Herencia Resources plc

("Herencia" or the "Company")

High Grade Drill Assay Results Continue at Paguanta

Highlights:

· High grade assay results from the Patricia drilling program including:

o 13.0m at 7.4% zinc, 2.6% lead and 133g/t silver in PTDD096

including 4.0m at 11.2% zinc, 6.0% lead and 296g/t silver

including 1.0m at 16.3% zinc, 12.1% lead and 624g/t silver

o 5.0m at 5.2% zinc, 2.8% lead and 86g/t silver in PTDD085

o 2.0m at 7.8% zinc, 1.3% lead and 103g/t silver in PTDD069

Following on from the high grade drill assays announced to the market last week, Herencia Resources is pleased to provide further high grade drill results in relation to its Paguanta Project (Herencia 70% owner) in northern Chile:

· Results from diamond drill hole PTDD096 (Cathedral Vein) include grades of 13m at 7.4% zinc, 2.6% lead and

133g/t silver from 154m including:

o 4m at 11.2% zinc, 6.0% lead and 296g/t silver from 154m depth, including:

o 1m at 16.3% zinc, 12.1% lead and 624g/t silver from 156m depth

and

o 6m at 6.8% zinc, 0.9% lead and 58g/t silverfrom 161m

· Hole PTDD096 (Cathedral Vein) also returned grades of 2m at 5.9% zinc, 1.1% lead and 84g/t silver from 142m

including 1.0m at 9.8% zinc, 2.2% lead, 148g/t silver and 0.59g/t gold from 143m depth, and 2.0m at 7.3% zinc, 2.6% lead and 163g/t silver from 149m including 1.0m at 10.9% zinc, 4.4% lead and 262g/t silver from 149m.

· Results from diamond drill hole PTDD085 (Cathedral Vein) include grades of 8m at 3.8% zinc, 2.1% lead and 63g/t

silver from 227m including 5.0m at 5.2% zinc, 2.8% lead and 86g/t silver from 230m depth.

· Results from diamond drill hole PTDD069 (Cathedral Vein) include grades of 8m at 3.3% zinc, 0.7% lead and 43g/t

silver from 197m including 2.0m at 7.8% zinc, 1.3% lead and 103g/t silver from 203m depth.

Herencia's Managing Director Michael Bohm commented "Again, Patricia appears to be delivering these consistent grade profiles. PTDD096 is a good hole and we have further deeper assays from this hole pending. Drilling is progressing on site and we expect to complete the Patricia drill program prior to Christmas."

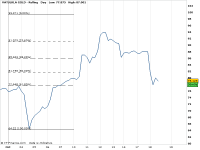

but when 4000 is possible and I think it is Im not inclined to wait

but when 4000 is possible and I think it is Im not inclined to wait hence XTA not likely to boom in theory

hence XTA not likely to boom in theory