Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

Ninja edit there SS.

It's all about the end game with CNR! I'm averaging 133 with it post consolidation but happy to wait it out... ORE & OTC however

Ninja edit there SS.

problem is cost of getting it out of the ground but nice its there.

problem is cost of getting it out of the ground but nice its there.I read that last week. Peace moves between all sections of kurds and Turkey would be bullish, as (small) attacks are often afaikhttp://af.reuters.com/article/energyOilNews/idAFL6E8I36W320120703?sp=true

Tue Jul 3, 2012 2:38pm GMT Print | Single Page[-] Text [+] By Evrim Ergin

ISTANBUL, July 3 (Reuters) - Iraq's semi-autonomous Kurdish region may begin selling natural gas directly to Turkey within two years, its energy minister said on Tuesday, a move likely to anger the central government and further strain Baghdad's ties with Ankara.

The Kurdistan Regional Government (KRG) in the north of the country and Baghdad have rowed for years over issues including late payments for crude, the legality of the regional government's oil deals and disputed territory.

Baghdad accuses the Kurds of smuggling their oil abroad, mainly to Iran, and wrecking the central budget by denying it revenue.

I'd like to top up CNR presuming there was no news for this

B2Gold Corp. (B2Gold) is a gold producer with mining operations in Nicaragua and a portfolio of development and exploration assets in Colombia, Nicaragua and Uruguay. It operates the Libertad Mine and the Limon Mine

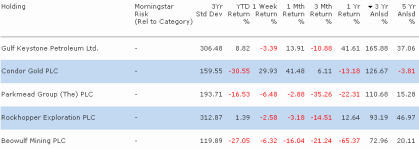

Analysts have downgraded their ratings on the stock with Merchant Securities saying the technical difficulties encountered by Borders ‘decreases the attractiveness of the South Falkland Island Basin because it increases exploration risks and developmental costs.’ Falkland Oil and Gas (FOGL.L) and Rockhopper Exploration (RKH.L) have fallen heavily too.

Holden, who runs a high risk portfolio with just 20 stocks, told Citywire this was 'rubbish'. He said the company was awaiting the results from test drilling in the nearby Darwin oil field. When these are published at the end of August they could transform the valuation of the company. Ironically, he said, the problems of high pressure that hindered the Stebbing well were a sign of the high level of hydrocarbons in the region. Morever, the company's discovery of a 'gas condensate' raised the chances that oil would eventually be found. He said he had bought more shares this week.

In his latest update to investors Holden says the fund’s exposure to exploration stocks has hurt the fund as the oil price has fallen. However, he is a conviction manager and took advantage of the falling share prices to top up holdings in Rockhopper, Borders & Southern, Ophir Energy (OPHR.L), Randgold Resources (RRS.L)and Cove Energy (COVE.L), the subject of a recent bidding war between Shell and Thailand's PTT.

be optimistic when people lose hope or try to moderate the extremes anyway I think can be profitable strategyWill we ever see 10p again???

http://www.iii.co.uk/articles/44862/range-and-red-emperor-abandon-testingRange Resources (RRL) and Red Emperor Resources (RMP) were the two most actively-traded stocks by the users of Interactive Investor after the companies confessed "no further testing could be justified" on the Upper Jesomma sand interval in the Shabeel North well in Puntland, Somalia.

This followed the announcement on Monday that the testing of the Upper Jesomma sand reservoir had yielded fresh water. Still, the well continued drilling through the entire Jesomma reservoir section and had reached a depth of 2,200 metres.

The section contained several additional sands with oil and gas shows and a full set of electrical logs was run to determine if these sands contained potential oil zones which would warrant further testing. However, the analysis of these logs indicated that the most prospective-looking zone in the well was the Upper Jesomma sand interval that had already been confirmed by testing to contain fresh water.

Hard for me to track this stock and its volume but I think soEchoed by the volumes, which were pretty pap if memory serves.

Anyone got any insight on why CNR is shooting up at the moment?

Highlights

· LIDC109 intercepted 12.2m at 34.79g/t from 173m drill depth which is 50m underneath an intercept of 34m true width at 2.31g/t (LIDC067). Grade increasing at depth.

· LIDC121 intercepted 6.65m at 32.23g/t from 111m drill depth which is 100m underneath an intercept of 15.5m true width at 7.39g/t from surface (LIRC102).

· 11m at 10.45g/t from 97m drill depth is 50m along strike from LIRC105 which returned 25.1m true width at 7.73g/t.

· 28m at 1.63g/t from 49m drill depth further demonstrates near surface open pit potential.

· Coalescence of La India Vein and California Vein continues to be proved along a 600m strike length with true width drill intercepts of 10m to 34m demonstrating continuity and width for open pit mining

· The resource on the California veins is currently 100m to 150m beneath surface.

Drilling and trenching has extended the gold mineralisation above this vein to surface. See Figure 5 cross section.