-- 2nd Update

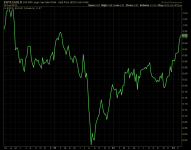

--Apple sells 9 million iPhones, most ever on a launch weekend --Company sells out of more expensive model --Sees revenue, margins at high end of previous forecast (Adds analyst reaction, beginning in paragraph five.) By Nathalie Tadena Apple Inc. (AAPL) sold nine million of its latest iPhones in their first three days in stores, a new company record, and said quarterly revenue and margins should be near the high end of its previous forecast. Apple said it has sold out of its initial supplies of the more expensive model. The company declined to say when more may be available, other than to note that stores continue to receive new iPhone shipments regularly. "The demand for the new iPhones has been incredible," Chief Executive Tim Cook said in a press release. Apple two weeks ago unveiled two new iPhone models that didn't stray far from the company's traditional form factors and pricing. The new flagship iPhone 5S includes a faster processor, a better camera and a new fingerprint scanner. A second, less expensive model called the iPhone 5C repackages much of the technology from last year's device in a new, colorful plastic case. The company on Monday didn't break out the sales by model. Informal polls of buyers Friday suggested the more expensive iPhone 5S was more popular. Cantor Fitzgerald said its survey of buyers in New York City found 88% bought the iPhone 5S, but the firm said Apple's sales numbers Monday suggested the less expensive phone also sold well. "The strength of this weekend's sales benefited from much stronger-than-expected demand for the iPhone 5C," Cantor Fitzgerald analyst Brian White said. "The criticism of the iPhone 5C as being too expensive versus expectations and thus demand would be muted were proven wrong with today's strong weekend sales." Also likely helping sales totals was the addition of China to the list of launch sites. The nine million iPhones sold this weekend surpassed the company's previous record of more than five million units sold, which occurred when the iPhone 5 launched last year. The amount also topped the five million to six million that many analysts were expecting, as well as the 3.7 million smartphones that Blackberry Ltd. (BB.T, BBRY) shipped in its whole second quarter. Apple said more than 200 million iOS devices are now running on its new iOS7 system, which the company called the fastest software upgrade in history. iOS7 is the first major design overhaul of the mobile operating system that Apple introduced in 2007, giving rise to the booming apps economy. In July, Apple projected revenue for its fiscal fourth quarter between $34 billion and $37 billion and gross margin between 36% to 37%. Analysts, on average, were expecting revenue of $36.1 billion and gross margin of 36.7%, according to Thomson Reuters. Shares of Apple recently jumped 4.4% to $488. Through Friday's close, the stock is up 13% over the past three months. The Wall Street Journal reported last week that demand for the gold 5S was so strong in China and Hong Kong that Apple already has asked its suppliers to increase production of that model, citing people familiar with the matter. As the world-wide market for smartphones has increased, Apple has lost market share, particularly outside the U.S. and among first-time smartphone buyers. On the low end, competitors have been able to come in far below Apple's prices. On the high end, rival Samsung Electronics Co. (005930.SE) has attracted customers with varied screen sizes and increasingly more impressive features, such as a pen to draw notes and more advanced camera systems.

(END) Dow Jones Newswires September 23, 2013 10:31 ET (14:31 GMT)