Soldato

The gov gets tax on normal shares, they have an interest in you staying with LSE

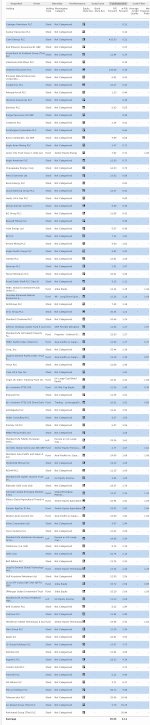

Just noticed this from a while back. There is a cash prize on this, I didnt do so bad last quarter though markets were going up then

This month the Dec comp is being won by someone who turned 10k into 300k I cant see how he did it though

I cant see how he did it though

AAZ is 46p to buy now which I will get some more of probably. CNR issued some shares hence lower ? I never follow the news properly

VGM had its 36% fund holder reduce to 20% or so, a famous gold bug sprott - very leveraged to the upside because they really do need gold 1600 or much higher price to make good on costs of an old old mine, possible Chinese backers/buyout

When do I get my GLEN shares now XTA is to be no more. I reckon that will rise eventually. POG owns IRC which is floated in China, doing well on Iron ore production which is purely a bonus to their gold mining, they'll also do great if cashflow allows them to prove their investment/ debt was well done.

Is HMV to die after xmas ?

First time Ive seen a decent longterm adjusted charts for CNR :

RRL all is not lost

http://www.4-traders.com/RANGE-RESOURCES-LTD-4001336/

Falling wedge, reversal

Just noticed this from a while back. There is a cash prize on this, I didnt do so bad last quarter though markets were going up then

This month the Dec comp is being won by someone who turned 10k into 300k

I cant see how he did it though

I cant see how he did it though

AAZ is 46p to buy now which I will get some more of probably. CNR issued some shares hence lower ? I never follow the news properly

VGM had its 36% fund holder reduce to 20% or so, a famous gold bug sprott - very leveraged to the upside because they really do need gold 1600 or much higher price to make good on costs of an old old mine, possible Chinese backers/buyout

When do I get my GLEN shares now XTA is to be no more. I reckon that will rise eventually. POG owns IRC which is floated in China, doing well on Iron ore production which is purely a bonus to their gold mining, they'll also do great if cashflow allows them to prove their investment/ debt was well done.

Is HMV to die after xmas ?

First time Ive seen a decent longterm adjusted charts for CNR :

RRL all is not lost

http://www.4-traders.com/RANGE-RESOURCES-LTD-4001336/

Falling wedge, reversal

Last edited:

460

460