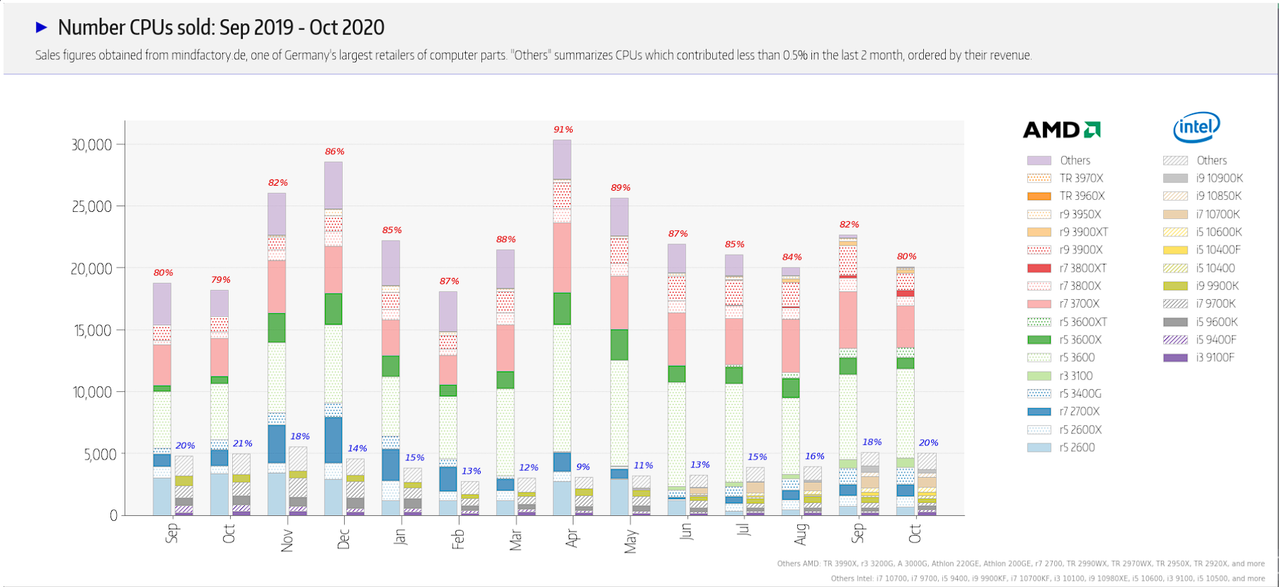

And this is a startling contrast to Intel's Quarter which was blamed on Covid.

cant blame covid on intel's woes. if anything covid has proven to be golden oppotunities for tech industries - sky rocketing demand.

ok covid has put some constraint on supply but this issue doesnt really affect intel as much as AMD and Nvidia

as a general trend, most tech companies are experiencing exceptional sales and revenues, even Tesla made a record breaking profit. intel is bucking that trend. in a climat where everyone else is growth massively, standing still is effectly shrinking and collapsing.

anyway, lets hope intel dont disappear. the arguement of too big to fail can also be turned around to argue that such a massive company would be too cumbersom to manourver quickly within a very dynamic market sector. (designs and investments are decided long before the final product is ready for consumer so it takes vision to see that through) intel has been caught with their pants down this year and it is the result of their arrogance and ignorance of the threat from AMD. lets hope this time next year they are in the process of pulling those pants back up again and we can enjoy choices and price reductions (though I am not holding out for the price reductions anytime soon)

I bet they've got some interesting patents on the books...

I bet they've got some interesting patents on the books...