-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Financial Results Thread

- Thread starter Kaapstad

- Start date

More options

Thread starter's postsSoldato

- Joined

- 25 Sep 2009

- Posts

- 10,286

- Location

- Billericay, UK

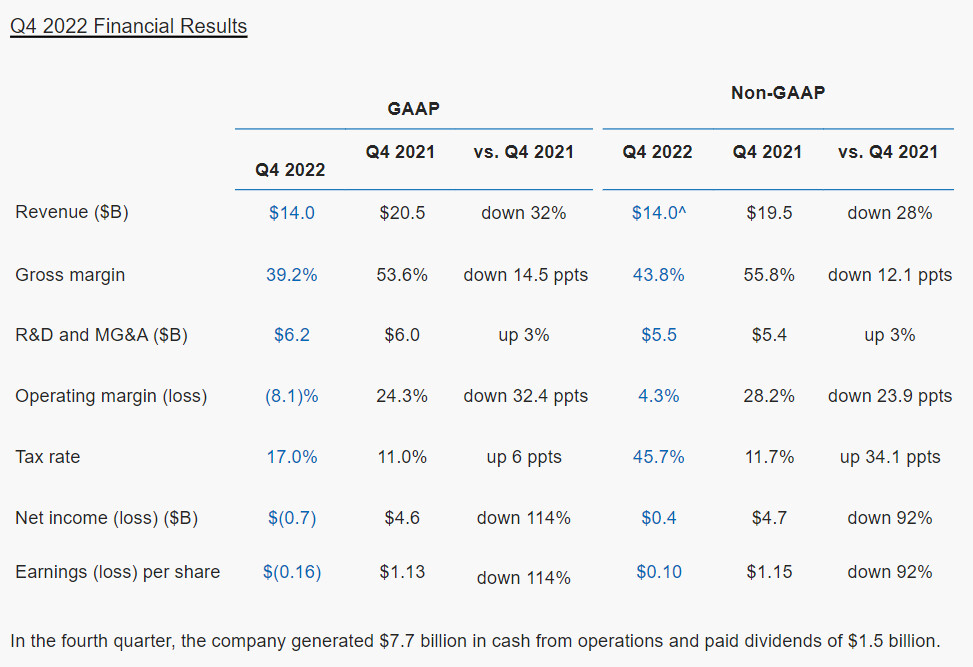

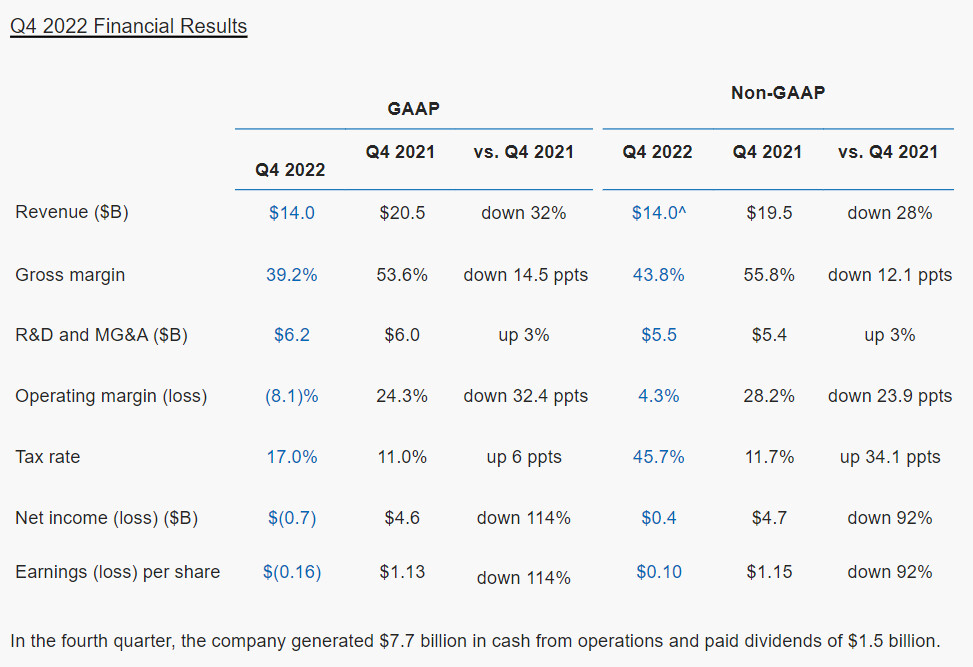

Intel's Q4 results are in and it's a blood bath at Chipzilla

www.anandtech.com

www.anandtech.com

The only slight good news is the Accelerated Computing Systems and Graphics division increased it's top line YoY albeit only by 1% hopefully though that will encourage Intel executives to stick with discrete graphics and roll out improved designs and better software.

Intel Q4 2022 Financial Results (GAAP) | ||||

Q4'2022 | Q3'2022 | Q4'2021 | Y/Y | |

| Revenue | $14.0B | $15.3B | $20.5B | -32% |

| Operating Income | -$1.1B | -$175M | $5.0B | -123% |

| Net Income | -$661M | $1.0B | $4.6B | -114% |

| Gross Margin | 39.2% | 42.6% | 53.6% | -14.5 ppt |

| Client Computing | $6.6B | $8.1B | $10.3B | -36% |

| Datacenter & AI | $4.3B | $4.2B | $6.4B | -33% |

| Network & Edge | $2.1B | $2.3B | $2.1B | -1% |

| Accelerated Computing Systems and Graphics | $247M | $185M | $245M | +1% |

| Mobileye | $565M | $450M | $356M | +59% |

| Intel Foundry Services | $319M | $171M | $245M | +30% |

AnandTech Forums: Technology, Hardware, Software, and Deals

Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.

The only slight good news is the Accelerated Computing Systems and Graphics division increased it's top line YoY albeit only by 1% hopefully though that will encourage Intel executives to stick with discrete graphics and roll out improved designs and better software.

Intel Reports Fourth-Quarter and Full-Year 2022 Financial Results, Largest Loss in Years

Intel Corporation today reported fourth-quarter and full-year 2022 financial results. The company also announced that its board of directors has declared a quarterly dividend of $0.365 per share on the company's common stock, which will be payable on March 1, 2023, to shareholders of record as...

Associate

- Joined

- 29 Jun 2016

- Posts

- 543

Whoooaaaaaa.... That is just woeful!

Soldato

- Joined

- 21 Jul 2005

- Posts

- 21,163

- Location

- Officially least sunny location -Ronskistats

@humbug must have his Henry smirk wobbling over that.

Intel Reports Fourth-Quarter and Full-Year 2022 Financial Results, Largest Loss in Years

Intel Corporation today reported fourth-quarter and full-year 2022 financial results. The company also announced that its board of directors has declared a quarterly dividend of $0.365 per share on the company's common stock, which will be payable on March 1, 2023, to shareholders of record as...www.techpowerup.com

Good. They really got complacent and lost the plot over there. With their r&d budget they should be doing much better. They need a Lisa type CEO. That said, that would be scary as once they got ahead a little again they would be trying to charge silly moneys to the consumers like AMD.

Intel's Q4 results are in and it's a blood bath at Chipzilla

Revenue Operating Income Net Income Gross Margin Client Computing Datacenter & AI Network & Edge Accelerated Computing Systems and Graphics Mobileye Intel Foundry Services

AnandTech Forums: Technology, Hardware, Software, and Deals

Seeking answers? Join the AnandTech community: where nearly half-a-million members share solutions and discuss the latest tech.www.anandtech.com

The only slight good news is the Accelerated Computing Systems and Graphics division increased it's top line YoY albeit only by 1% hopefully though that will encourage Intel executives to stick with discrete graphics and roll out improved designs and better software.

That doesn't tell the whole story of AXG, Intel are $1.1bn in the red, guess how that happened?

AXG is the biggest loss maker. AXG turned over $247 million, at a cost of $688 million, so they are $441 million in the red, nearly half of Intel's losses are AXG alone.

Last edited:

Soldato

- Joined

- 30 Jul 2012

- Posts

- 2,775

Yeah, I do not think Intel will be spending money on GPU's.

Seems such a shame really, having done all that R&D on it. It would be such a waste to stop, now that they have their foot in the door.Yeah, I do not think Intel will be spending money on GPU's.

Isn't stepping your foot in the market always gonna put you in the red anyway especially when there are 2 way more competent competitors running the show. Now that they are in, the only way is up and to improve surely!

Intel are new, sort of, to discreet GPU's, but they are not new to GPU's, Intel like to boast they "are the largest GPU company" they mean of course iGPU's without saying that.

Intel's problem is their GPU's when applied to compete in high performance are woefully insufficient compared to AMD and Nvidia, at the same performance Nvidia and AMD are half the size even on equivalent nodes, so costs are higher for equivalent GPU's, its why Intel tried to charge $450 for the A770 and compared it to the RTX 3060, they even ignored the $350 RX 6600XT which is better than both, pretending it didn't exist and hoping you wouldn't notice.

ARC is like Vaga, correction, ARC is a clone of Vaga and like ARC AMD had to sell Vaga at bom cost, which doesn't take in to account initial and on going development costs which actually puts you in the red.

Intel will have to spend; and with that lose billions more to try again.

Last edited:

Intel have to make GPU's for workstation and datacentre, its the way things are going, Nvidia are already there, AMD are getting there, believe it or not, and they are putting more money in to it than Intel, they have developed an API (AMD ROCm) that converts CUDA into their own code on the fly without a performance hit, much to Nvidia's annoyance...

But that doesn't mean Gaming GPU's, necessarily.

But that doesn't mean Gaming GPU's, necessarily.

Last edited:

Good to see they are growing. This only includes 2 weeks of 7900xt/xtx sales too.

Intel, Nvidia and AMD are one thing but no matter how brutal (especially Intel), it is all nothing compared to memory manufacturers.

Think only Hynix have a simple to follow chart:

and

From

www.techpowerup.com

and

www.techpowerup.com

and

www.computerbase.de

Unsure which of those includes the cost of the fabs, possibly the last one?

www.computerbase.de

Unsure which of those includes the cost of the fabs, possibly the last one?

But no surprise, when fabs cost billions then servicing those bonds/debts/cab-ex is a huge undertaking.

Samsung also released results but those are harder to summaries:

www.techpowerup.com

Guess even "just" Samsung Electroncs have their fingers in so many pies (sorry are so diversified!) that it is hard to see what is what.

www.techpowerup.com

Guess even "just" Samsung Electroncs have their fingers in so many pies (sorry are so diversified!) that it is hard to see what is what.

Micron haven't announced yet AFAIK.

Still, cheap RAM and SSDs for a few quarters! Longer term: if cap-ex gets scaled back too much we have a flood followed by drought. Again; but then all the memory manufacturers must be well used to that by now.

Think only Hynix have a simple to follow chart:

and

From

SK hynix Reports 2022 and Fourth Quarter Financial Results

SK hynix Inc. (or "the company") reported today financial results for 2022 ended on December 31. The company recorded revenues of 44.648 trillion won, an operating profit of 7.007 trillion won and a net income of 2.439 trillion won. Operating and net profit margin for the full year was 16% and...

Quartalszahlen: SK Hynix im Abwärtsstrudel des Speichermarktes

SK Hynix hatte bereits früh gewarnt, die neuen Zahlen untermauern ihre Befürchtungen mit tiefroten Zahlen zum Ende des Jahres 2022.

But no surprise, when fabs cost billions then servicing those bonds/debts/cab-ex is a huge undertaking.

Samsung also released results but those are harder to summaries:

Samsung Electronics Announces Fourth Quarter and FY 2022 Results, Profits at an 8-year Low

Samsung Electronics today reported financial results for the fourth quarter and the fiscal year 2022. The Company posted KRW 70.46 trillion in consolidated revenue and KRW 4.31 trillion in operating profit in the quarter ended December 31, 2022. For the full year, it reported 302.23 trillion in...

Micron haven't announced yet AFAIK.

Still, cheap RAM and SSDs for a few quarters! Longer term: if cap-ex gets scaled back too much we have a flood followed by drought. Again; but then all the memory manufacturers must be well used to that by now.

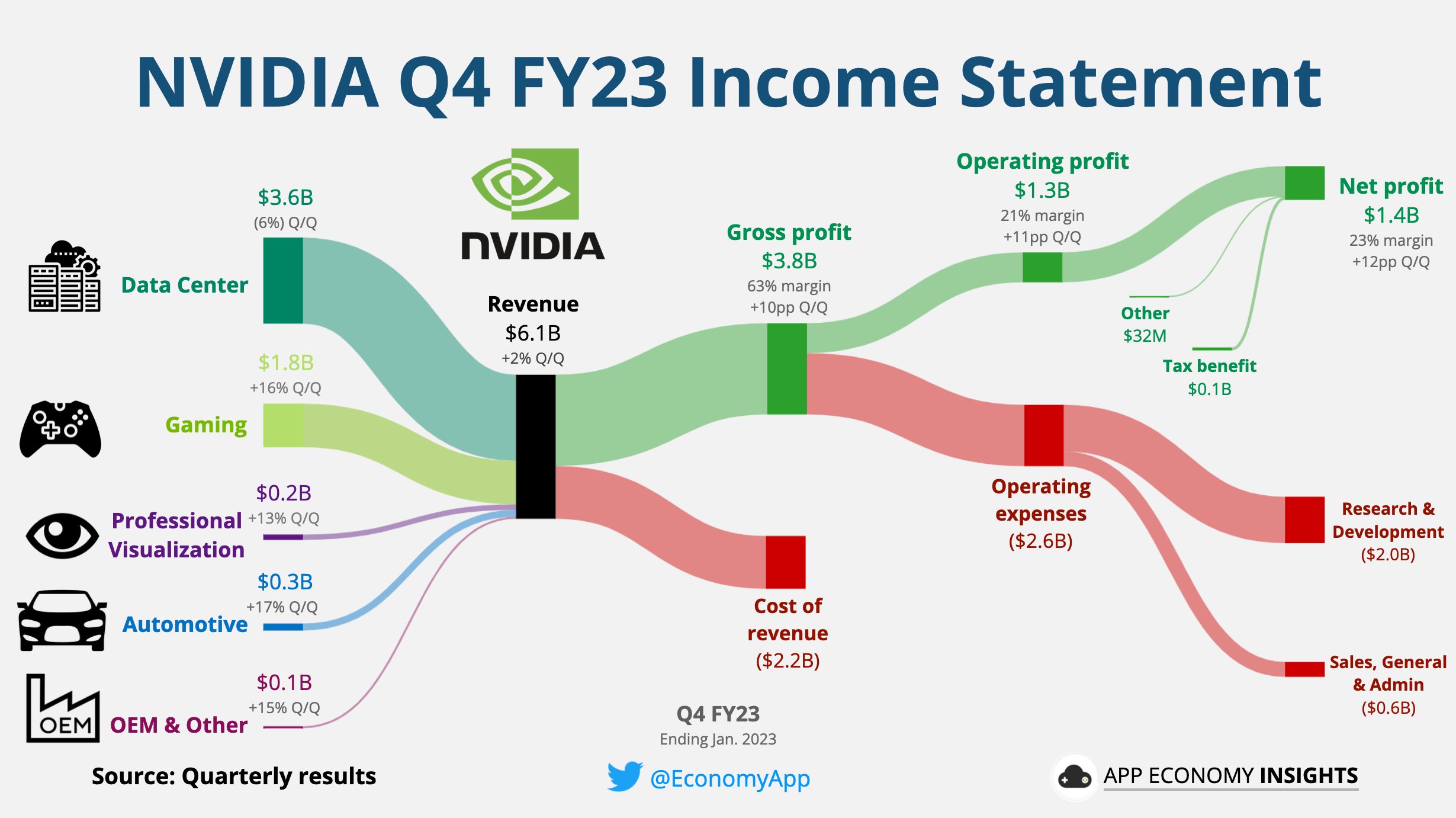

NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2023

NVIDIA today reported revenue for the fourth quarter ended January 29, 2023, of $6.05 billion, down 21% from a year ago and up 2% from the previous quarter.

Summary

- Total Revenue is $6.051 billion down 21% YoY and Up 2% QoQ

- GAAP Gross Margin is at 63.3% (down 2.1 bps YoY and up 9.7 bps QoQ)

- Non-GAAP Gross Margin is at 66.1% (down 0.9 bps YoY and up 10 bps QoQ)

- GAAP EPS $0.57 (down 52% YoY and up 111% QoQ)

- Non-GAAP EPS $0.88 (down 33% YoY and up 51% QoQ)

- Fourth-quarter revenue was $3.62 billion, up 11% from a year ago and down 6% from the previous quarter.

Fiscal-year revenue rose 41% to a record $15.01 billion.

Gaming

- Fourth-quarter revenue was $1.83 billion, down 46% from a year ago and up 16% from the previous quarter.

Fiscal-year revenue was down 27% to $9.07 billion.

Professional Visualization

- Fourth-quarter revenue was $226 million, down 65% from a year ago and up 13% from the previous quarter.

Fiscal-year revenue was down 27% to $1.54 billion.

Automotive and Embedded

- Fourth-quarter revenue was a record $294 million, up 135% from a year ago and up 17% from the previous quarter.

Fiscal-year revenue rose 60% to a record $903 million.

Last edited:

Soldato

- Joined

- 30 Nov 2011

- Posts

- 11,528

That explains why AMD aren't bothered about competing in PC GPU, they are basically only using it as a test bed to develop the next console chips

Nvidia aren't using their own fabs like Intel does. With fab parity amd doesn't stand a chance to actually compete. You could easily tell last year with RDNA 2, it should have been a blow across the board to nvidia due to TSMC 7 vs shamesung 8, but it wasn't. Even in the desktop space, the competition Intel is losing is between them and TSMC, amd isn't even in the picture.That explains why AMD aren't bothered about competing in PC GPU, they are basically only using it as a test bed to develop the next console chips

Intel uses TSMC for their ARC gpus.Nvidia aren't using their own fabs like Intel does. With fab parity amd doesn't stand a chance to actually compete. You could easily tell last year with RDNA 2, it should have been a blow across the board to nvidia due to TSMC 7 vs shamesung 8, but it wasn't. Even in the desktop space, the competition Intel is losing is between them and TSMC, amd isn't even in the picture.

Last edited: