Soldato

On ENRC debacle

http://www.telegraph.co.uk/finance/...uy-into-ENRC-ahead-of-potential-takeover.html

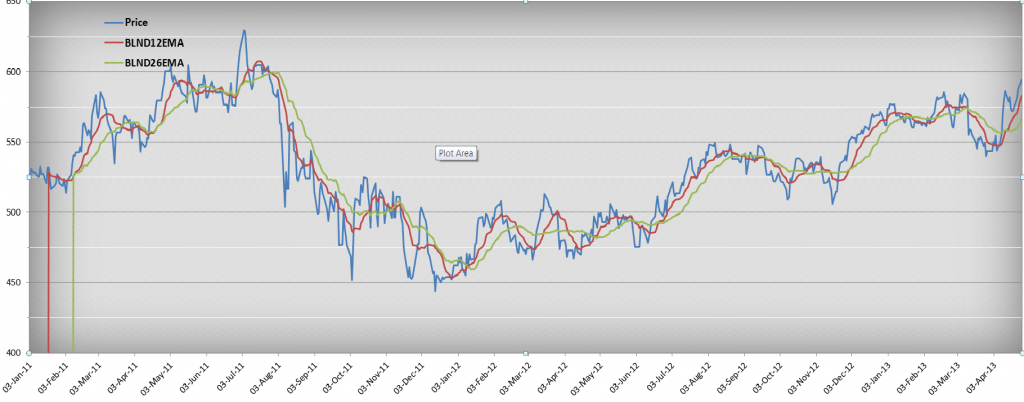

^^ I will take some KAZ as it does fit the 61% fib retracement bullish scenario if taking thurs low to fri high. Just some TA mumbo jumbo, strength in a weak stock can be profitable (like the 50p double bottom on BARC) but I think they are ok fundamentally in any case

Alternative ideas would be DGO CEY AAZ RRL at 3p and Apple

http://www.telegraph.co.uk/finance/...uy-into-ENRC-ahead-of-potential-takeover.html

there is unlikely to be any other bidder as the parties in the consortium already own 55pc of group equity. This means there is unlikely to be a significant premium offered. Indeed, it is entirely possible that any initial offer is below the current share price.

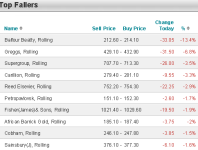

Miners are out of favour among investors as they are suffering a margin squeeze prompted by rising costs and falling commodity prices.

Perhaps the bigger winners from a takeover are likely to be investors in copper group Kazakhmys, which owns 26pc of ENRC.

City analysts reckon it is likely that this holding will also be part of the offer

this would give Kazakhmys’s balance sheet a nice $1.5bn boost.

^^ I will take some KAZ as it does fit the 61% fib retracement bullish scenario if taking thurs low to fri high. Just some TA mumbo jumbo, strength in a weak stock can be profitable (like the 50p double bottom on BARC) but I think they are ok fundamentally in any case

Alternative ideas would be DGO CEY AAZ RRL at 3p and Apple

mining is so slow

mining is so slow

also stats. Street smarts work best.

also stats. Street smarts work best.