The analogy is framed incorrectly. Thames never owned the house, the robbers did.I dont think ttaskmaster analogy is too far from the truth (you were robbed, why should you lose your house) .

At the end of the day its a failure of regulation. OFWAT as a toothless or narcolepsy suffering regulator letting water companies run roughshod over the law and not advocating for thhe customer enough.

I also think its a failure of financial regulation and maybe we should look at limiting the amount of money business can borrow against assests to try and prevent this kind of finacial extraction in the future.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

plan for collapse of Thames Water

- Thread starter Mrwong

- Start date

More options

Thread starter's postsSoldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

It is a failure of regulation first and foremost I think.

Macquarie came in and asset stripped Thames Water and the legal and regulatory framework allowed them to do it. They did it by loading up on debt and cutting expenditure to pay dividends.

It couldn't happen as easily now, regulator has started to introduce protections on gearing, dividends, exec pay & bonuses etc, tougher service improvement targets, and most recently mechanisms to ensure allowed expenditure is actually spent on what it's supposed to be spent on.

In the 90s and early 00s most water companies were publicly listed and shares openly traded. During this time dividend policies were reasonable, companies tended to spend what they were allowed and weren't beholden to the whims of a single investor. Then private equity started buying up these companies and things changed. I don't believe that should have been allowed to happen. An open shareholder model still works fine (as per the only three remaining publicly listed companies Severn Trent, United Utilities and South West Water). Of course they still pay dividends and have debt, but they aren't being exploited in the same way as Thames was.

Ultimately though most water companies despite being privately owned now, and operating under the same regulatory mechanisms, aren't in the same position as Thames. Thames went too far clearly and it was their Board and holding company Board that allowed it to happen.

Why, I don't know. Kickbacks too good to say no to, lack of willpower/morals to stand up to aggressive investors, or just bad luck finding themselves with investors like Macquarie who railroaded them. It's still a failure of regulation that it wasn't spotted and prevented sooner.

Welsh Water operates on a not for profit model, I personally like that approach. Thames now having lost its equity investors could switch to that model, it would still need to raise debt to fund itself and so still needs a good credit rating which will depend on the latest regulatory settlement and allowed revenues.

The main issue is it's gearing is high already, and so it's difficult to raise more debt to pay for future expenditure. That's why they'd want more equity injection but they will struggle to get it because of the deliberately curtailed returns that are now being imposed by the regulator in response to the historical issues.

Macquarie came in and asset stripped Thames Water and the legal and regulatory framework allowed them to do it. They did it by loading up on debt and cutting expenditure to pay dividends.

It couldn't happen as easily now, regulator has started to introduce protections on gearing, dividends, exec pay & bonuses etc, tougher service improvement targets, and most recently mechanisms to ensure allowed expenditure is actually spent on what it's supposed to be spent on.

In the 90s and early 00s most water companies were publicly listed and shares openly traded. During this time dividend policies were reasonable, companies tended to spend what they were allowed and weren't beholden to the whims of a single investor. Then private equity started buying up these companies and things changed. I don't believe that should have been allowed to happen. An open shareholder model still works fine (as per the only three remaining publicly listed companies Severn Trent, United Utilities and South West Water). Of course they still pay dividends and have debt, but they aren't being exploited in the same way as Thames was.

Ultimately though most water companies despite being privately owned now, and operating under the same regulatory mechanisms, aren't in the same position as Thames. Thames went too far clearly and it was their Board and holding company Board that allowed it to happen.

Why, I don't know. Kickbacks too good to say no to, lack of willpower/morals to stand up to aggressive investors, or just bad luck finding themselves with investors like Macquarie who railroaded them. It's still a failure of regulation that it wasn't spotted and prevented sooner.

Welsh Water operates on a not for profit model, I personally like that approach. Thames now having lost its equity investors could switch to that model, it would still need to raise debt to fund itself and so still needs a good credit rating which will depend on the latest regulatory settlement and allowed revenues.

The main issue is it's gearing is high already, and so it's difficult to raise more debt to pay for future expenditure. That's why they'd want more equity injection but they will struggle to get it because of the deliberately curtailed returns that are now being imposed by the regulator in response to the historical issues.

Last edited:

Equity is basically the value of assets sold minus money owed. Since the assets can't actually be sold off, as they're public assets and must remain with the service undertaker, they retain their value.

If they could be sold off, you'd have had no water for at least the past decade.

Again the value of the equity can go to zero.

It is a failure of regulation first and foremost I think.

Macquarie came in and asset stripped Thames Water and the legal and regulatory framework allowed them to do it. They did it by loading up on debt and cutting expenditure to pay dividends.

It couldn't happen as easily now, regulator has started to introduce protections on gearing, dividends, exec pay & bonuses etc, tougher service improvement targets, and most recently mechanisms to ensure allowed expenditure is actually spent on what it's supposed to be spent on.

In the 90s and early 00s most water companies were publicly listed and shares openly traded. During this time dividend policies were reasonable, companies tended to spend what they were allowed and weren't beholden to the whims of a single investor. Then private equity started buying up these companies and things changed. I don't believe that should have been allowed to happen. An open shareholder model still works fine (as per the only three remaining publicly listed companies Severn Trent, United Utilities and South West Water). Of course they still pay dividends and have debt, but they aren't being exploited in the same way as Thames was.

Ultimately though most water companies despite being privately owned now, and operating under the same regulatory mechanisms, aren't in the same position as Thames. Thames went too far clearly and it was their Board and holding company Board that allowed it to happen.

Why, I don't know. Kickbacks too good to say no to, lack of willpower/morals to stand up to aggressive investors, or just bad luck finding themselves with investors like Macquarie who railroaded them. It's still a failure of regulation that it wasn't spotted and prevented sooner.

Welsh Water operates on a not for profit model, I personally like that approach. Thames now having lost its equity investors could switch to that model, it would still need to raise debt to fund itself and so still needs a good credit rating which will depend on the latest regulatory settlement and allowed revenues.

The main issue is it's gearing is high already, and so it's difficult to raise more debt to pay for future expenditure. That's why they'd want more equity injection but they will struggle to get it because of the deliberately curtailed returns that are now being imposed by the regulator in response to the historical issues.

Even though DCWW is not for profit. I believe we have the most expensive water?

Imagine how bad it would be if it was for profit!

I think the actual prices are set by the regulator so potentially exactly the same, depending on their assessment of the company's business plan... I guess the company might exert more pressure for the regulator to agree to increases if they ended up having to service massive debts like Thames Water did though...Even though DCWW is not for profit. I believe we have the most expensive water?

Imagine how bad it would be if it was for profit!

Last edited:

I think the actual prices are set by the regulator so potentially exactly the same, depending on their assessment of the company's business plan... I guess the company might exert more pressure for the regulator to agree to increases if they ended up having to service massive debts like Thames Water did though...

The companies ask to increase bills by X and the regulator approves or not. And if not it goes back and forth until resolution.

But individual companies get different allowances

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

The cost of your bill isn't really linked to profit or profiteering. Its a function of the historic regulatory capital value set at privatisation in 1990, and then the investment that's subsequently taken place since then and been allowed by the regulator.Even though DCWW is not for profit. I believe we have the most expensive water?

Imagine how bad it would be if it was for profit!

Water companies can't increase the bill to make more profit as the allowed revenues are fixed and that's what drives the bill. What they can do is underspend, take on debt (historically, not so much now as there are rules on gearing) and pay dividends from that headroom. Its financial engineering but the allowed revenues don't change.

Last edited:

Dcww do have a lot of debt too if I rememberThe cost of your bill isn't really linked to profit or profiteering. Its a function of the historic regulatory capital value set at privatisation in 1990, and then the investment that's subsequently taken place since then and been allowed by the regulator.

Water companies can't increase the bill to make more profit as the allowed revenues are fixed and that's what drives the bill. What they can do is underspend, take on debt and pay dividends from that headroom. Its financial engineering but the allowed revenues don't change.

Obviously the infrastructure here is probably considerably more expensive due to low population density + huge area + difficult terrain

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

Dcww do have a lot of debt too if I remember

Obviously the infrastructure here is probably considerably more expensive due to low population density + huge area + difficult terrain

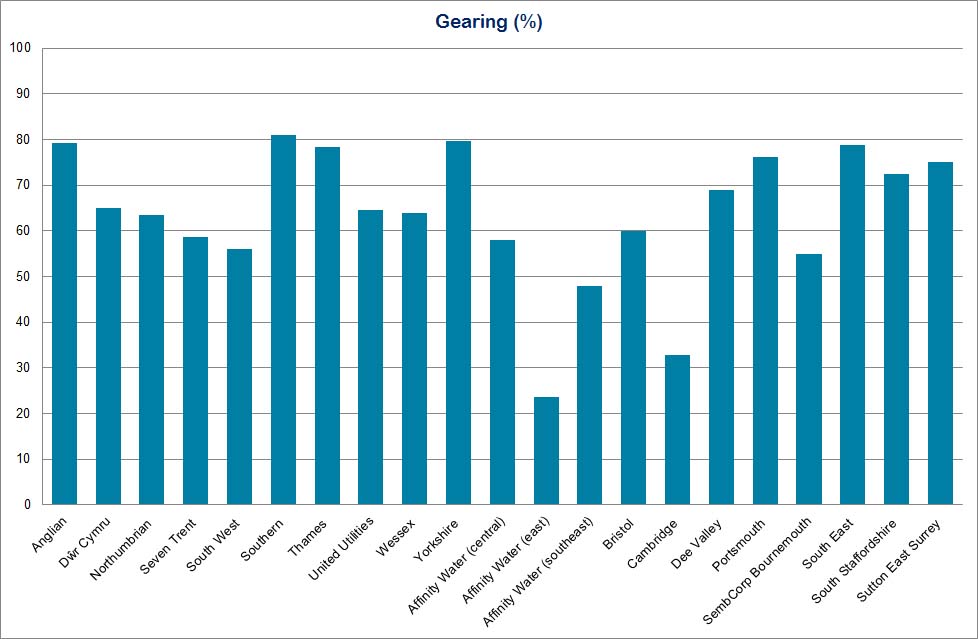

Not particularly, gearing at 65%. Even Thames isn't the highest.

Edit - actually that data is 10 years old now, need to find an updated version.

Last edited:

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

Here's an updated table of key financial metrics from 2022/23.

Soldato

- Joined

- 11 Sep 2013

- Posts

- 12,548

Actually the above makes it a lot cheaper. It's far easier to install and maintain stuff in undeveloped land than highly developed areas, as there is less/no conflicting infrastructure and buried services, issue over ownership and access rights, complexity in engineering, risk and consequence of failure, etc.Dcww do have a lot of debt too if I remember

Obviously the infrastructure here is probably considerably more expensive due to low population density + huge area + difficult terrain

We always owned the house. We were owned by our parents, who were owned by the evil slaveholders that later robbed us.The analogy is framed incorrectly. Thames never owned the house, the robbers did.

Actually the above makes it a lot cheaper. It's far easier to install and maintain stuff in undeveloped land than highly developed areas, as there is less/no conflicting infrastructure and buried services, issue over ownership and access rights, complexity in engineering, risk and consequence of failure, etc.

We always owned the house. We were owned by our parents, who were owned by the evil slaveholders that later robbed us.

Surely have 100 people paying in one tower block is more profitable than piping to one person's house through solid rock?

Soldato

- Joined

- 11 Sep 2013

- Posts

- 12,548

Does the solid rock require NRSWA parking suspensions, lane rentals, access rights and permissions, land owner disputes or local authority approval?Surely have 100 people paying in one tower block is more profitable than piping to one person's house through solid rock?

Are there any buildings on top of the solid rock? Roads? Railways? Infrastructure?

Are there any conflicting buried services in the rock?

Is the rock traffic sensitive?

The cost of installation, cost of maintenance and cost impact of failure are massively higher the closer you go into built-up areas.

Why do you think so many companies are springing up that focus on rural fibre internet?

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

Yeah it works both ways actually.Surely have 100 people paying in one tower block is more profitable than piping to one person's house through solid rock?

In some aspects it is cheaper to supply denser areas, you can get economies of scale more easily from that. For example one bigger treatment works instead of lots of smaller ones.

In other aspects dense city environments make things more expensive, such as when having to dig up roads in London.

The way Ofwat models this by the way is by using population density metrics that are non-linear. So more sparse areas get more funding than average, and very dense areas get more funding than average. I.e a U shape curve.

Last edited:

That still doesn't add up for me... the total amount of infrastructure per person will still just be a lot higher for rural areas, can't see that being outweighed by relatively simple maintenance for the bits which literally just run through fields or along quiet country roads.Does the solid rock require NRSWA parking suspensions, lane rentals, access rights and permissions, land owner disputes or local authority approval?

Are there any buildings on top of the solid rock? Roads? Railways? Infrastructure?

Are there any conflicting buried services in the rock?

Is the rock traffic sensitive?

The cost of installation, cost of maintenance and cost impact of failure are massively higher the closer you go into built-up areas.

Why do you think so many companies are springing up that focus on rural fibre internet?

The infrastructure within villages will still have silmar issues around digging up roads etc. And any infrastructure that runs through properly remote areas will have additional access challenges compared to infrastructure just off a main road.

If it's so much cheaper to provide rural fibre broadband the why is the government spending hundreds of millions of pounds subsidising it with their voucher scheme etc?

Last edited:

Does the solid rock require NRSWA parking suspensions, lane rentals, access rights and permissions, land owner disputes or local authority approval?

Are there any buildings on top of the solid rock? Roads? Railways? Infrastructure?

Are there any conflicting buried services in the rock?

Is the rock traffic sensitive?

The cost of installation, cost of maintenance and cost impact of failure are massively higher the closer you go into built-up areas.

Why do you think so many companies are springing up that focus on rural fibre internet?

Flip that around. Why do rural areas traditionally have much worse landline speeds? It's more profitable in dense areas?

Also those rural areas might need to run hundreds of metres for one house. Where as in London you can supply 100s of residents connecting up one tower block. Which has probably been built taking water supply into consideration.

Looks like @danlightbulb is more in the know though. Will let him come back on your comment.

Yeah it works both ways actually.

In some aspects it is cheaper to supply denser areas, you can get economies of scale more easily from that. For example one bigger treatment works instead of lots of smaller ones.

In other aspects dense city environments make things more expensive, such as when having to dig up roads in London.

The way Ofwat models this by the way is by using population density metrics that are non-linear. So more sparse areas get more funding than average, and very dense areas get more funding than average. I.e a U shape curve.

I believe dcww with our huge coastline has a lot more water treatment duties than Thames for example too?

Soldato

- Joined

- 14 Jul 2005

- Posts

- 9,174

- Location

- Birmingham

He is right at the micro level it is far more expensive to dig up services in London for example.Will let him come back on your comment.

At the macro level Thames is obviously a very big company and so serves London which is very expensive for network maintenance but also a lot of rural areas too where its cheaper.

Regulators look at the macro areas of a company when setting cost allowances. Thames is on average the most densely populated water company because of London of course, but their rural areas pull them back somewhat. If a water company only supplied London (as was proposed, to split up Thames), then they would have much higher network maintenance costs on average than the current company does.

You're also right that some aspects of rural areas are more expensive too. Digging up pipes is cheaper in rural Wales but its true that you have more pipe per head in rural Wales than you do in central London.

Last edited:

Soldato

- Joined

- 11 Sep 2013

- Posts

- 12,548

The infrastructure required and the costs involved will be different, though.That still doesn't add up for me... the total amount of infrastructure per person will still just be a lot higher for rural areas, can't see that being outweighed by relatively simple maintenance for the bits which literally just run through fields or along quiet country roads.

In rural areas you can put in pretty much whatever you like. The more densely populated an area, the more restricted you are on what you can fit in there and what will work.

For example, a rural area catchment of 1600 properties will benefit from balancing ponds and other flood alleviation measures at a relatively low cost (say, £2mil for a large one), whereas somewhere like London might require a FLIP device to be installed at each at-risk property, costing about £40,000 each for a total of £64mil.

Village infrastructure is mostly in undeveloped land and minor roads. Works are unlikely to impact railways, bridges, buried services, SSIs, graded buildings, schools, hospitals, or any of that stuff.The infrastructure within villages will still have silmar issues around digging up roads etc. And any infrastructure that runs through properly remote areas will have additional access challenges compared to infrastructure just off a main road.

Physically accessing sites is also quite easy in remote areas, whereas you can't just pick up a London railway station and move it aside while you work on the stuff beneath.

Dunno. We got our rural fibre without needing any vouchers... but we are also serviced by someone who isn't one of their scheme suppliers.If it's so much cheaper to provide rural fibre broadband the why is the government spending hundreds of millions of pounds subsidising it with their voucher scheme etc?

It sounds more like government fingers in profitable pies, than anything else.

Because the cost of putting up telephone poles and laying/upgrading wire per metre is basically the same wherever you go, and rural areas needed more of them?Flip that around. Why do rural areas traditionally have much worse landline speeds? It's more profitable in dense areas?

Rural pipe might cost £300 per metre, where the same pipe in suburbia would cost £3500 and in a city centre could easily be £5000.Also those rural areas might need to run hundreds of metres for one house. Where as in London you can supply 100s of residents connecting up one tower block. Which has probably been built taking water supply into consideration.

Higher population desnities also tend to require larger diameter pipes to cope with the heavier flows, and often you'll need to go even larger to accommodate the commercial/industrial needs as well.

In places with really dense populations you won't have the space to put enough large diameter pipes in, so you'll double-barrel them as with the Oxford City Trunk sewer and the five-barrel Northern Outfall Sewer.

And maintain.He is right at the micro level it is far more expensive to dig up services in London for example.

OPEX is massive in built-up areas.

TW also has to deal with Luton, Slough, Oxford, Swindon, Reading and Basingstoke, which have some of the highest population densities per area in the UK.Thames is on average the most densely populated water company because of London of course, but their rural areas pull them back somewhat. If a water company only supplied London (as was proposed, to split up Thames), then they would have much higher network maintenance costs on average than the current company does.

You often have longer single pipe runs in rural areas, but built-up areas have lots of short runs making up the networks. The latter is also more likley to have additional back-up networks, in the event of failure and to transfer flows between catchments as demand and capability vary.You're also right that some aspects of rural areas are more expensive too. Digging up pipes is cheaper in rural Wales but its true that you have more pipe per head in rural Wales than you do in central London.