In any case Market value is not so much based on revenue as it is what people think the company will grow into, what they get long term in return for their investment.

Nvidia are valued higher than AMD and Intel put together on revenues of $26 Billion, because they have continuous growth and a high confidence among investors that they are going to be a much larger company in the future.

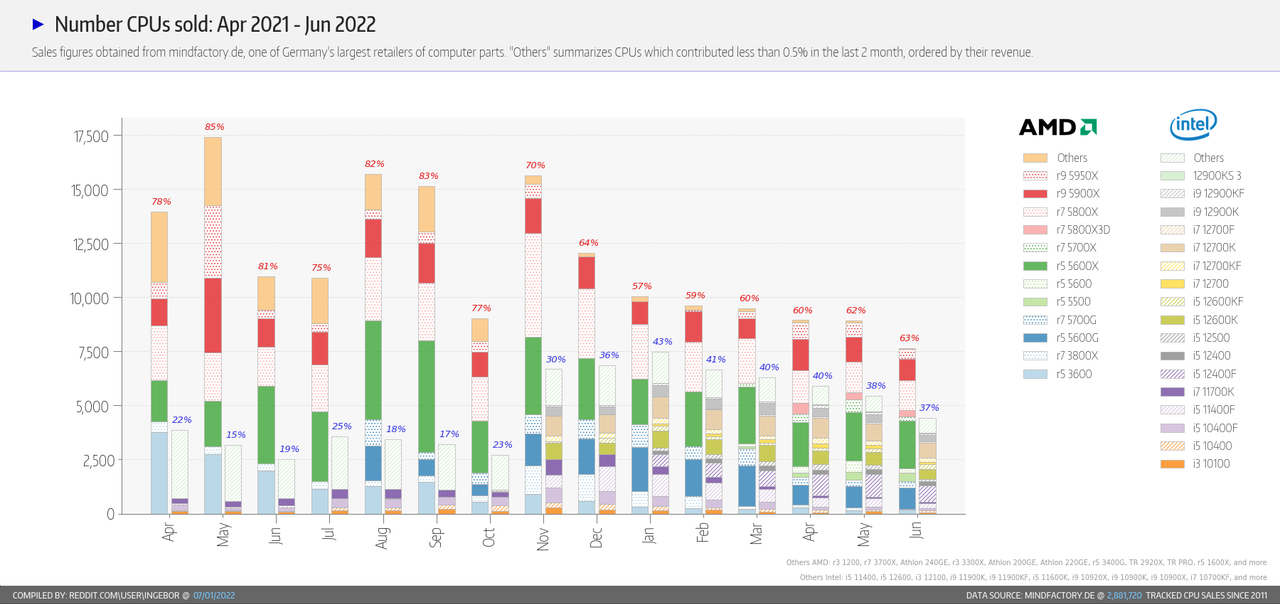

Intel are very depressed, they are losing market share to every competitor, their product roadmap is uninspiring, Pat Gelsinger keeps popping up #### talking AMD and how they are now in the rear view mirror and then having to walk back that arrogance when people point at AMD's up coming Genoa and Bergamo CPU's and asking "are you sure, Pat?"

Its not a good look, Intel's margins are down from 65% in 2017 to 53% now, i just watched Ian Cutress interview an industry expert who pointed out Intel have pretty much admitted they are not actually going to make any real money over the next couple of years.

AMD are very much resurgent, taking market share from Intel or forcing them to give away margins to keep it, thier revenue is growing by an average of 30% annually, AMD's revenues are forecast to be $21 Billion at the close of this year, up from $16.4 Billion, their margins are growing, currently at 50%, they will probably over take Intel's margins this year, they are constantly expanding and then growing in new markets.

Nvidia are valued higher than AMD and Intel put together on revenues of $26 Billion, because they have continuous growth and a high confidence among investors that they are going to be a much larger company in the future.

Intel are very depressed, they are losing market share to every competitor, their product roadmap is uninspiring, Pat Gelsinger keeps popping up #### talking AMD and how they are now in the rear view mirror and then having to walk back that arrogance when people point at AMD's up coming Genoa and Bergamo CPU's and asking "are you sure, Pat?"

Its not a good look, Intel's margins are down from 65% in 2017 to 53% now, i just watched Ian Cutress interview an industry expert who pointed out Intel have pretty much admitted they are not actually going to make any real money over the next couple of years.

AMD are very much resurgent, taking market share from Intel or forcing them to give away margins to keep it, thier revenue is growing by an average of 30% annually, AMD's revenues are forecast to be $21 Billion at the close of this year, up from $16.4 Billion, their margins are growing, currently at 50%, they will probably over take Intel's margins this year, they are constantly expanding and then growing in new markets.