-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AMD on the road to recovery.

- Thread starter humbug

- Start date

More options

View all postshttps://seekingalpha.com/news/35486...tm_campaign=rta-stock-news&utm_content=link-3

AMD scores $600M supercomputer win

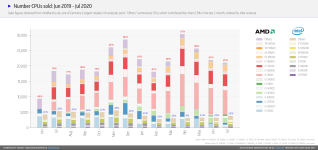

I'm surprised CPU sales are near double that of March last year..... or at least it has for AMD

AMD's investing heavily into its R&D - Spending is up over 18%

https://www.overclock3d.net/news/mi...avily_into_its_r_d_-_spending_is_up_over_18/1

When the original Zen was released back in Q1 2017, AMD was spending $271 million on R&D but now in early 2020, they are up to $442 million, an increase of over 60%!

I think this shows nicely how successful the Zen architecture is and its good to see AMD willing to invest big into R&D.

Good. And that's just in one quarter, if they keep this up they will be spending $2 Billion annually on R&D, that's healthy, good things will come from this.

They also brought their total Debt and liabilities down from $2.359 Billion to $1.985 Billion Year over Year, they still made $177 Million net profit this quarter.

Cash and cash equivalents: $1.33 Billion.

Total Assets: 5.864 Billion

Market Cap: (Company value) : $65 Billion.

I love how AMD sold more 3700X than Intel sold CPU's and they aren't even their best sellers.

It's ___________ helarious.

It's ___________ helarious.

AMD share value breaks $60 for the first time.

AMD is now valued with a Market Cap of $72.4 Billion.

https://www.hardwaretimes.com/amd-i...surpasses-intels-for-the-1st-time-in-history/

https://seekingalpha.com/symbol/AMD

AMD is now valued with a Market Cap of $72.4 Billion.

https://www.hardwaretimes.com/amd-i...surpasses-intels-for-the-1st-time-in-history/

https://seekingalpha.com/symbol/AMD

Is it still worth buying some shares now? They only seem to be going up and this dominance seems like it's going to last another couple of years.

I keep telling myself it can't go up much more at this point..... but then it does.

A companies value is tied to its share price, While AMD are trading at $76 with Intel at $48 AMD shares are more diluted than Intel's.

In real terms AMD market cap value is $90 Billion, Intel are valued at $205 Billion, so AMD are worth near half as much as Intel, i'll say that again, AMD are worth half as much as Intel.

At some point that value growth has to top out, to me it already looks too good to be true, its like we are watching the rise of AMD and the fall of Intel, unless that is true at some point AMD are going to come crashing back down to reality.

AMD hit $78.96 today, market cap increased to over $92 Billion, can they hit $100 Billion this quarter?

Jessss.....

AMD Reaches Highest Overall x86 Chip Market Share Since 2013

https://www.tomshardware.com/news/amd-vs-intel-highest-overall-x86-chip-market-share

Look at the Intel slide they provided, Intel Chip sales are down 9% yoy, That's OEM's, DIY Desktop doesn't really matter, OEM's do and those Ryzen 4000 APU in Laptops are stealing Intel's lunch.

https://www.hardwaretimes.com/amd-facing-acute-shortage-of-7nm-ryzen-4000-mobile-processors/

AMD Facing Acute Shortage of 7nm Ryzen 4000 Mobile Processors

AMD are selling them faster than they can make them...

AMD market cap: $106 Billion

Intel market cap: $216 Billion.

Nvidia Market cap: $325 Billion.

Intel market cap: $216 Billion.

Nvidia Market cap: $325 Billion.

The Ryzen effect.

Intel (NASDAQ:INTC) shares slide 10.3% AH after the Q3 revenue beat, in-line profit, and raised full-year guidance were offset by the surprise decline in the Data Center Group.

Data-centric revenue was down 10% Y/Y overall with DCG down 7% Y/Y to $5.9B, below the $6.22B consensus.

Within DCG, cloud revenue was up 15%, while the Enterprise & Government market was down 47% after two quarters of 30%+ growth due to the pandemic-related economic strain.

PC-centric revenue was up 1% to $9.8B as the pandemic tailwind continues for the PC industry.

10nm update: Intel says its third 10nm facility (located in Arizona) is now fully operational, and the company expects to ship 30% higher production volumes this year than forecast in January.

For Q4, Intel forecasts $17.4B in revenue (consensus: $17.38B), 26.5% operating margin, and $1.10 EPS (consensus: $1.07). PC-centric revenue is expected to be down low single digits Y/Y, and Data-centric is guided down 25%.

For the year, Intel sees revenue of $75.3B vs. $75B prior guidance and the $75.16B consensus. EPS is raised from $4.85 to $4.90 compared to the $4.85 consensus. PC-centric and Data-centric sales are expected up mid-single digits Y/Y.

-------------------------

Seeing "no easy fix" for the manufacturing/competitive headwinds, BofA downgrades Intel (NASDAQ:INTC) from Neutral to Underperform and lowers the price objective from $60 to $45.

Analyst Vivek Arya says yesterday's earnings results showed three structural issues: "1) No plan/update to fix manufacturing challenges at next-gen 7nm, with continued low yields at current-gen 10nm process; 2) Mix pressure as demand moves to more competitive cloud/consumer markets away from INTC’s profitable enterprise PC/server markets (data center missed Q3 by 4%, down 8% YoY, plus 10nm Ice Lake server pushed out to Q1); 3) increasing competition from faster, nimbler fabless competitors such as NVDA, AMD, ARM-based suppliers and others that are able to take advantage of the foundry ecosystem."

Arya praises Intel's "portfolio breadth" and balance sheet but thinks the shaky roadmap execution could continue to threaten INTC's 80-85% value share of the PC/data center markets and pressure EPS growth.

BofA lowers its CY21/22 EPS estimates by 1-2% to $4.65 and $4.70, respectively.

The firm reiterates its Buy ratings on Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), citing the expected continuing CPU and GPU share gains.

https://seekingalpha.com/news/36250...tm_campaign=rta-stock-news&utm_content=link-3

https://seekingalpha.com/news/36252...tm_campaign=rta-stock-news&utm_content=link-3

Intel shares plunge after Q3 data center sales fall 7%, missing estimates

Intel (NASDAQ:INTC) shares slide 10.3% AH after the Q3 revenue beat, in-line profit, and raised full-year guidance were offset by the surprise decline in the Data Center Group.

Data-centric revenue was down 10% Y/Y overall with DCG down 7% Y/Y to $5.9B, below the $6.22B consensus.

Within DCG, cloud revenue was up 15%, while the Enterprise & Government market was down 47% after two quarters of 30%+ growth due to the pandemic-related economic strain.

PC-centric revenue was up 1% to $9.8B as the pandemic tailwind continues for the PC industry.

10nm update: Intel says its third 10nm facility (located in Arizona) is now fully operational, and the company expects to ship 30% higher production volumes this year than forecast in January.

For Q4, Intel forecasts $17.4B in revenue (consensus: $17.38B), 26.5% operating margin, and $1.10 EPS (consensus: $1.07). PC-centric revenue is expected to be down low single digits Y/Y, and Data-centric is guided down 25%.

For the year, Intel sees revenue of $75.3B vs. $75B prior guidance and the $75.16B consensus. EPS is raised from $4.85 to $4.90 compared to the $4.85 consensus. PC-centric and Data-centric sales are expected up mid-single digits Y/Y.

-------------------------

Intel gets post-earnings downgrade at BofA on PC, data center pressure

Seeing "no easy fix" for the manufacturing/competitive headwinds, BofA downgrades Intel (NASDAQ:INTC) from Neutral to Underperform and lowers the price objective from $60 to $45.

Analyst Vivek Arya says yesterday's earnings results showed three structural issues: "1) No plan/update to fix manufacturing challenges at next-gen 7nm, with continued low yields at current-gen 10nm process; 2) Mix pressure as demand moves to more competitive cloud/consumer markets away from INTC’s profitable enterprise PC/server markets (data center missed Q3 by 4%, down 8% YoY, plus 10nm Ice Lake server pushed out to Q1); 3) increasing competition from faster, nimbler fabless competitors such as NVDA, AMD, ARM-based suppliers and others that are able to take advantage of the foundry ecosystem."

Arya praises Intel's "portfolio breadth" and balance sheet but thinks the shaky roadmap execution could continue to threaten INTC's 80-85% value share of the PC/data center markets and pressure EPS growth.

BofA lowers its CY21/22 EPS estimates by 1-2% to $4.65 and $4.70, respectively.

The firm reiterates its Buy ratings on Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), citing the expected continuing CPU and GPU share gains.

https://seekingalpha.com/news/36250...tm_campaign=rta-stock-news&utm_content=link-3

https://seekingalpha.com/news/36252...tm_campaign=rta-stock-news&utm_content=link-3

Ouch, how much lower do we think Intel stock will go?

Dunno but its gone from $54 to $47 in the last few days, i suspect it will take another dive when AMD release their financials tomorrow.

Dunno but its gone from $54 to $47 in the last few days, i suspect it will take another dive when AMD release their financials tomorrow.

This is where Intel are vulnerable, all this money they are loosing in shares as investors cashout has to be paid out of Intel's coffers, its literally being drawn out of the bank of Intel, Intel's reserves will have already taken a hit and if this keeps going it could put them in a black hole. Like a run on the banks

Nokia was bigger.I reckon Intel will be a good bet if you can time the bottom. They're too big and have too many good engineers to stay down for long. Their management are their biggest handicap.

Read and understood thank you ^^^

Yeah, that ^^^^ is #### all to do with Covid, what? Intel Data Centre revenue shrinks 10% at the same time as AMD's grows more than 100% and its Covid? pull the other one Intel.....

https://www.techpowerup.com/273851/amd-reports-third-quarter-2020-financial-results

Not shoddy.

Xillinx bought for 35bn on a share deal as well, no cash.

And this is a startling contrast to Intel's Quarter which was blamed on Covid.

Enterprise, Embedded and Semi-Custom segment revenue was $1.13 billion, up 116 percent year-over-year and 101 percent quarter-over-quarter. Revenue was higher year-over-year and quarter-over-quarter due to higher semi-custom product sales and increased EPYC processor sales.

Yeah, that ^^^^ is #### all to do with Covid, what? Intel Data Centre revenue shrinks 10% at the same time as AMD's grows more than 100% and its Covid? pull the other one Intel.....

Intel isn't going anywhere but i think their days of having it all to themselves are over, AMD are unstoppable now especially with their acquisition of Xilinx.

Your business is going to shrink over the next few years Intel and you will have to get used to a much much tougher opponent in AMD, one that you can't put down.

Your business is going to shrink over the next few years Intel and you will have to get used to a much much tougher opponent in AMD, one that you can't put down.

I'm not, Intel's CEO and guidance did however in their Q3 earnings call, they blamed their datacentre and enterprise dip this quarter on Covid uncertainty.

What annoys me about people like this is their assumption that people are idiots, there is a degree of narcissism in it. Its what drives me to want to see them fail and fail hard.