Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

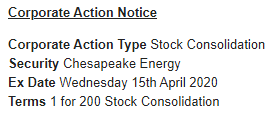

CHK is very iffy because they owe so much in debt, the stock is chained to the liquidity of the company. They have tons of assets but little profit exactly, they used to own the pipelines but its revenue is already gone in prior deals.

The bond holders are the real owners not the stock holders is something we've seen before but I wouldnt say I know how it ends except gravity is with the debt.

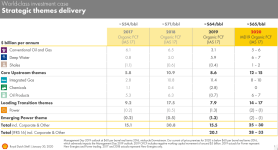

Famous company, the old CEO was a champion deal maker but he is passed. ET or WMB is more reasonable with lots of homework. The natural gas price itself was already low, its really not been as bad as oil in its drop I guess.

The real story is demand needs to be higher and its not, that was true prior to the virus and now.. I still count oil and gas as perfectly valid, CHK has the problem it has not the time to wait it out.

Its going to be a repeated story, any debt owed will come back to dollar depreciation and general monetary policy. Can you service it meanwhile then fine, if you cant then a firm who can will I expect benefit in the end possibly they buy up these stricken firms.

Japan gov debt is in theory broke, insolvent and unable to pay, Greece, even USA cannot pay all that debt if rates went to 5% which is normal scenario. So what happens is the cash value will be destroyed in a soft default, UK did it in the 70's so its not a wild theory it'll happen again I guess.

I am still holding off buying anything, as I think the aftermath of the virus will be terrible. and worse than the virus itself.

We didnt even reach 2016 prices so yep but also the value of cash is falling even year, no graph accounts for that afaik.

https://seekingalpha.com/article/43...ampaign=rta-author-article&utm_content=link-0

Last edited:

and interested to see how this gains or drops in the next couple of months. I can see a lot of people adopting it - not just business users, but family/friends - but I'm sure the bubble will pop soon.

and interested to see how this gains or drops in the next couple of months. I can see a lot of people adopting it - not just business users, but family/friends - but I'm sure the bubble will pop soon.