FSA is doing or has done a review called RDR I think. Its partly responsible for a few of these changes ongoing

All charges must be explicit not kick backs

I have iii also, they used to be white label halifax. AFAIK they wont charge for transferring stocks out now, I believe they have recently agreed to waiver this

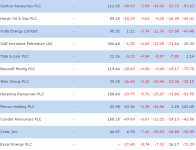

Im considering xo selftrade and halifax . ST charges like Barclays but also includes the iii thing of 1.50 dealing which is how I often buy little batches of beaten up stocks that 'flatlined'. So that could be a nice one, I doubled my holding of RRL from 2010 recently and that turned nice so far. Anyway it means you only have to spend 1.50 x 4 per year .

XO is free and halifax too and does regular deal for 2. Im not sure if RDR will cause any further complications.

You say investments, if you mean funds I guess HL is cheap

Selftrade is part of Socgen. They are the most sophisicated broker Ive had, you can hold some very extreme stuff in that account basically deal options - or not of course

Anyone who deals over 10k might find entirely different is cheapest like

http://www.interactivebrokers.co.uk/en/main.php

I've also got some paper shares that need transferred to electronic

I know Halifax will transfer those to nominee on request. Why do you have to do that though

otherwise 2.50 a quarter

otherwise 2.50 a quarter good question

good question

I bought some Essr but they are weak from Iran oil sanctions

I bought some Essr but they are weak from Iran oil sanctions