That legal requirement may not always mean maximum profits, the shareholders best interest might not be profit margins, there is many examples out there where its clear companies could probably charge more than they do.“Can choose to sell for less”

- They are legally required to carry out business decisions, in the best interests of the shareholders.[it’s the same for all business with shareholders]

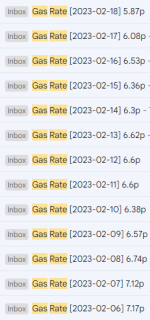

- It’s a business at the end of day - they will sell their products for as high as price a possible

- They are being taxed a high % on these profits.

- They are making big donations to charities and other support orgs.

Not all businesses charge the maximum they can get away with, whilst to many people they just assume thats what everyone would do perhaps because thats what their own selfish self does, thats not the case. I would say 20 years ago it was a uncommon thing, it seems to be in recent years this has become a much stronger trend, margins over volume.

The reason for the high tax is the high profits.

Charities serve as a distraction, it doesnt excuse anything.

This all supports us moving towards the French model. What you typed just shows the problems with having businesses handle an essential commodity.

This has kind of turned into a is profit ok discussion, my original point was people been fooled by the corporate veil where people can be fooled by a subsidiary with much lower margins than its parent company.

Is it reasonable to expect Centrica to subsidise British Gas e.g. from its very healthy profits to support more affordable energy? Something I havent offered an opinion on, I think I read a post above that this is apparently against Ofgem's rules, Ofgem may also not have the power to extend acceptable profits to parent companies also?

Another reason I think going state managed/owned is the way to go on energy production, removes these complexities, and the ££££ needs of shareholders. For as long as we rely on the open market, we need to also satisfy the desires of shareholders.