You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsAssociate

- Joined

- 20 Oct 2002

- Posts

- 484

Care to share your thoughts? I notice you have been in and out of these before, so would know more than me. I will obviously do my own research.I think Barc is a massive buy now, easy 10% to be made over the next couple of months, just a shame I bought in a few days ago.

I have the money coming in for a sale of a house on friday so if they do not go back up I will pile in some more cash

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

UPDATE: Iraqi Kurds To Get $243M For February-March Oil Sales

(Adds more quotes paragraph 5, background from paragraph 6.)

By Hassan Hafidh

Of DOW JONES NEWSWIRES

AMMAN (Dow Jones)--Iraq's Kurdistan region will get $243 million, which represents around 50% of net revenues from exporting some 5 million barrels of oil in February and March, ending a dispute with the federal government in Baghdad that has continued for years, the region's prime minister said Thursday.

"The Kurdistan Regional Government has received a written notice from the federal ministry of finance in Baghdad, confirming release of the first oil export payment to the KRG," Barham Salih said in a statement carried out by the official KRG website.

Meantime, the region's Oil Minister Ashti Hawrami said that the Kurdistan region has been exporting at an average level of 135,000 barrels a day between March 27-April 29, compared with an average of 100,000 barrels a day in February and March.

Hawrami said that all the money received from Baghdad will be paid to contracting companies that are developing the region's oil fields, among them Norway's DNO International SA (DNO.OS), which is pumping oil from Tawke oil field, and China's Sinopec (SHI) and Turkey's Genel Enerji, which are jointly producing oil from Taq Taq field.

Hawrami welcomed the Baghdad government's move to release the payments, saying it would incite them to "increase oil export to 200,000 barrels a day by the end of this year."

The Iraqi central government late last year reached an agreement with Kurdish authorities to resume oil exports from the semi-autonomous region as from February, and agreed to pay exploration costs and expenses to foreign firms in the KRG.

The Kurds suspended exports of 40,000-60,000 barrels a day in September 2009, from the Tawke and Taq Taq fields, after a brief trial because the federal government refused to compensate oil companies for costs incurred during exploration and production.

The federal government, which grants all oil-export licenses, has been at odds with the Kurds since 2007 over several oil and gas contracts the Kurds signed with foreign companies. Baghdad argues it has neither seen them or been consulted on these deals.

Salih said the new move could help pave the way for solving all pending issues between the KRG and the central government in front of which enacting a federal hydrocarbon and oil-revenue sharing laws. The long-awaited draft laws have been stalled by debates at the country's parliament for years.

-By Hassan Hafidh, Dow Jones Newswires;

May 05, 2011 11:09 ET (15:09 GMT)

All the banks near more realistic levels now. RBS also. Barc I'll wait for 260, too many possible false dawns. lloy could be 44, rbs maybe 37 who knows

BP going to 400 was a possibility I realised when it broke its 200 day average. Still at least it pays me a div next wed :/ [433p 420 hurdles first]

CNR at 8p now. Not enough time to consider how justified the move down is on many things.

DXY is the symbol to watch, inverse to most share prospects usually, hope lives with it below 74.23

Last edited:

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

16.27 for RRL

This is highs of Feb, brief low of Feb and also now recent low

Yes its a reasonable place to buy unfortunately everything is looking quite similar. CNR was 7.56 to buy this morning but my order failed because other positions had emptied my account.

RBS is up at least, my old order for that gained 7% with no thought. Pity it was a tiny scale, always pays to have lots of nice cashflow to feed in at the bottom

Bigger buys today are FPM who a good prospect now. PMG who own them are also off their lows, gone from 38 to 11p and this now is the deflated real price with potential to bounce

Doubled Lloy holding and HOC

Dollar is out of its cage and a threat to oil prices, etc (in theory)

Barc price now is not good. Its on par with majority of lows of this year and its stayed at this low today when it could or should have bounced.

Its free to leave for 390 but its drawn to 250 yet again?

A close over 282 would help prove me wrong

This is highs of Feb, brief low of Feb and also now recent low

Yes its a reasonable place to buy unfortunately everything is looking quite similar. CNR was 7.56 to buy this morning but my order failed because other positions had emptied my account.

RBS is up at least, my old order for that gained 7% with no thought. Pity it was a tiny scale, always pays to have lots of nice cashflow to feed in at the bottom

Bigger buys today are FPM who a good prospect now. PMG who own them are also off their lows, gone from 38 to 11p and this now is the deflated real price with potential to bounce

Doubled Lloy holding and HOC

BP hit bottom at that 433, Emed has reversed their price doubling, 11p is on trend with highs of previous two years. Again looks to be a realistic value to buy[433p 420 hurdles first]

Dollar is out of its cage and a threat to oil prices, etc (in theory)

PRESS RELEASE: DBRS Comments on Lloyds Banking Group plc's 1Q11 IMS; Senior at A (high), Trend Stable

DBRS(R) As It Happens

MAY 6, 2011 10:05 AM

Press Releases

(http://www.dbrs.com)

DBRS Comments on Lloyds Banking Group plc's 1Q11 IMS; Senior at A (high), Trend Stable

DBRS Inc. (DBRS) has today commented that the ratings for Lloyds Banking Group plc (Lloyds or the Group), including its Issuer and Long-Term Debt rating of A (high) and the ratings of Lloyds TSB Bank plc, including its Senior Debt & Deposits rating of AA (low), are unaffected by the Group's 1Q11 Interim Management Statement (IMS). The trend for all ratings is Stable.

Despite a statutory loss, which reflected the impact of a one-time non-operating item, Lloyds' results indicate continued progress towards achieving the Group's strategic initiatives, which include strengthening and right sizing the balance sheet and further transforming the funding profile. For the quarter, Lloyds reported a statutory pre-tax loss of GBP 3.5 billion, which included a GBP 3.2 billion provision charge for potential costs of customer contact and redress related to Payment Protection Insurance (PPI) complaints. On 20 April 2011, the High Court ruled that U.K. banks, including Lloyds, had failed in their appeal against positions taken by the FSA and FOS on PPI; as a result of the Court's ruling, Lloyds established the aforementioned reserve to cover the expected lifetime costs. PPI was sold alongside various debt products and repays loans if a borrower's income drops due to unemployment or illness. While the loss was significant, given the non-recurring nature of the loss, DBRS does not view this as an indication of any sustained weakness in Lloyds' business model or franchise. Accordingly, DBRS looks to underlying results as a better gauge of the Group's financial performance.

On a combined business basis, which includes the impact of certain adjustments, including fair value unwind and mark-to-market of the enhanced capital notes, Lloyds reported a profit before tax of GBP 284 million compared to a loss of GBP 276 million in the prior quarter. The improved quarter-on-quarter underlying results were driven by lower impairment charges partially offset by reduced net interest income, which fell 10% to GBP 3.2 billion. While part of the decrease in net interest income reflects margin compression, the reduction of GBP 20.7 billion of non-core assets also has a negative impact on net interest income levels, as the balance sheet continues to shrink. Net interest margin fell 5 basis points on a linked quarter basis to 2.07%, reflecting the impact of higher funding costs as the Group successfully issued term debt in volatile capital markets. While DBRS recognises the resulting impact on the income statement, DBRS views the planned reduction in non-core assets and the issuance of higher cost, longer-term funding as prudent measures taken in order to strengthen the balance sheet, which in DBRS's view, more than offsets the income statement impact.

Although Lloyds achieved a 30% reduction in impairment charges compared to 4Q10, credit costs remain elevated. Indeed, impairment charges at GBP 2.6 billion increased as compared to the comparable period a year ago, reflecting the weakness in Ireland. In the GBP 585.4 billion customer loan book impaired loans remain high at 11% of the book. Impaired loans increased 3% during the quarter from year-end 2010, to GBP 66.3 billion, with the increase largely attributable to continued growth of impaired loans in the Irish loan book. Non-core loans and advances to customers generated approximately 75% of the Group's impaired loans reflecting their higher risk profile. While credit costs and the quantum of impaired loans remains elevated, DBRS sees the positive trend on a linked quarter basis as illustrating the progress the Group has made in removing risk from the balance sheet.

Lloyds continues to make progress in strengthening its funding and liquidity profile. During the quarter, in a competitive environment, Lloyds grew its customer deposit base by 2% to GBP 389.3 billion. As a result, the Group's loan-to-deposit ratio improved to 148% from 154% at year-end 2010, and within the core business this ratio was 116%. Importantly, the good deposit growth along with the GBP 13.5 billion of public term issuance completed in the quarter and reduction of non-core assets afforded the Group the ability to further reduce liquidity support from the government and central bank facilities, which declined 26% to GBP 70.4 billion. Regarding capital, at 31 March 2011, the Group's core Tier 1 ratio stood at 10.0%, a slight decrease from year-end 2010 reflecting the statutory loss partially mitigated by a GBP 15 billion, or 4% decline in risk-weighted assets to GBP 390.9 billion.

Notes: All figures are in GBP unless otherwise noted.

The principal applicable methodology is the Global Methodology for Rating Banks and Banking Organisations. Other methodologies used include the Enhanced Methodology for Bank Ratings -- Intrinsic and Support Assessments. Both can be found on the DBRS website under Methodologies.

Barc price now is not good. Its on par with majority of lows of this year and its stayed at this low today when it could or should have bounced.

Its free to leave for 390 but its drawn to 250 yet again?

A close over 282 would help prove me wrong

Last edited:

MXP has stood up well against the dive in commodities. News due imminently regarding ASK-1 and various other operations, next week could be exciting!

I hope so, got a bit invested there. But for some strange reason I don't have much faith in them.

Market looks it about to bounce, few stocks now blue.

Soldato

- Joined

- 13 Jul 2004

- Posts

- 20,341

- Location

- Stanley Hotel, Colorado

Got stopped out of RBS, that bounce didnt last long :/

Not sure I'll bother reentering, STAN is cheap and far more deserving as far I know. Will buy Friday if it stays low long enough which I think is highly possible

Dollar is rising which usually means lots of profit taking and pull backs.

So the target on DXY now is late Feb prices and Im thinking this is when the market might be really overly positive again

Prices up today but I think we go sideways mostly. Disappointment on average

This is when divs are useful, Stan pays wed and BP SHELL also if you hold in a SB account

Only GOG has risen for me, anyone seeing (relative) highs on their stock?

Not sure I'll bother reentering, STAN is cheap and far more deserving as far I know. Will buy Friday if it stays low long enough which I think is highly possible

Dollar is rising which usually means lots of profit taking and pull backs.

So the target on DXY now is late Feb prices and Im thinking this is when the market might be really overly positive again

Prices up today but I think we go sideways mostly. Disappointment on average

This is when divs are useful, Stan pays wed and BP SHELL also if you hold in a SB account

Only GOG has risen for me, anyone seeing (relative) highs on their stock?

Last edited:

Nice to see a screen of blue today. CAZA recovering well, news expected this week. MXP is doing my nut in, news of ASK is well overdue.

Hey silversurfer, what trading platform do you use? I'm thinking of getting level 2, currently using III for sharedealing but was wondering about the other options. I've heard TD Waterhouse is to be avoided.

Hey silversurfer, what trading platform do you use? I'm thinking of getting level 2, currently using III for sharedealing but was wondering about the other options. I've heard TD Waterhouse is to be avoided.

Anyone else in XEL?

I've had to majorly restructure my 2011 investment plans after today. Disappointing but still very content to long hold for production. I'm just getting really antsy about being out of GKP at the moment.

Roll on BEM Kallak North JORC...

I've had to majorly restructure my 2011 investment plans after today. Disappointing but still very content to long hold for production. I'm just getting really antsy about being out of GKP at the moment.

Roll on BEM Kallak North JORC...

Anyone else in XEL?

I've had to majorly restructure my 2011 investment plans after today. Disappointing but still very content to long hold for production. I'm just getting really antsy about being out of GKP at the moment.

Roll on BEM Kallak North JORC...

yeah disappointing reaction to the news but a broker target still of 600p - held since 60p and still holding for the long term. i would buy some more if i had any spare money, but i don't

Anyone else in XEL?

I've had to majorly restructure my 2011 investment plans after today. Disappointing but still very content to long hold for production. I'm just getting really antsy about being out of GKP at the moment.

Roll on BEM Kallak North JORC...

Likewise in XEL and have found the results dissapointing. I think i'm just going to have to sit it out until production.

Anyone else in XEL?

I've had to majorly restructure my 2011 investment plans after today. Disappointing but still very content to long hold for production. I'm just getting really antsy about being out of GKP at the moment.

Roll on BEM Kallak North JORC...

Good time to get in XEL I think ?

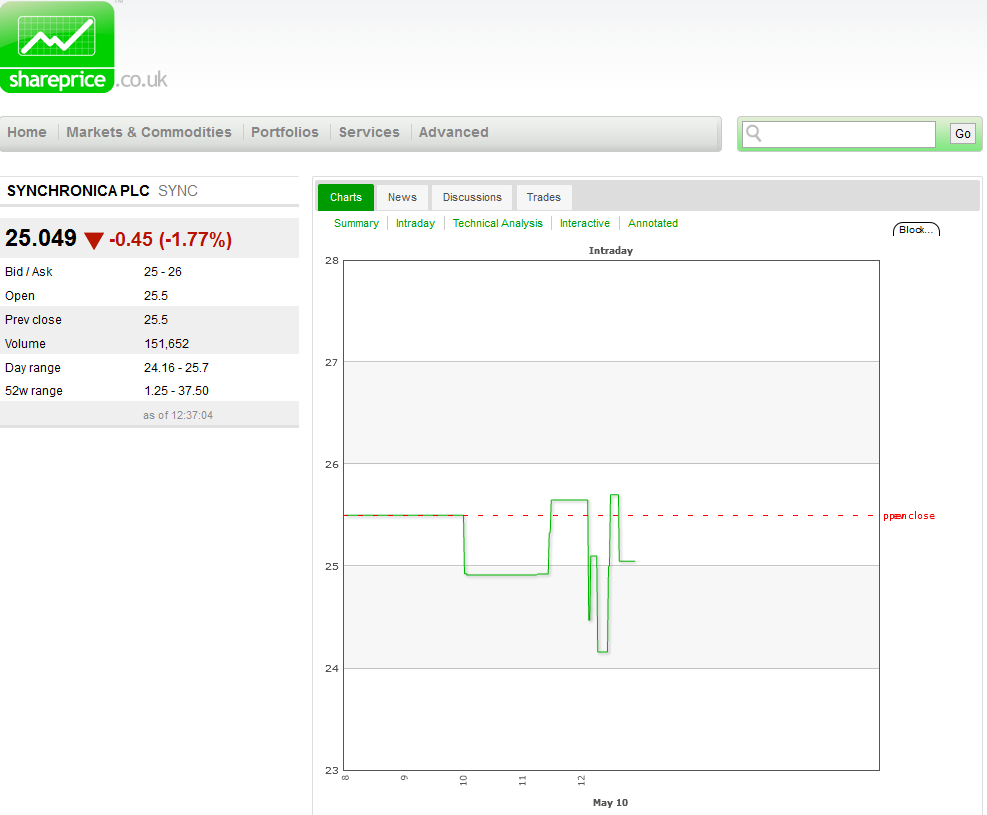

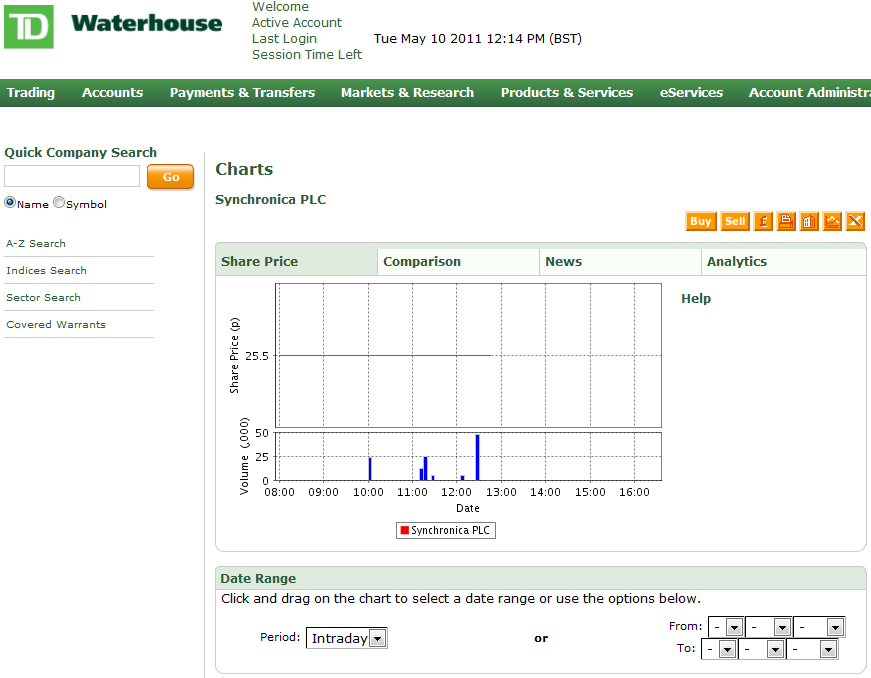

Surely TD use 15min delayed prices whereas Shareprice use level 1 contended?

Price had been under 25 for over an hour