

AMD Unveils CPU Market Share Statistics – Highest Market Share Since 2014, Captured All Segments Including Server, Desktops, and Notebooks https://wccftech.com/amd-cpu-market-share-highest-since-2013-ryzen-threadripper-epyc/

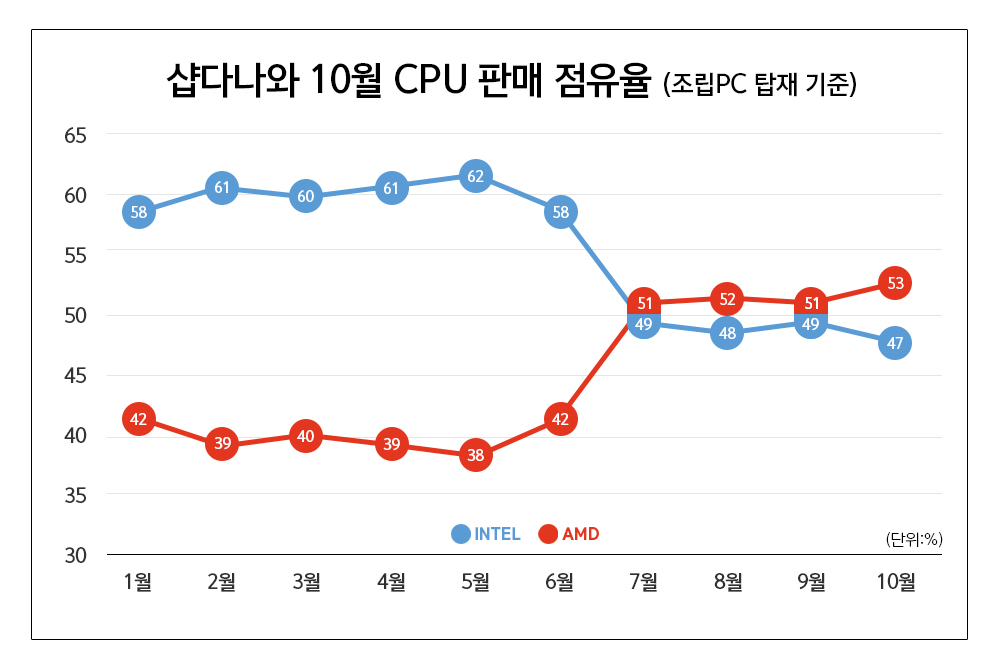

Slowly rising (and decreasing) in Q119

https://wccftech.com/amd-cpu-market-share-desktop-notebook-gains-q1-2019/

It's quite interesting how the desktop market share remains flat sequentially!

https://www.tomshardware.com/news/amd-desktop-pc-mobile-server-overall-market-share,40141.html

AMD Desktop Unit Market Share 2Q 2019 = 17.1% (+0 over Q1 2019 and +4.8% over Q2 2018)

AMD Mobile Unit Market Share 2Q 2019 = 14.1% (+1% over Q1 2019 and +5.3% over Q2 2018)

AMD Server Unit Market Share 2Q 2019 = 3.4% (+0.5% over Q1 2019 and +2% over Q2 2018)

It's always nice to keep record on the progress achieved by AMD:

https://www.techradar.com/news/amd-...are-but-intel-isnt-going-down-without-a-fight

AMD Desktop Unit Market Share 3Q 2019 = 18%

AMD Mobile Unit Market Share 3Q 2019 = 14.7%

AMD Server Unit Market Share 3Q 2019 = 4.3%