Soldato

Hi guys, is this easy to do online?

Any sites to recommend?

Hey, ive just started in the last month.

Using III, interactive investor - takes 5 mins to setup.

Hi guys, is this easy to do online?

Any sites to recommend?

Hey, ive just started in the last month.

Using III, interactive investor - takes 5 mins to setup.

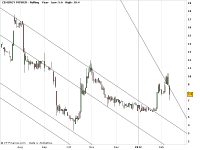

have i mentioned that i love gkp - i think i have

Looks like i sold out at the right time

They actually went to 17 in early december. Seemed like a no-brainer to me (although i don't have a brain so it was still a hard call)

I'm waiting for them to hit 30 and think i'll get out there.

Looks link CNR could find Fort Knox and it still wouldnt shift the price!

Thats about 4 positive RNS recently now and barely a movement

i have worked in LTSb for a year. Their shares have gone from 22p to 37p in less than a year.

Havent traded much since Jarvis went bust!!

jmhduck View Post

Does anybody on here buy/sell futures/options? If so who do you use to do it?

Rubbing my hands together this morning.

RKH doing nicely, those I wish they'd release the CPR update, could be serious uplift after that.

Glad to ZEN turning and results are out this Friday 10th of February so expecting ZEN to increase as the week progresses with people buying in before the RNS.

Thanks for getting back to me, I can't see options listed on selftradeSelftrade will let you do them. They are Socgen. Barclays I think also.

Ive looked at them a few times but it is complex and probably a bit expensive unless you are great at spotting volatility approaching.

Selling options sounds great, money for nothing in some cases. Sell an option for Barclays at 400 when its 390 for 6 months ahead and you get to keep your shares. Worst case, you have to sell them. If you have 100k of Barc that is

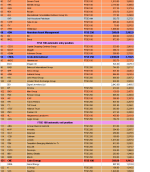

. They have te following accounts listed:

. They have te following accounts listed:If you really want a thrill just go to casino, or play fruit machinesCNR are boring. Might just take the money and pile more in GKP on Monday.

.

.CNR are boring. Might just take the money and pile more in GKP on Monday.

Why do you think they will drop ? The retreat to 310 was an ideal buying opportunity.

Looks like i sold out at the right time, 11.25p close. Sold out @ 11.7p

Share only needs to go up 1p for people to make there kill and out.

Got a sneaky feeling quite a few shares would get dumped at end of day.

On a risk reward basis do you really think it was worth sinking over 10k in for such a small profit?

As are ORE at the moment. Both very quiet, one with news and one without yet both shares are staying at the same levels.

Can't stay that way forever, and the last 2 weeks has seen a gentle creep back to my entry points. I remain hopeful!

Thanks for getting back to me, I can't see options listed on selftrade.

CNR are boring. Might just take the money and pile more in GKP on Monday.

On a risk reward basis do you really think it was worth sinking over 10k in for such a small profit?

seems about rightThe retreat to 310 was an ideal buying opportunity.