-

Competitor rules

Please remember that any mention of competitors, hinting at competitors or offering to provide details of competitors will result in an account suspension. The full rules can be found under the 'Terms and Rules' link in the bottom right corner of your screen. Just don't mention competitors in any way, shape or form and you'll be OK.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Financial Results Thread

- Thread starter Kaapstad

- Start date

More options

Thread starter's posts

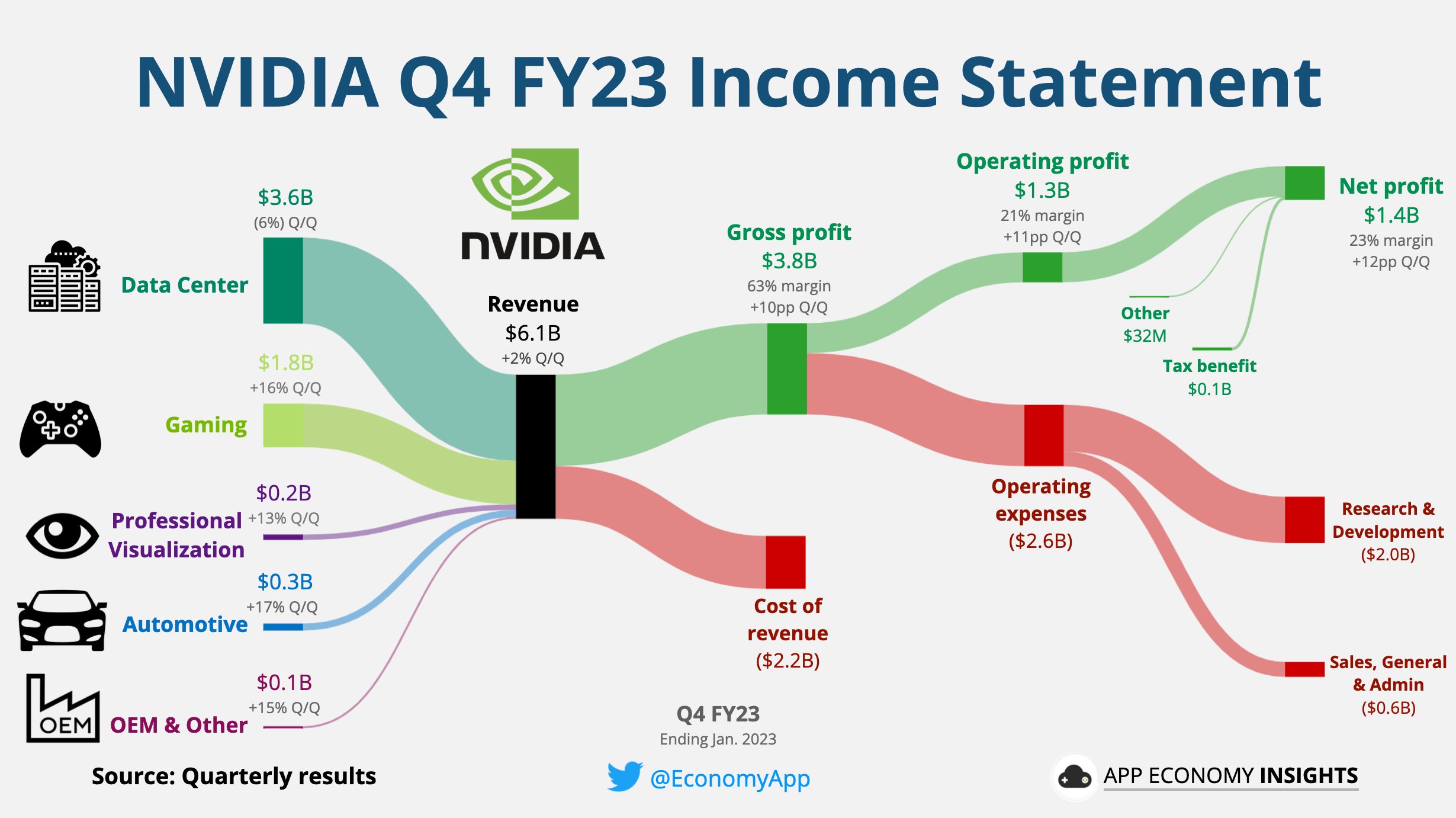

NVIDIA Announces Financial Results for Fourth Quarter and Fiscal 2023

NVIDIA today reported revenue for the fourth quarter ended January 29, 2023, of $6.05 billion, down 21% from a year ago and up 2% from the previous quarter.nvidianews.nvidia.com

Summary

Data Center

- Total Revenue is $6.051 billion down 21% YoY and Up 2% QoQ

- GAAP Gross Margin is at 63.3% (down 2.1 bps YoY and up 9.7 bps QoQ)

- Non-GAAP Gross Margin is at 66.1% (down 0.9 bps YoY and up 10 bps QoQ)

- GAAP EPS $0.57 (down 52% YoY and up 111% QoQ)

- Non-GAAP EPS $0.88 (down 33% YoY and up 51% QoQ)

- Fourth-quarter revenue was $3.62 billion, up 11% from a year ago and down 6% from the previous quarter.

Fiscal-year revenue rose 41% to a record $15.01 billion.

Gaming

- Fourth-quarter revenue was $1.83 billion, down 46% from a year ago and up 16% from the previous quarter.

Fiscal-year revenue was down 27% to $9.07 billion.

Professional Visualization

- Fourth-quarter revenue was $226 million, down 65% from a year ago and up 13% from the previous quarter.

Fiscal-year revenue was down 27% to $1.54 billion.

Automotive and Embedded

- Fourth-quarter revenue was a record $294 million, up 135% from a year ago and up 17% from the previous quarter.

Fiscal-year revenue rose 60% to a record $903 million.

Total Revenue is $6.051 billion down 21% YoY and Up 2% QoQ

They can't sell GPU's directly to crypto miners anymore, oh no, what a ###### shame.....

Anyway... watch out for AMD, Nvidia..... they are pulling up right behind you. Do you hear that? the angry roaring right up your arse? It would be a tragedy if they became the bigger company.....

You really need to get a life.

They can't sell GPU's directly to crypto miners anymore, oh no, what a ###### shame.....

Yep, just prior to the crypto crash it appears 50% of Nvidia gaming GPUs wer sold for mining purposes

Associate

- Joined

- 19 Sep 2022

- Posts

- 1,084

- Location

- Pyongyang

If 50% were sold to crypto miners as you say then I see this going only one way - higher prices

Last edited:

Caporegime

- Joined

- 18 Oct 2002

- Posts

- 31,200

Nvidia be praying for a bitcoin boom....

Sony is now AMD's biggest customer, contributing 16% of AMD's entire revenue and about 50% of Radeon Group's revenue (Radeon revenue for 2022 = $6.8billion, of which $3.7billion came from sales to Sony)

www.tomshardware.com

www.tomshardware.com

Sony Becomes AMD's Largest Customer on Booming PS5 Sales

Gaming was AMD's largest business in 2022.

Last edited:

Caporegime

- Joined

- 9 Nov 2009

- Posts

- 25,795

- Location

- Planet Earth

Nvidia's latest results:

nvidianews.nvidia.com

nvidianews.nvidia.com

It appears gaming revenue YoY is down 38% and overall revenue down because of this.

NVIDIA Announces Financial Results for First Quarter Fiscal 2024

NVIDIA today reported revenue for the first quarter ended April 30, 2023, of $7.19 billion, down 13% from a year ago and up 19% from the previous quarter.

Highlights

NVIDIA achieved progress since its previous earnings announcement in these areas:

Data Center

- First-quarter revenue was a record $4.28 billion, up 14% from a year ago and up 18% from the previous quarter.

- Launched four inference platforms that combine the company’s full-stack inference software with the latest NVIDIA Ada, NVIDIA Hopper™ and NVIDIA Grace Hopper™ processors.

- Announced that Google Cloud is the first cloud provider offering the new NVIDIA L4 Tensor Core GPU to accelerate generative AI applications.

- Introduced NVIDIA AI Foundations to help businesses create and operate custom large language models and generative AI models trained with their own proprietary data for domain-specific tasks.

- Unveiled the NVIDIA cuLitho software library for computational lithography to accelerate the design and manufacturing of next-gen semiconductors.

- Expanded its partners offering new products and services based on the NVIDIA H100 Tensor Core GPU — including Amazon Web Services, Google Cloud, Microsoft Azure and Oracle Cloud Infrastructure.

- Partnered with ServiceNow to build generative AI across enterprise IT.

- Announced a collaboration with Medtronic to build an AI platform for medical devices.

- Joined with Dell Technologies in Project Helix to deliver full-stack solutions to help enterprises build and deploy trustworthy generative AI applications.

- Announced it is integrating NVIDIA AI Enterprise software into Microsoft’s Azure Machine Learning to help enterprises accelerate their AI initiatives.

Gaming

- First-quarter revenue was $2.24 billion, down 38% from a year ago and up 22% from the previous quarter.

- Announced the GeForce RTX™ 4060 family of GPUs, bringing the advancements of NVIDIA Ada Lovelace architecture and DLSS, starting at $299.

- Launched the GeForce RTX 4070 GPU based on the Ada architecture, which enables DLSS 3, real-time ray-tracing and the ability to run most modern games at over 100 frames per second at 1440p resolution.

- Added 36 DLSS gaming titles, bringing the total number of games and apps to 300.

- Made path tracing available for the first time on a major gaming title through collaboration with CD PROJEKT RED on an update to Cyberpunk 2077.

- Expanded GeForce NOW’s game titles to more than 1,600, including the first Microsoft Xbox game, Gears 5.

Professional Visualization

- First-quarter revenue was $295 million, down 53% from a year ago and up 31% from the previous quarter.

- Announced NVIDIA Omniverse™ Cloud, a fully managed service running in Microsoft Azure, for the development and deployment of industrial metaverse applications.

- Expanded its collaboration with Microsoft to connect Microsoft 365 applications with Omniverse.

- Announced six new NVIDIA RTX™ GPUs for mobile and desktop workstations based on the Ada architecture.

Automotive

- First-quarter revenue was a record $296 million, up 114% from a year ago and up 1% from the previous quarter.

- Announced that its automotive design win pipeline has grown to $14 billion over the next six years, up from $11 billion a year ago.

- Announced that the world’s leading electric vehicle maker BYD will extend its use of NVIDIA DRIVE Orin™ across new models.

It appears gaming revenue YoY is down 38% and overall revenue down because of this.

Last edited:

Ouch 38%, don't forget, that YOY gaming revenue drop is bolstered with their latest and greatest arch's new product launches this quarter, so large initial batches shipping out of 4070 and 4060ti to their partners to prepare enough launch stock (and their direct sales). I'm sure their partners are going to a little cautious going forward and not want to end up with too much stock, so not going to sell/ship as much in subsequent quarters for those models. I guess Nvidia has the 4060 still to come for what thats worth.

Caporegime

- Joined

- 9 Nov 2009

- Posts

- 25,795

- Location

- Planet Earth

Ouch 38%, don't forget, that YOY gaming revenue drop is bolstered with their latest and greatest arch's new product launches this quarter, so large initial batches shipping out of 4070 and 4060ti to their partners to prepare enough launch stock (and their direct sales). I'm sure their partners are going to a little cautious going forward and not want to end up with too much stock, so not going to sell/ship as much in subsequent quarters for those models. I guess Nvidia has the 4060 still to come for what thats worth.

Overall revenue is down $1 billion YoY,because of the huge drop in gaming revenue. But this has been disguised by a $1 billion drop in "expenses" YoY which makes things look better.

Caporegime

- Joined

- 9 Nov 2009

- Posts

- 25,795

- Location

- Planet Earth

Nvidia shares jumped up 26% on todays strong Q1 2023 financial results

Strong demand for data centre AI accelerated products is keeping them a float

Yep. But the issue is that operating costs are down a lot compared to a year ago,which is helping pump up profits. So its quite clear Nvidia is starting to tighten its belt - so I expect the rumours of a new generation only in 2025 might be true. Although having longer generations might mean companies are forced to get more out of less.

But some of the people on Reddit are so deluded they think it is down to huge GPU sales ,when Nvidia has stated client sales are down. JPR is showing dGPU shipments are down,but they are being sold(especially with Nvidia) for higher than average prices(even for the RTX3000 series) - that is what is happening.

I really don't understand people defending these pricing moves from BOTH Nvidia and AMD. They are just trying to sell off old stock for as high a price as possible.

Last edited:

Soldato

- Joined

- 19 Oct 2008

- Posts

- 6,070

As well as that Nvidia's market cap has increased more in afterhours trading than AMD's entire market cap. Pretty impressive tbh, and also the world's 6th largest company. So much for all the Nvidia end of days ideas been hearing about for years......Nvidia shares jumped up 26% on todays strong Q1 2023 financial results

Strong demand for data centre AI accelerated products is keeping them a float

More than the current results, what's driving the buying is probably the 50% increase in their Q2 revenue prediction.

Last edited:

They were starting to tighten their belt, i fear with this up-tick in data centre AI accelerated products the belt tightening and incentive to lower prices will now fall away.So its quite clear Nvidia is starting to tighten its belt...

As well as that Nvidia's market cap has increased more in afterhours trading than AMD's entire market cap. Pretty impressive tbh, and also the world's 6th largest company. So much for all the Nvidia end of days ideas been hearing about for years......

AMD's market cap at $175 Billion, compare that to Intel's market cap of $125 Billion, are you sure?

Advanced Micro Devices, Inc. (AMD) Stock Price, Quote, News & Analysis

A high-level overview of Advanced Micro Devices, Inc. (AMD) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

Intel Corporation (INTC) Stock Price, Quote, News & Analysis

A high-level overview of Intel Corporation (INTC) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

Soldato

- Joined

- 19 Oct 2008

- Posts

- 6,070

Nvidia, $NVDA, just added $220 billion in market cap in 1 hour after reporting earnings. By comparison, here is the total market cap of their competitors: 1. AMD, $AMD: $175 billion 2. Intel, $INTC: $120 billion 3. Micron, $MU: $73 billionAMD's market cap at $175 Billion, compare that to Intel's market cap of $125 Billion, are you sure?

Advanced Micro Devices, Inc. (AMD) Stock Price, Quote, News & Analysis

A high-level overview of Advanced Micro Devices, Inc. (AMD) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.seekingalpha.com

Intel Corporation (INTC) Stock Price, Quote, News & Analysis

A high-level overview of Intel Corporation (INTC) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.seekingalpha.com

If the price holds today Nvidia will be a near $1Trillion market cap company

Last edited:

Nv heavily going into AI - at the expense of retail - what is ignored is `gaming` includes contract sales to system builders as well. Would love to see a detailed breakdown but that wont happen.

edit - oh and the increase in profit margin

edit - oh and the increase in profit margin

Last edited: