You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsSoldato

Its been a bit of an exciting week - glad now I didnt get back into XEL but may do in future. Took a hit on BLVN but more rumours this week - about 20% down on that but hopefully £2+ TO will salvage that one. RMP this week has been a bit of a godsend, RRL seems just to be treading water at the moment but I think these two will come good at some point shortly once TD is reached and they release some figures. GKP - closed eyes and fingers in the ears at the moment but I'm sure with the banked oil numbers they have its only a matter of time before someone takes them over - if not EXXON then the Chinese will

Soldato

The Chinese might not be able to buy GKP without invading the country or entering into a civil war. If that werent a possiblity they never would have been at 90p, they'd be 500

Might as well buy CEY and enter into Egypt, gold mine making actual big profits but it might end up overwhelmed by the countries problems

CNR back at 6p again and gold price is jumping around as Jobs rate for USA stays at 8.3% its taken as positive, helping the $$ adjusting gold, etc Gold has no serious pressure on it even if jobs improves its not going to alter the debt ratio situation, CNR still seems a reasonable buy.

Now is the best time to learn trading, volatility is gigantic. Finance is the worlds most subsided industry, you have cheapest rates in human history. Events are unparalled in their unpredictability and changes occuring in the world are paramount. This is all about trading, you want big waves if you are going to surf.

So long as the price doesnt gap down suddenly its stable enough. It might be wise to start small, 10 shares a trade is possible

Cairn doing well enough. Its indian shares up 5%, I guess that is largely what steers it, in fact they are quoted near their highest ever. Due to oil price ?

XEL seems fine to me, 110 or 120 was an expected area for it to hold and it has so good so far

Might as well buy CEY and enter into Egypt, gold mine making actual big profits but it might end up overwhelmed by the countries problems

CNR back at 6p again and gold price is jumping around as Jobs rate for USA stays at 8.3% its taken as positive, helping the $$ adjusting gold, etc Gold has no serious pressure on it even if jobs improves its not going to alter the debt ratio situation, CNR still seems a reasonable buy.

Now is the best time to learn trading, volatility is gigantic. Finance is the worlds most subsided industry, you have cheapest rates in human history. Events are unparalled in their unpredictability and changes occuring in the world are paramount. This is all about trading, you want big waves if you are going to surf.

So long as the price doesnt gap down suddenly its stable enough. It might be wise to start small, 10 shares a trade is possible

Cairn doing well enough. Its indian shares up 5%, I guess that is largely what steers it, in fact they are quoted near their highest ever. Due to oil price ?

XEL seems fine to me, 110 or 120 was an expected area for it to hold and it has so good so far

Soldato

Been a good week for me with RMP indeed

Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

So Shareprice.co.uk have started spamming their subscribers. You can unsubscribe but with this hefty caveat:

Basically, receive this email or lump it for live prices. Bit of a bummer.

You have been sent this email because you or someone using this email address registered on SharePrice.co.uk. If you no longer wish to receive any further correspondence from us, which also invalidates your access to the website and mobile apps then please click here

Basically, receive this email or lump it for live prices. Bit of a bummer.

Is this the Precogz thing? I can opt out

'You are of course welcome to opt-out of this particular trial at any time without any impact on your ongoing access to the SharePrice web site or mobile apps'

Seems pointless to me, I guess if enough people follow it then it would work

'You are of course welcome to opt-out of this particular trial at any time without any impact on your ongoing access to the SharePrice web site or mobile apps'

Seems pointless to me, I guess if enough people follow it then it would work

Or just add [email protected] to your spam filter?

Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

Is this the Precogz thing? I can opt out

'You are of course welcome to opt-out of this particular trial at any time without any impact on your ongoing access to the SharePrice web site or mobile apps'

Seems pointless to me, I guess if enough people follow it then it would work

Oooo, where does it say that? I'll have a mooch.

Or just add [email protected] to your spam filter?

Waaaay ahead of you buddy.

Oooo, where does it say that? I'll have a mooch.

Waaaay ahead of you buddy.

Thats at the top of the email, I use the iii account for trading too though so maybe they are nicer too me than just people who sign up for live prices ?

Soldato

RRL up and CNR down, these two are like the scales of justice. Nice to see at least one up

Bought a bit more of CNR, diluted by new shares but they are being held long term so its fair enough if the money used also increases company asset worth ?

Been buying this price for a year, people must be bored at this point

KAZ is abnormally weak, keeps getting sold. FTSE is 8 month high, I sold that and I hold KAZ, buying weakness is not usually so clever but i like cheap

Take a look at FRES, they have promised to pay out a cut of the profits and they make a lot. Its not cheap, I originally meant to buy at 550 but even now especially if it can fall on 'USA recovery strength' (I aint buying that) I might buy some even just for income.

I got HOC

EMED do well as production becomes more likely, copper doing ok?. Its a minor monetary metal in theory but obviously industrial right now hence shakey like KAZ

Bought IGG. Volatility ranks lowest for a long time. Very wrong as the world is changing, this company pays good dividend and should do well in crazy market. Might sell to try to get it at 420'

calm before the storm imo 14.8 -

iii turned broker in the autumn

beginning of the end lol

Bought a bit more of CNR, diluted by new shares but they are being held long term so its fair enough if the money used also increases company asset worth ?

Been buying this price for a year, people must be bored at this point

KAZ is abnormally weak, keeps getting sold. FTSE is 8 month high, I sold that and I hold KAZ, buying weakness is not usually so clever but i like cheap

Take a look at FRES, they have promised to pay out a cut of the profits and they make a lot. Its not cheap, I originally meant to buy at 550 but even now especially if it can fall on 'USA recovery strength' (I aint buying that) I might buy some even just for income.

I got HOC

EMED do well as production becomes more likely, copper doing ok?. Its a minor monetary metal in theory but obviously industrial right now hence shakey like KAZ

Bought IGG. Volatility ranks lowest for a long time. Very wrong as the world is changing, this company pays good dividend and should do well in crazy market. Might sell to try to get it at 420'

calm before the storm imo 14.8 -

iii turned broker in the autumn

Federal Reserve Launches A Twitter Channel

(MORE TO FOLLOW) Dow Jones Newswires

March 14, 2012 09:20 ET (13:20 GMT)

beginning of the end lol

Last edited:

Nice jump for RRL but was hoping for more by now. CNRzzzzzzzzzzzzzzzz.

Starting to sell a few of mine now as need house deposit in 2 weeks Was hoping for more from some of mine but I should have some left to carry on (hoping GKP sort something soon as I was sat on 8k profit at 420

Was hoping for more from some of mine but I should have some left to carry on (hoping GKP sort something soon as I was sat on 8k profit at 420  )

)

Starting to sell a few of mine now as need house deposit in 2 weeks

Was hoping for more from some of mine but I should have some left to carry on (hoping GKP sort something soon as I was sat on 8k profit at 420

Was hoping for more from some of mine but I should have some left to carry on (hoping GKP sort something soon as I was sat on 8k profit at 420  )

)Soldato

Im all for taking profits on things though you have to mirror that with buys on dire sentiment too.

Im convinced these markets are still wild and untamed just wants to buckaroo

Its less diverse then RRL as I understand it. I will post a chart later maybe but its been more profitable from the lows.

Im apt to get wary when people are very happy about a company or prospects especially if they havent actually got the sure fire reserves. Sometimes its justified. RRL target is about 16 but it'd be nice if it broke the ceiling, I cant sell any as I didnt buy tons on the lows but never sold the 2010 stuff either. RMP is a multiple of that optimism I guess and price

They both got good volume. Does RMP has a Aussie listing just the same, more history helps

highest vol ever on RMP, target downside 36 and it better hold that. I guess its similar to GKP, hard to say. East Africa has reserves for sure, like in the falkland right but doesnt mean they all got some so who knows

My downside target for gold pencilling in - 1600

reason - inline with declining highs of 2011, a trend we broke in 2012 (hopefully)

Im convinced these markets are still wild and untamed just wants to buckaroo

What's your opinion on RMP SS?

I always enjoy reading your analysis ;D

Its less diverse then RRL as I understand it. I will post a chart later maybe but its been more profitable from the lows.

Im apt to get wary when people are very happy about a company or prospects especially if they havent actually got the sure fire reserves. Sometimes its justified. RRL target is about 16 but it'd be nice if it broke the ceiling, I cant sell any as I didnt buy tons on the lows but never sold the 2010 stuff either. RMP is a multiple of that optimism I guess and price

They both got good volume. Does RMP has a Aussie listing just the same, more history helps

highest vol ever on RMP, target downside 36 and it better hold that. I guess its similar to GKP, hard to say. East Africa has reserves for sure, like in the falkland right but doesnt mean they all got some so who knows

http://www.theequitydesk.com/george_soros.aspGeorge Soros said:George Soros

Best Quote: "Short term volatility is greatest at turning points and diminishes as a trend becomes established… By the time all the participants have adjusted the rules of the game will change again"

My downside target for gold pencilling in - 1600

reason - inline with declining highs of 2011, a trend we broke in 2012 (hopefully)

Last edited:

Soldato

Looks like quite a few thought similar end of today. Still positive short term, profit taking on a rise is healthy so Im told

http://i.imgur.com/gOfs4.png I can remember someone on iii going over RMP and how much share price related to success in Somalia and also on Georgia. I dont especially know , obviously I hope we find oil

If this was any other stock I would want to buy at 26. Im not great at judging the big movers

I do know of a few people who have moved across to prop trading for firms. More day trading which I dont really do. Im not especially successful, timing counts for a lot and I just hope to be right in the long term often enough.

Ive been reading finance since late eighties when I was determined Microsoft shares were a buy on great growth potential. Nobody listened to me and I spent my money on a computer instead. Actions count for a lot more then forum posts and such like unfortunately

The best advice I reckon is avoid handling shares like a lottery ticket - buy a little & sell a little if possible always have some profits.

Or some guys on iii are like football team supporters? A fantasy football team would be more like it and pick apart what is best about each company, who competes best in the sector this 'season'

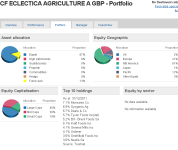

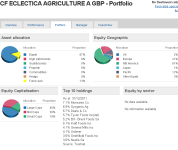

Thinking of buying this fund in a SIPP as a safer commodity market fund

http://i.imgur.com/gOfs4.png I can remember someone on iii going over RMP and how much share price related to success in Somalia and also on Georgia. I dont especially know , obviously I hope we find oil

If this was any other stock I would want to buy at 26. Im not great at judging the big movers

I do know of a few people who have moved across to prop trading for firms. More day trading which I dont really do. Im not especially successful, timing counts for a lot and I just hope to be right in the long term often enough.

Ive been reading finance since late eighties when I was determined Microsoft shares were a buy on great growth potential. Nobody listened to me and I spent my money on a computer instead. Actions count for a lot more then forum posts and such like unfortunately

The best advice I reckon is avoid handling shares like a lottery ticket - buy a little & sell a little if possible always have some profits.

Or some guys on iii are like football team supporters? A fantasy football team would be more like it and pick apart what is best about each company, who competes best in the sector this 'season'

Thinking of buying this fund in a SIPP as a safer commodity market fund

Last edited:

Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

Interest building at ORE, finally!

Soldato

SEA energy is up 13% today on sextuple volume. I knew that was a decent one plus a nice div soon I think, wish I had got more on the lows now but never that confident Im not missing something;

I see RMP is holding up on higher volume also, seems fair ?

ABG back to 400 briefly, bargain pricing I last saw before the summer gold rush and yet it repeats just because we have fallen a bit. Gold up 20% ABG down 20% nonsense.

All the same I wait for 1600 to add more maybe

I went to buy KAZ at close yesterday but ran out of funds, should have got it this morning because its risen all day. Could easily repeat this again I guess, +/- 10% easy and yet its a blue chip with good div,etc

GAME is voodoo trading, maybe a bidder but its obviously a bad bet to me. OCUK is proof city centre retail is secondary for a long time now. gamblers glory

I see RMP is holding up on higher volume also, seems fair ?

ABG back to 400 briefly, bargain pricing I last saw before the summer gold rush and yet it repeats just because we have fallen a bit. Gold up 20% ABG down 20% nonsense.

All the same I wait for 1600 to add more maybe

I went to buy KAZ at close yesterday but ran out of funds, should have got it this morning because its risen all day. Could easily repeat this again I guess, +/- 10% easy and yet its a blue chip with good div,etc

GAME is voodoo trading, maybe a bidder but its obviously a bad bet to me. OCUK is proof city centre retail is secondary for a long time now. gamblers glory

Ireland is a step closer to increasing its oil production thanks to Providence Resources' (PVR) work in the North Celtic Seas Basin. The Barryroe appraisal well generated stabilised flow rates of 3.500 barrels of oil a day (bopd), almost twice the company's 1,800 bopd target, the minimum required for the well to be classed as commercially viable. Shares in Providence, the operator and 80% owner of the prospect, surged 52p to 482p, while those in 20% shareholder Lansdowne Gas and Oil (LOGP) inched 1p higher to 55.75p.

Last edited:

347 million shares in issue...

347 million shares in issue...