Soldato

Try trade2win, people dont daytrade here afaik

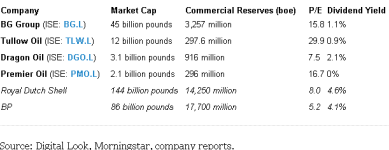

Swapped RKH for PMO, not sure how wise but pmo pay div next year apparently?

If CNR has a potential of 1 million ounces open pit and it clears say 1000 after costs per ounce thats a billion dollars coming to a company valued at 50m.

Why wouldnt B2gold at 1.5bn worth just offer to take over a neighbouring mine like this. Even if it was 500 per ounce after costs and they had to pay out 150m for the shares, doesnt that make sense to do.

As the gold price ratchets up I think this scenario becomes a fair and balanced possibility.

ZEN with the ski slope looking share graph has a reverse takeover into cloud based software radical move

radical move

Swapped RKH for PMO, not sure how wise but pmo pay div next year apparently?

Also, that resource valuation needs to be adjusted. You need to think whether the miner should be valued on NAV (most likely) or some other metric. How are other peers trading against NAV? How long ahead will you project your share target price? etc.

Just because something is worth X in NAV doesn't mean investors will give it that price.

If CNR has a potential of 1 million ounces open pit and it clears say 1000 after costs per ounce thats a billion dollars coming to a company valued at 50m.

Why wouldnt B2gold at 1.5bn worth just offer to take over a neighbouring mine like this. Even if it was 500 per ounce after costs and they had to pay out 150m for the shares, doesnt that make sense to do.

As the gold price ratchets up I think this scenario becomes a fair and balanced possibility.

1.7g a ton is quite standard I guess, if CNR had 3 or 4g we are very lucky ?La Libertad Mine performed very well in 2011, generating gold revenue of $154.8 million from the sale of 98,797 ounces at an average price of $1,566 per ounce. Total gold production was 99,567 ounces at an operating cash cost of $460 per ounce and total cash cost of $541 per ounce

The current average grade being processed at La Libertad mill is 1.72 grams per tonne.

ZEN with the ski slope looking share graph has a reverse takeover into cloud based software

radical move

radical move

Is Cloud a load of bs, probably not I guessCloudCall gives organisations the ability to make, receive and record telephone calls from existing software such as email clients, web browsers, smartphones and CRM/ERP platforms;

Last edited:

- I read that one in the telegraph, safety oil rig design IP

- I read that one in the telegraph, safety oil rig design IP

so I kept my core holding and I will be getting some more this week

so I kept my core holding and I will be getting some more this week