You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsSoldato

No but Iraq is hellish risky. Right now the sun shines all is well but when its chaos the shares can be sold down to 90p

Dont buy if you cant handle 'losing' money like that. Obviously price doesnt mean the company is worth less in assets exactly

Anyway on that basis I bought some more SEA who seem to have far more in favour then against them plus a holding in LOGP who then hold 20% of a Irish appraisal drill done by PVR

nice to have connections. ditto for RRL, its spread out on a few things. One of my worst is GPX who operate in Syria, freaking nightmare but they also operate wells in gulf of mexico however GKP is pretty much Kurd or zero hence I never held much and none now

Some relevant news was Exxon was banned from major Iraq contracts for dealing with the Kurds

http://money.cnn.com/2012/02/13/news/international/exxon_mobil_iraq/

Dont buy if you cant handle 'losing' money like that. Obviously price doesnt mean the company is worth less in assets exactly

Anyway on that basis I bought some more SEA who seem to have far more in favour then against them plus a holding in LOGP who then hold 20% of a Irish appraisal drill done by PVR

nice to have connections. ditto for RRL, its spread out on a few things. One of my worst is GPX who operate in Syria, freaking nightmare but they also operate wells in gulf of mexico however GKP is pretty much Kurd or zero hence I never held much and none now

Some relevant news was Exxon was banned from major Iraq contracts for dealing with the Kurds

http://money.cnn.com/2012/02/13/news/international/exxon_mobil_iraq/

Because the authors can't make money trading.

True, in most cases, but not in this one. Rather surprised that someone interested in trading wouldn't know who he is - black swan and fooled by randomness were best sellers and fairly influential.

Associate

I've read black swan and so have heard of him...True, in most cases, but not in this one. Rather surprised that someone interested in trading wouldn't know who he is - black swan and fooled by randomness were best sellers and fairly influential.

Andrew presumably hasn't though or he wouldn't have made that comment.

http://en.m.wikipedia.org/wiki/Nassim_Nicholas_Taleb

http://en.m.wikipedia.org/wiki/Nassim_Nicholas_Taleb

Soldato

The books cost that much because they are so specialist, I guess its a similar fate for many study type books, anyone at uni probably knows too well

You want to make a million from book sales and support yourself, choose a less sleep inducing topic - economies of scale

Robbie burns has a new book release out, in fact he is a journalist by trade but unless he is lying, appears to do very well. Was just looking at his site, he says he went for 20 for GKP at 292 last wed week. Jammy! lol £20 means 2000 shares

lol £20 means 2000 shares

I recognised taleb of course, he is on twitter he follows no one! Not really a trader afaik

Not really a trader afaik

If you want the number one obvious person to read its Warren Buffet. Again not a trader but doesnt mean you cant learn and mix it up (in a good and bad way ).

He writes an annual letter to his shareholders, due to release again soon. You can go back 50 years and learn, these are some - http://www.berkshirehathaway.com/letters/letters.html

George Soros, Jim Rogers, Peter Schiff, Marc Faber. All of them speak reguarly, my tip is do not ever try to duplicate someone elses trade

Soros especially speaks in riddles, he has said gold is a bubble many times. Its also one of his largest investments

Buffet says gold is useless yet he also points out bonds are an awful and dangerous holding (cash is a zero rate bond in effect)

BP dividend pays £5.07 (x100 shares) a quarter now or thereabouts depending on your location, etc. Sold some CAD to pay for SEA as its volume is bad and its at a ceiling I think, CAD should double this year I think. XEL is doing great price and vol

[Paid 5 and drops from 500 to 484 or 16p a share from yesterdays high to todays low, next time I should try to trade that ! ie. that trade was 3x the actual div]

You want to make a million from book sales and support yourself, choose a less sleep inducing topic - economies of scale

Robbie burns has a new book release out, in fact he is a journalist by trade but unless he is lying, appears to do very well. Was just looking at his site, he says he went for 20 for GKP at 292 last wed week. Jammy!

lol £20 means 2000 shares

lol £20 means 2000 sharesI recognised taleb of course, he is on twitter he follows no one!

Not really a trader afaik

Not really a trader afaikIf you want the number one obvious person to read its Warren Buffet. Again not a trader but doesnt mean you cant learn and mix it up (in a good and bad way ).

He writes an annual letter to his shareholders, due to release again soon. You can go back 50 years and learn, these are some - http://www.berkshirehathaway.com/letters/letters.html

George Soros, Jim Rogers, Peter Schiff, Marc Faber. All of them speak reguarly, my tip is do not ever try to duplicate someone elses trade

Soros especially speaks in riddles, he has said gold is a bubble many times. Its also one of his largest investments

Buffet says gold is useless yet he also points out bonds are an awful and dangerous holding (cash is a zero rate bond in effect)

BP dividend pays £5.07 (x100 shares) a quarter now or thereabouts depending on your location, etc. Sold some CAD to pay for SEA as its volume is bad and its at a ceiling I think, CAD should double this year I think. XEL is doing great price and vol

[Paid 5 and drops from 500 to 484 or 16p a share from yesterdays high to todays low, next time I should try to trade that ! ie. that trade was 3x the actual div]

Last edited:

Soldato

Im only about even here, just a hold for me. Not including the small stuff I traded along the way. I'd sell at 300 maybe

I did sell XEL today at 178, put in an order based previous volume. Seems a lot of people got marooned at this price like 260 with Barc and are taking back savings, etc

They are probably still worth over 200 but a lot of volume happening on this reverse also. Got 100% gain in less then a month on that one and this might be a bullish pullback like GKP did at 300 but I bought ABG yesterday as I think its got too cheap for a company selling 699,539 ounces of gold a year so I may just stick to that instead

I did sell XEL today at 178, put in an order based previous volume. Seems a lot of people got marooned at this price like 260 with Barc and are taking back savings, etc

They are probably still worth over 200 but a lot of volume happening on this reverse also. Got 100% gain in less then a month on that one and this might be a bullish pullback like GKP did at 300 but I bought ABG yesterday as I think its got too cheap for a company selling 699,539 ounces of gold a year so I may just stick to that instead

Soldato

Made a nice profit on GKP, got in at £3.78 on wednsday, not bad for two days work. Looking to get in again sub £4 to trade.

Silversurfer, BEM dropping again. Sure someone made a killing.

Gutted didnt buy XEL at 125, but i knew it was too risky. I expect it to slide as PI's cash out.

Whats your take on PCI surfer? My brothers recommended it as one to watch..

Another one he says to look out for is FOGL.

Silversurfer, BEM dropping again. Sure someone made a killing.

Gutted didnt buy XEL at 125, but i knew it was too risky. I expect it to slide as PI's cash out.

Whats your take on PCI surfer? My brothers recommended it as one to watch..

Another one he says to look out for is FOGL.

Soldato

The **** just hit the fan over at XEL.

I know I said I wouldn't jump back in but I did this morning and its been a roller coaster ride all the way from 180p and down this lunch time to around 150p!

Going back up now...having a heart attack at my desk!

I know I said I wouldn't jump back in but I did this morning and its been a roller coaster ride all the way from 180p and down this lunch time to around 150p!

Going back up now...having a heart attack at my desk!

Soldato

The **** just hit the fan over at XEL.

I know I said I wouldn't jump back in but I did this morning and its been a roller coaster ride all the way from 180p and down this lunch time to around 150p!

Going back up now...having a heart attack at my desk!

What did you get in at?

Made a nice profit on GKP, got in at £3.78 on wednsday, not bad for two days work. Looking to get in again sub £4 to trade.

Silversurfer, BEM dropping again. Sure someone made a killing.

Gutted didnt buy XEL at 125, but i knew it was too risky. I expect it to slide as PI's cash out.

Whats your take on PCI surfer? My brothers recommended it as one to watch..

Another one he says to look out for is FOGL.

I'm in PCI, they seem to have a solid base in Algeria, just had $100m in from a sale there with more on the table so they appear well-sorted in terms of funding. Decent potential drills in Italy and of course they are involved in Kurdistan with Hess which could be very lucrative.

Bought a little bit of FOGL as well recently - plenty of drilling prospects, it seems unlikely that Argentina is going to take over the Falklands and there's the potential for quite a lot of oil there.

All oil is speculative and on average 4/5 drills come up with nothing, but that's why the rewards are so high.

EDIT: I ummed and ahhed over XEL the last couple of weeks but decided against it. BOD has a bad reputation and I hadn't really seen anything especially positive. From my understanding this 70%+ rise has been caused by a rig visit or rumours of rig movement and not DECC approval. Feels like people who are already onboard with XEL buying up to try and cancel their losses / people caught up in momentum trying to jump on a spike. Great if you're trading but not if you're investing.

Last edited:

Soldato

Silversurfer, BEM dropping again. Sure someone made a killing.

Gutted didnt buy XEL at 125, but i knew it was too risky. I expect it to slide as PI's cash out.

Whats your take on PCI surfer? My brothers recommended it as one to watch..

Another one he says to look out for is FOGL.

Bem I was going to say previously has 16p as a speed bump. I dont think its fatal unless theres been news.

It was support on the way down, now its a ceiling. I was thinking of buying more, just need a few more people to give up

The volume is low, so not especially significant

XEL is indeed crazy looks like. I will sit back and ponder

Im good either way, was just selling what I had the good fortune to buy recently still stuck with older purchases.

Im good either way, was just selling what I had the good fortune to buy recently still stuck with older purchases. It might slide but PI dont matter, they are the tics on a hippo. Either Bentley as a oilfield floats or it dont, seems really safe to me just needs investment

FOGL is falklands, I gave up on them as north sea is much easier and closer to actual profit sales imo. Of course shares can be flipped meantime. GKP acclerates like this as they are flipping asset sales, CNR hopes to do similar I guess

ABG tripled their dividend, thats the benefit of real cashflow

PCI I dont know Over 9 target 12 maybe but I'd rather have had it at 5 or 6 based on volume

Soldato

FOGL's the one im quite interested in. Ive not done any research on it yet but according to my brother they have a lot of land for drilling, a lot more than RKH and look at where their share price is now.

Man of Honour

Hi guys,

What would you say is a good entry point for RKH? I sold a load a while ago, making around 150% profit, and am looking at sinking around back £15k or so into it as I feel the prospects could be good

Cheers.

What would you say is a good entry point for RKH? I sold a load a while ago, making around 150% profit, and am looking at sinking around back £15k or so into it as I feel the prospects could be good

Cheers.

FOGL's the one im quite interested in. Ive not done any research on it yet but according to my brother they have a lot of land for drilling, a lot more than RKH and look at where their share price is now.

FOGL have been well over 200 already on that assumption

Soldato

Topped up on Junior oils trust recently

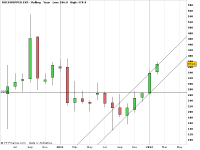

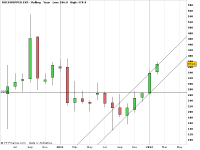

Depends how optimistic you want to be. February lows could be it. Higher levels of volume have occurred around

325

275

225

Its a very strong trend that its risen on but like Skull says momentum and the herd are often half of it at least.

325 is the most obvious pullback but still very positive price.

I dont have the conviction (or previous profits) so 260 or 225 for me at the most but judging market by your circumstance is how to screw up tbh

BP had a surge in NYC friday close, should be positive here then as USA is closed monday. I will sell something

http://www.youtube.com/watch?v=19qI_vncg6U&feature=channel

cap of a tipster's sales spiel

Code:

COOPER ENERGY 7.40 (-) -

ENCORE OIL 6.50 (-) -

PAREX RESOURCES INC 6.40 (-) - -

VICTORIA OIL & GAS 4.20 (-) - -

CAZA OIL & GAS INC 4.00 (-) - -

DRAGON OIL 3.90 (-) - -

NORSE ENERGY CORP ASA 6.5% NTS 14/07/13 USD1000 3.90 (-) - -

VALIANT PETROLEUM PLC 3.60 (-)

AMERISUR RESOURCES PLC 3.60 (-)

CIRCLE OILHi guys,

What would you say is a good entry point for RKH? I sold a load a while ago, making around 150% profit, and am looking at sinking around back £15k or so into it as I feel the prospects could be good

Cheers.

Depends how optimistic you want to be. February lows could be it. Higher levels of volume have occurred around

325

275

225

Its a very strong trend that its risen on but like Skull says momentum and the herd are often half of it at least.

325 is the most obvious pullback but still very positive price.

I dont have the conviction (or previous profits) so 260 or 225 for me at the most but judging market by your circumstance is how to screw up tbh

BP had a surge in NYC friday close, should be positive here then as USA is closed monday. I will sell something

Among other resource stocks, oil producers were fuelled by a spurt in the price of oil after Iran said it had stopped selling crude to British and French companies. BP put on 10.3 to 499¼p. Also lifting the oil giant was the first government settlement involving the Macondo well at the centre of last year’s Gulf of Mexico oil spill. Mitsui’s Moex unit, a minority partner in the well, agreed a $90m settlement on Friday, spurring hopes that BP could yet settle before a trial into claims relating to the disaster begins next week.

The scent of M&A sparked a rise among some smaller oil companies as Friday’s news that Dragon Oil was considering a tilt at BowLeven fuelled hopes that other explorers could attract a suitor. UBS said it expected M&A read-across, although not necessarily with Dragon as a buyer, to be helpful for – among others – Premier Oil, Soco International and Heritage Oil. Premier rose 9 to 431.2p while Soco put on 1.6 to 315p, but Heritage eased 0.1 to 188.5p. BowLeven itself fell 1 to 119p.

http://www.youtube.com/watch?v=19qI_vncg6U&feature=channel

cap of a tipster's sales spiel

Last edited:

Soldato

Been a nice time in the RRL camp lately, news should be due shortly on the T&T seismics which could help keep the momentum going. It's tempting to sell out and bundle into XEL though, it's taking a bit of a beating.

Soldato

Been a nice time in the RRL camp lately, news should be due shortly on the T&T seismics which could help keep the momentum going. It's tempting to sell out and bundle into XEL though, it's taking a bit of a beating.

Was in XEL but managed to get out at 154 just before the pump and dump but happy with my 100>154 on that one - I dont think I would jump in yet - PI's are a bit nervous with XEL given the £4 --> sub £1 drop last year and now this apparent manipulation this week after the RNS. So I think it might slide a bit yet as that rig hasnt moved either.

Am also in RRL, RMP, BLVN, GKP and MXP on the oilies

Will hold GKP until TO so not interested in the odd down day - there are proven reserves in the ground there and it will only be a matter of time before the pressure to let exports of oil out of Kurdistan starts. Money talks and its just posturing at this point in time - I'm sure a few pockets will get lined and then it will be a free for all

Last edited: