You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsHuge 82% jump this month for my GWP shares. Now at 160p (average base price for me 77p)

I had some GWP shares way back in 2005, i knew they would come good when they finally got approval. However I got tired of waiting and eventually sold them for a minuscule profit.

Reckon GWP could be a takeover target from one of the big drug players, might take a punt on them.

Could use some advice... A month ago I spent around £1500 on some shares in Tesla motors (TSLA). Since then they've lost almost £180 in value (bought at 177$, currently around 160$). I was planning this to be a long term investment, but I'm seeing more and more reports saying to sell and that the value could reach a low of 120$ (I bought at 177$).

Get out of dodge and take my losses or stick around?

Get out of dodge and take my losses or stick around?

Could use some advice... A month ago I spent around £1500 on some shares in Tesla motors (TSLA). Since then they've lost almost £180 in value (bought at 177$, currently around 160$). I was planning this to be a long term investment, but I'm seeing more and more reports saying to sell and that the value could reach a low of 120$ (I bought at 177$).

Get out of dodge and take my losses or stick around?

I almost got in a month ago but hesitated. Some reports said they'd be the next big car giants. Others said that by the time they actually get manufacturing big scale the other car giants would have their own offerings.

My personal feeling is the tesla boat has sailed share wise. i hope i'm proved wrong because while I wont invest I do like them as a company.

Soldato

The guy behind it setup Paypal as well apparently. He says himself of the value it is very complimentary and one day he hopes to make it totally justified, ie. he believes the company worth will reflect it in its earnings.

Apple did it of course, they were bid up ahead of actual earnings.

http://stocktwits.com/symbol/TWTR?q=twtr

Go there and theres a lot of comments, links from big down to small players on share value + Fundamentals for USA shares

Apple did it of course, they were bid up ahead of actual earnings.

http://stocktwits.com/symbol/TWTR?q=twtr

Go there and theres a lot of comments, links from big down to small players on share value + Fundamentals for USA shares

100 million users a day. Let’s assume they can figure out how to generate a daily revenue run rate of $10 million. That’s about $3.5 billion a year in sales. Put a 5x-10x multiple on that revenue number and you’re going to end up with a $20 billion-$35 billion valuation for Twitter when it comes public.

Right now the valuation for Twitter at its IPO is rumored to be running around $10 billion-$15 billion, and if that’s the case, I expect the stock will pop huge the first day of trading

Actual accuracy of these is down to personal judgement but its a lot better then what we get on iiicfwtrader

Very interesting article on the 'Valuation wars: $AAPL vs.$GOOG, $TWTR vs. $FB' http://stks.co/grjc

They do already, Nissan leaf? Does Tesla do it better, are they ahead of the curveother car giants would have their own offerings

RedDogT3Live

FYI we're going to be offering a free trial to the @t3live Virtual Trading Floor for the Twitter $TWTR IPO - stay tuned for more details

Soldato

I think I am going to pass on merlin

They just seem too be cashing in on royal mail

That's exactly why I'll spread bet it; Merlin's in the public high and there's momentum for it.

Never heard of merlin

Yes you have, just not the group name

. Madame Tussaud's, Warwick Castle, Thorpe Park etc: www.merlinentertainments.biz

. Madame Tussaud's, Warwick Castle, Thorpe Park etc: www.merlinentertainments.bizMerlin ipo is opening today according to hargreaves ? 280p - 330p price

£1000 minimum investment

Ta. Do you know when it goes public as that's when it will be available to spread bet?

Never done spread betting. Dunno if I have the bottle for it.

At least with actual buys you can't loose more than you put in

Tbh I don't fully understand the whole thing.

From what I gather you don't make/loose anything until it goes beyond a range.

Is there some weighting? Ie RM was very likely to go up after float. So would it have to go up a lot to make anything and down a smaller amount?

It's a bit too gambly for me I feel. If something drops through the floor can't you be left in the do do if you haven't got the capital to back it up?

At least with actual buys you can't loose more than you put in

Tbh I don't fully understand the whole thing.

From what I gather you don't make/loose anything until it goes beyond a range.

Is there some weighting? Ie RM was very likely to go up after float. So would it have to go up a lot to make anything and down a smaller amount?

It's a bit too gambly for me I feel. If something drops through the floor can't you be left in the do do if you haven't got the capital to back it up?

Never done spread betting. Dunno if I have the bottle for it.

At least with actual buys you can't loose more than you put in

Tbh I don't fully understand the whole thing.

From what I gather you don't make/loose anything until it goes beyond a range.

Is there some weighting? Ie RM was very likely to go up after float. So would it have to go up a lot to make anything and down a smaller amount?

It's a bit too gamely for me I feel. If something drops through the floor can't you be left in the do do if you haven't got the capital to back it up?

You should have a stop loss order for that. If one doesn't put stop loss then there's a margin call, only for spread betting they won't call you to increase your deposits to satisfy margin requirement, they will simply close your position at a loss.

It is gambling or to be pedantic it's speculation. Big risks big rewards.

Soldato

The only reason it's 'riskier' than traditional share dealing is a) if you don't understand leverage and b) you don't understand how it works. So pretty much the same as share dealing!

Most people think incorrectly, like you have, that there are odds or weighting involved, which there aren't, which is why it's great. It's also great because you can also sell and profit on a stock going down, unlike share dealing.

Yes, you need enough money in your account to prevent the trade from automatically closing but you don't need a lot. For example I'm just staking £1 or £2 on Royal Mail. I only have £300 in my account atm and it would need to pretty much go into administration (-300 points) to wipe itself out.

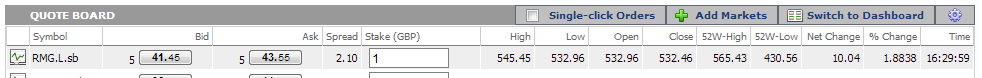

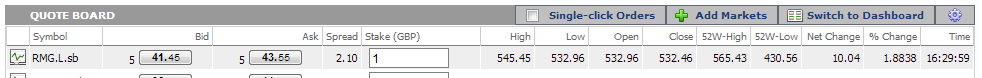

RMG as an example:

Bid is the sell price (541.45), Ask is the buy price (543.55) and the spread is the difference. So if I stake £1 @ 543.55 I'll be instantly down -£2.10 (ie if I was to sell at the current price), so it would need to swing at least 2.10 points to level out and then the rest is profit @ £1 a point. You can close your position at any time so long as the market is open.

It's only really risky once you start doing large stakes and at the moment for me it's small gains. I've only made £50 off RMG so far by buying low, selling high, repeat, etc, but then that's 20% of my investment so far more than an ISA or savings account.

If you'd done a £1 stake when they IPO'd @ 330p then you'd be up £210, whilst risking a maximum of £330 (ie if the stock dropped to 0p). £2 stake = £420, £3 stake = £630... and you can start to see how the big whales rake it in with £1,000 stakes. If you'd done a £750 stake instead of buying £750 worth of shares then you'd be up £157,500. But you'd have been risking £247,500 (but then how likely was it drop any more than 100 points, or 75k?).

I find it far more interesting than share dealing!

Most people think incorrectly, like you have, that there are odds or weighting involved, which there aren't, which is why it's great. It's also great because you can also sell and profit on a stock going down, unlike share dealing.

Yes, you need enough money in your account to prevent the trade from automatically closing but you don't need a lot. For example I'm just staking £1 or £2 on Royal Mail. I only have £300 in my account atm and it would need to pretty much go into administration (-300 points) to wipe itself out.

RMG as an example:

Bid is the sell price (541.45), Ask is the buy price (543.55) and the spread is the difference. So if I stake £1 @ 543.55 I'll be instantly down -£2.10 (ie if I was to sell at the current price), so it would need to swing at least 2.10 points to level out and then the rest is profit @ £1 a point. You can close your position at any time so long as the market is open.

It's only really risky once you start doing large stakes and at the moment for me it's small gains. I've only made £50 off RMG so far by buying low, selling high, repeat, etc, but then that's 20% of my investment so far more than an ISA or savings account.

If you'd done a £1 stake when they IPO'd @ 330p then you'd be up £210, whilst risking a maximum of £330 (ie if the stock dropped to 0p). £2 stake = £420, £3 stake = £630... and you can start to see how the big whales rake it in with £1,000 stakes. If you'd done a £750 stake instead of buying £750 worth of shares then you'd be up £157,500. But you'd have been risking £247,500 (but then how likely was it drop any more than 100 points, or 75k?).

I find it far more interesting than share dealing!

Last edited:

I'll have to have a proper look this weekend

I've chosen dealing atm with the following in mind

Cash isa, savings are not worth anything buy guaranteed pretty much

Dealing is half way, you risk what you have, but if sensible (buying into big companies in hard times) you rarely come off worse than savings in savings accounts

Spread betting is another step up, and yes the rewards look eyewatering.

It's the twitter flotation that has my eye, but for now I don't know if Idare rrisk a bet. Royal mail I would say was safer than twitter for a rise

Oh, and that is probably the best explanation I have seen

So assume merlin ipos at 330

If you were to buy at the buy price (somewhere over 330) every penny over the buy price you gain whatever unit you bid (bid 1£ then you gain 1£) and if company went bust you loose 330 ish pounds?

I've chosen dealing atm with the following in mind

Cash isa, savings are not worth anything buy guaranteed pretty much

Dealing is half way, you risk what you have, but if sensible (buying into big companies in hard times) you rarely come off worse than savings in savings accounts

Spread betting is another step up, and yes the rewards look eyewatering.

It's the twitter flotation that has my eye, but for now I don't know if Idare rrisk a bet. Royal mail I would say was safer than twitter for a rise

Oh, and that is probably the best explanation I have seen

So assume merlin ipos at 330

If you were to buy at the buy price (somewhere over 330) every penny over the buy price you gain whatever unit you bid (bid 1£ then you gain 1£) and if company went bust you loose 330 ish pounds?

Last edited:

Soldato

Yes, correct re: Merlin.

If you're interested then buy this: www.amazon.co.uk/Naked-Traders-Guide-Spread-Betting/dp/1906659230. Only £6 on Kindle so about the same as a stock trade. Its the only book I've ever read on it (plus I've read his Share Dealing one).

The biggest bonus of spread betting is selling. For example a share may have gone from 100p to 200p in a year. Great, double your money in normal trading. But in that time it will have fluctuated every day to get there and you can profit from every dip and every rise with spread betting.

If you're interested then buy this: www.amazon.co.uk/Naked-Traders-Guide-Spread-Betting/dp/1906659230. Only £6 on Kindle so about the same as a stock trade. Its the only book I've ever read on it (plus I've read his Share Dealing one).

The biggest bonus of spread betting is selling. For example a share may have gone from 100p to 200p in a year. Great, double your money in normal trading. But in that time it will have fluctuated every day to get there and you can profit from every dip and every rise with spread betting.

Last edited:

The biggest bonus of spread betting is selling. For example a share may have gone from 100p to 200p in a year. Great, double your money in normal trading. But in that time it will have fluctuated every day to get there and you can profit from every dip and every rise with spread betting.

The vast majority of people will lose money attempting this sort of directional trading and to do so via spread betting is relatively (and often deceptively) expensive . That's not to say there aren't potential uses for spread betting (though the ability to short is hardly a unique aspect) - in a few circumstances it may make sense... Someone wanting to look into short term trading seriously ought to perhaps be prepared to do a lot more reading, look at non directional approaches, aim to minimise transaction costs and use a broker/clearer providing direct access to the main venue(s) (exchanges, ECNs) for whatever you want to trade.

Most people would likely be better off forgetting about it altogether and simply building up a portfolio of long term investments in decent stocks if they want to be actively involved in the markets.

Last edited:

Do you guys all have funds and trusts in your S&S's ISA's as well then ? which ones do you have ? i am aiming to have £500 in 10 different ones to add diversification and then stocks outside that

ATM i have

Aberdeen Property Share Fund

Accumulation Shares

Artemis Strategic Assets

Retail Accumulation Wealth 150 fund

Jupiter Strategic Bond

Accumulation Wealth 150 fund

Marlborough Multi Cap Income

Retail GBP Accumulation Wealth 150 fund

Edinburgh Investment Trust plc

Ordinary 25p Shares

ATM i have

Aberdeen Property Share Fund

Accumulation Shares

Artemis Strategic Assets

Retail Accumulation Wealth 150 fund

Jupiter Strategic Bond

Accumulation Wealth 150 fund

Marlborough Multi Cap Income

Retail GBP Accumulation Wealth 150 fund

Edinburgh Investment Trust plc

Ordinary 25p Shares

Soldato

I've got some Edinburgh IT shares in my S&S ISA. Some question about what happens with Neil Woodford managing it with him leaving Invesco (eg this)

Soldato

Best to ask a professional of some kind, phone up HL maybe. Personally I thought FB should be $11 but last July at $22 it was a buy apparently.

Now its thought to be worth more then Disney, dont they make a lot from owning marvel

So I dont expect Medusa to recover till after its new shares are all floated. Thats usually how it goes, the graph looks really poor so unless gold goes up a lot my guess is not much upside :/

250m market cap (today) 100m turnover and 50m profits or 7 PE apparently, sounds good in theory but not plain sailing

The PE is Shareholders funds (m) divided by profits I guess

http://www.investopedia.com/terms/s/shareholdersequity.asp

Just so long as you realise £1 of Apple is about £50,000 and its in pounds not dollars if a bet (the shares obviously would be dollars and subject to exchange rates, bets are simpler)

RMG traded the grey market so I'd guess the same

http://www.stockchallenge.co.uk/ for November is coming. I might just enter all these new IPO shares to see how bad/good that turns out on paper

Not every IPO turns up. I did the SL ipo and it was a bit of a wash out, mostly a loss at first as market turned down but they did go up next year and after a lot of trouble in 08/09 they up about 50% this year.

Always they paid good dividends so always a good share imo, RMG appears similar not sure if the rest will do so well

Now its thought to be worth more then Disney, dont they make a lot from owning marvel

1. Settlement of the the first tranche of 9,445,195 New Shares ("Tranche 1") is to occur on or about 07 November 2013, with the New Shares to be issued under the existing authority granted by shareholders at the Company's 2012 Annual General Meeting.

2. Settlement of the second tranche of 9,445,195 New Shares ("Tranche 2") is conditional on the approval by shareholders of the proposed Resolution 4 (Disapplication of pre-emptive rights) at the Company's 2013 Annual General Meeting to be held on 22 November 2013 ("Approval Resolution"), and subject to that Approval Resolution being passed, settlement is to occur on or about 25 November 2013.

250m market cap (today) 100m turnover and 50m profits or 7 PE apparently, sounds good in theory but not plain sailing

The PE is Shareholders funds (m) divided by profits I guess

http://www.investopedia.com/terms/s/shareholdersequity.asp

Every penny on the share is a pound because you bet £1. Or another way is to say £1 is 100 shares which makes its totally not any more risk then buying shares.every penny over the buy price you gain whatever unit you bid (bid 1£ then you gain 1£) and if company went bust you loose 330 ish pounds?

Just so long as you realise £1 of Apple is about £50,000 and its in pounds not dollars if a bet (the shares obviously would be dollars and subject to exchange rates, bets are simpler)

I dont know if any of those places are especially popular, profitable, innovative or likely to grow so not an IPO for me as I basically I have no idea if they are worth it.Yes you have, just not the group name. Madame Tussaud's, Warwick Castle, Thorpe Park etc: www.merlinentertainments.biz

Ta. Do you know when it goes public as that's when it will be available to spread bet?

RMG traded the grey market so I'd guess the same

http://www.stockchallenge.co.uk/ for November is coming. I might just enter all these new IPO shares to see how bad/good that turns out on paper

Not every IPO turns up. I did the SL ipo and it was a bit of a wash out, mostly a loss at first as market turned down but they did go up next year and after a lot of trouble in 08/09 they up about 50% this year.

Always they paid good dividends so always a good share imo, RMG appears similar not sure if the rest will do so well

Soldato

I dont know if any of those places are especially popular, profitable, innovative or likely to grow so not an IPO for me as I basically I have no idea if they are worth it.

I haven't looked at detailed figures yet either but I do need to. I know of all/most of their places though and from general knowledge they are very popular. Due to the nature of the business they're also intrinsicly linked to land value in a similar way to Tesco (but on a smaller scale) and I also think their business model is good for the type of business they are: relatively expensive days out but always 50% offers via cereals, newspapers etc. Advertising, faux-deals and impulse visiting all in one. I would imagine they've done pretty well over the last 2 or 3 years as well with people opting to holiday in the UK or day out generally as opposed to travelling abroad but again, need to actually look at any figures they have.