Soldato

BP have just settled 4 billion worth of criminal. I would like to see BP hit 489 at which point I break even bloody sharea have been a pain for the two years i've owned them although the dividends have been good.

Last edited:

Do you think the FTSE will start to fall silversurfer? Everything seems a bit OTT at the moment.

Brian Shannon ?@alphatrends

when I FEEL the market is extended, I will only adjust my trading size, not whether I engage in a good setup

or not

about 70% of FTSE100 earnings come from abroad

Buffett said:"emotions cause most people to shun such common sense and root like heck for any stock they own, like “a commuter who rejoices after the price of gas increases, simply because his tank contains a day’s supply.”

bp by the fingernails, can it quit its losing habits. ex div soon so that'll push it down to repeat lows? profits down 19%, people like Neil Woodford say big oils are bad betsjust holding 461

anyone involved in the bitcoin bubble ? They reckon it could climb as high as £20 GBP. Went from £8.80 for 1 btc to around £13 in the space of 5 weeks or so. Question is what's driving this massive increase and how long will it go on for ?

http://bitcoincharts.com/charts/

Glaser: What miners do you think are the best-positioned right now?

Park: So the two miners I like the most right now are Yamana Gold and Eldorado Gold. The reason for that is that they have the features that we're looking for in an attractive gold-mining investment, so an attractive growth profile, while still maintaining their low costs. Both of these companies have costs that are in the lowest quartile of the industry. I think another important feature that you have to look for when you're looking into gold miners is a good management team. You have to have a good management team in order to keep these projects going on budget and on schedule. Right now, gold miners have had a hard time because investors have been worried about surging cost inflation, capital-expenditure costs that are going out of control. These two companies have management teams that have a good track record of delivering projects on time and on budget. They have a good pipeline of projects. Yamana purchased a very ultra-high-grade deposit called Cerro Moro in Argentina, and Eldorado still has the attractive growth projects that it purchased through the European Goldfields acquisition. So I think those will be able to generate some attractive returns for shareholders.

31 January 2013

QUARTERLY REPORT FOR PERIOD ENDING 31 DECEMBER 2012

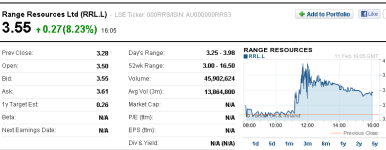

Issued Capital 2,447m* ASX Code RRS Closing price $0.060*

Market Capital A$147m* AIM Code RRL Closing Price £0.035*

* as at 31 December 2012

Gross Production for the Quarter

Gas 229k Mcf Range Interest - 50k Mcf 75 (14% decrease from prior quarter)

Oil 86,021 bbl Range Interest - 75,565 bbl (15% decrease from prior quarter)

The Board of Range Resources Limited ("Range" or "the Company") provides the

following commentary to be read in conjunction with the Appendix 5B (Quarterly

Cash Flow Report) which is attached.

Trinidad

During the quarter, previously announced operational and supply chain difficulties resulted in fewer-than expected wells being drilled by year-end, which subsequently resulted in a decrease in quarter on quarter production. Encouragingly, actual results from the current Lower Forest development program, are exceeding the Company's expectations in terms of average well performance. Additionally, the Company is anticipating three wells to come into production in the coming weeks (QUN 135, 138 and 139) following receipt of approvals, as well as remedial work commencing on four wells with a small work-over rig.

When compared to the five wells completed in Q4 (of which two of the wells encountered the southern extremity of the Lower Forest trend), the Company anticipates a marked increase in activity during Q1 2013, with the Company seeing ten to twelve wells coming into production during this quarter.

The Company continues to work to regain the drilling and completion

momentum established during Q3 2012, and having all six rigs up and running as

soon as possible, which again will see another marked increase in the number

of completed wells.

The Company continued with the development of the Lower Forest formation on the Morne Diablo license area with additional success, having completed five new wells during the quarter, with three wells drilling into the New Year.

As mentioned above, of the wells completed during the quarter, two

were drilled to test the southern limit of the Forest Formation productive

trend and encountered thin Lower Forest sands. The results of these two wells

have allowed Range to define the southern extremity of the Lower Forest trend,

with each well having the potential to be side tracked back into the main

productive area within the Lower Forest trend.

The QUN 137 well was completed and encountered the Lower Forest formation with initial production rates of 100 bopd and continues to produce at 85-90 bopd.

The QUN 138 well also reached its target depth of 1,000 ft. and

logged 100 ft. of net oil sands across a number of horizons, including a

highly resistive zone between 770 and 810 ft. that is expected to yield better

than average production rates. The Company is awaiting approvals to perforate

and place the well into production.

The Company spudded the QUN 139 with an original target depth of 1,000 ft. having logged 80 ft. of good quality oil sands to 945 ft. post quarter end. The well is currently being drilled to a revised target depth of 1,300 ft. The QUN 139 location is contiguous to producing wells QUN 119 and QUN 129 which achieved initial production rates of 129 bopd and 138 bopd, respectively. Both wells still flow under natural pressure, with QUN 129 having now produced for over 12 months since first production.

The QUN 140 well is expected to spud shortly with the Company awaiting receipt of necessary approvals and, like the QUN 139 well, will also be drilled to an initial target depth of circa 1,000 ft.

During the quarter, Range's fourth drilling rig, with the deepest

capabilities of the Company's fleet continued to drill the MD 248 well which

is targeting multiple horizons; the Lower Forest formation (circa 1,000 ft.),

the Upper Cruse formation (circa 2,000 ft.) and the Middle & Lower Cruse

formations (circa 4,000 ft. and 6,500 ft. respectively). After reaching a

depth of 4,000 ft. and having 7" casing run, the well experienced operational

delays due to equipment shortages. Additional equipment has been acquired to

improve efficiencies and reduce downtime, with drilling continuing to the

target depth of 6,500 ft.

The MD 248 well is the first well that will target development of

the Middle Cruse sands at 4,000 ft., as well as explore the Lower Cruse

formation at 6,500 ft. Upon completion of the MD 248 well, Rig 8 is scheduled

to move on to drill the first of a series of wells that will test the prolific

Herrera formation as their primary objective, while testing the prolific

Forest and Cruse formations. Rig 8 is capable of drilling to approximately

11,000 ft., a depth believed to be sufficient to test and develop the highly

prospective Herrera section.

The Company also spudded the QUN 135 well during the quarter with a

target depth of 3,500 ft., being Range's first well to target the Middle Cruse

formation, with the well reaching its target depth subsequent to quarter end.

Following conditioning of the well bore, logging operations were initiated and

more than 80 ft. of net oil pay was identified in the Lower Forest, Upper

Cruse and Middle Cruse formations. Based on oil shows while drilling and

induction logs indicating that the well reached its planned total depth in the

top of a Middle Cruse oil zone, the QUN 135 well is now being deepened to

confirm what may represent a previously undiscovered reservoir in the Middle

Cruse section. Following deepening of the well and evaluation of open hole

logs, the Company will determine which of the multiple oil zones present is

the best candidate for initial completion.

Reserves Upgrade

During the quarter, the Company announced a 29% increase in Proved,

Probable and Possible (3P) net attributable reserves across the Company's

three onshore Trinidad licenses, following the Company's independent petroleum

consultants, Forrest A. Garb and Associates ("Forrest Garb"), having completed

a review of the Trinidad reserves following the first year of Range's

operations in Trinidad.

Below is the comparison between October 2012 and December 2011 of the oil and gas reserves attributable to Range's (100%) interest in its Trinidad Licenses, net of government and overriding royalties, as described more fully in the report from Forest Garb & Associates.

Category Oil

(MMBO)

Dec `11 Oct `12 %age

Mvmt

Proved (P1) 15.4 17.5 +14%

Probable (P2) 2.2 2.7 +23%

Possible (P3) 2.0 5.0 +150%

Total 3P Reserves 19.6 25.2 +29%

Prospective Resource (unrisked)

Low 2.0 8.1

Best 10.0 40.5

High 19.9 81.0

Based on the reserve numbers shown above, Forrest Garb estimates the net cash flow attributable to Range's interests for Proved, Probable and Possible reserves as shown below, based on average WTI prices for 2011, and compared to the $85 / bbl case per December 2011.

US$85 / bbl case US$94 / bbl case

December 2011 October 2012

Category Undiscounted PV10 Undiscounted PV10

US$M US$M US$M US$M

Proved 679 385 799 446

Probable 133 73 142 81

Possible 120 49 276 153

Total 932 507 1,217 680

The valuations above are based on forecast production rates that reflect the current drilling and development schedule, and estimated individual well decline profiles derived from the Company's recent operating results.

As reported above, the recent reserves report saw a 30.5 million barrels (305%) increase in total unrisked net prospective (best estimate) resources across the Company's licenses to 40.5 million barrels.

Of the 40.5 million barrels in unrisked prospective resources,

circa 30.5 million barrels are associated with identified Herrera prospects

that have been mapped on the Company's 3D seismic database and are scheduled

to be drilled following completion of the MD248 well. Of the 40.5 million best

estimate unrisked net prospective resource associated with the Herrera

prospects, a risk factor of 25% has been assigned, with the remaining

resources risked at 45%.

Revised License Agreements

The Company has received the final revised agreements that will see

an initial reduction in the enhanced royalty currently being paid by the

Company. The revised terms will see a significant improvement in the net back

price received per barrel of oil produced. The revised royalties at production

rates of 1,000 bopd will see net backs increase to circa $40 / barrel before

tax, and circa $50 / barrel before tax at 2,000 bopd - assuming $90 barrel oil

and Opex at current levels. Only minor administrative items relating to market

communications remain to be resolved.

In addition, discussions continue with the regulatory agencies and other farm-in operators for further performance-based drilling and production incentives. Updates will be provided upon progress when available.

Puntland

Puntland Onshore

During the quarter Range's JV partner and operator of its Puntland Project, Horn Petroleum Corp (TSXV: HRN), demobilized the drilling rig and associated equipment and has completed restoration of both drilling locations.

Efforts are now focused on making preparations for a seismic

acquisition campaign in the Dharoor PSA which will include a regional seismic

reconnaissance grid in the previously unexplored eastern portion of the basin

as well as prospect specific seismic to delineate a drilling candidate in the

western portion of the basin where an active petroleum system was confirmed by

the recent drilling at the Shabeel-1 and Shabeel North-1 locations.

Based on the encouragement provided by these two Shabeel wells, the

Operator (Horn Petroleum Corporation) and their partners, Range Resources and

Red Emperor, have entered into the next exploration period in both the Nugaal

and Dharoor Valley Production Sharing Contracts ("PSCs") which carry a

commitment to drill one well on each block within an additional 3 year term.

The current operational plan would be to contract a seismic crew to acquire

additional data in the Dharoor Valley block and to hold discussions with the

Puntland Government to gain access regarding drill ready prospects in the

Nugaal Valley block. The focus of the Dharoor seismic program will be to

delineate new structural prospects for the upcoming drilling campaign.

Puntland Offshore

During the June quarter, Range entered into an agreement with the Puntland Government with respect to obtaining a 100% working interest in the highly prospective Nugaal Basin Offshore Block.

The Block is an extension of the onshore Nugaal Region which has the potential for deltaic deposits from the Nugaal Valley drainage system and comprises over 10,000km.

The Company will commit to a 2D seismic program within the first

three years, with further 3D seismic and an exploration well to follow in the

second three year period. The agreement is subject to a formal Production

Sharing Agreement (PSA) being entered into and the receipt of all necessary

regulatory approvals. Commercial terms will be similar to the current on-shore

PSAs and is scheduled to be completed this current quarter.

Georgia

During the quarter the Joint Venture announced the completion of the acquisition of a 200km 2D seismic program. The majority of this recent seismic was acquired over Block VIb to firm up leads identified in the previous 410km 2D seismic program, along with targeting two gas wells, which were drilled and suspended in Soviet times.

Two lines were also acquired over the site of the Mukhiani well,

the first exploration well drilled in Block VIa. The processing of the seismic

is currently under way and results of the interpretation is expected to be

completed in Q1 2013, with the joint venture confident that it will then have

assembled the requisite amount of seismic and geological information to enable

the JV to identify revised drillable targets and attract potential farm in

partners if desired.

The JV continues to work towards the development of the CBM and

conventional potential around the Tkibuli†Shaori Coal Field ("Tkibuli").

The Georgian Industrial Group ("GIG") has made available a significant amount

of information including a detailed geological model based on 339 wells

drilled in the region, many of which vented methane. The Joint Venture is

looking to finalise agreements with GIG for the development of Tkibuli

shortly, with binding arrangements currently being concluded and the potential

for third party financing being available to fund a pilot production program.

It is envisaged that following completion of the current technical and

economic analysis, between three and four pilot production well locations will

be identified with drilling expected to commence in 2H 2013.

With the majority of the seismic program completed during the quarter, coupled with the proposed third party funding for the joint venture development of the Tkibuli CBM project, Range's exploration expenditure associated with the Georgian operations will be dramatically reduced moving forward.

Texas

North Chapman Ranch

During the previous quarter, the Company announced a significant increase in

Proved (P1) and Probable (P2), reserves for the North Chapman Ranch Project,

in which Range holds a 20-25% interest.

The Company engaged leading independent petroleum consultants Forrest A. Garb and Associates ("Forrest Garb") to complete a review of the North Chapman Ranch reserves following the successful completion of the Smith #2 and Albrecht wells that saw a significant reclassification of the previous Possible (P3) reserves into the Proved (P1) and Probable (P2) categories.

Set out below is a comparison of the gross reserves (100% basis)

for the Company's North Chapman Ranch asset between the previous reserve

update in December 2011 and the current gross reserves update for June 2012.

Category Oil Natural Gas Natural Gas Liquid

(MMBO) (Bcf) (MMBO)

Dec Jun %age Dec Jun %age Dec Jun %age

`11 `12 Mvmt `11 `12 Mvmt `11 `12 Mvmt

Proved (P1) 5.1 8.4 +64% 64.3 106.0 +65% 5.0 8.0 +60%

Probable (P2) 3.7 4.4 +19% 48.6 56.7 +17% 3.8 4.4 +16%

Possible (P3) 9.9 5.0 -50% 129.6 64.8 -50% 10.1 5.1 -50%

Total 3P 18.7 17.8 242.5 227.5 18.9 17.5

Reserves

Set out below is the comparison between June 2012 and December 2011 of Range's attributable interest in the net reserves on the Company's North Chapman Ranch asset which is net of government and overriding royalties and represents Range's economic interests in its development and production assets as classified in the report from Forest Garb.

Category Oil Natural Gas

Natural Gas Liquids

(MMBO) (Bcf) (MMBO)

Dec `11 Jun `12 %age Dec `11 Jun `12 %age Dec `11 Jun `12 %age

Mvmt Mvmt Mvmt

Proved (P1) 0.7 1.1 +57% 7.6 11.7 +54% 0.7 1.1 +57%

Probable (P2) 0.5 0.6 +20% 5.5 6.4 +16% 0.5 0.6 +16%

Possible (P3) 1.3 0.7 -46% 14.6 7.3 -50% 1.3 0.7 -46%

Total 3P 2.5 2.4 27.7 25.4 2.5 2.4

Reserves

With the field having now been largely appraised and value demonstrated, the

Company is looking at the divestment of its North Chapman Ranch interests so

that it can focus its capital on higher value adding opportunities in its

portfolio and has engaged US based advisors to assist in the process, with a

number of interested parties having reviewed the Company's dataroom.

Negotiations are currently being finalised with regards to the sale of the

assets, scheduled for this quarter. As previously announced, the conditional

offer is for US$20m up front (settlement before current quarter end) and

US$20m in royalty payments from current and future production. Range will

update the market as soon as the transaction is finalised.

East Texas Cotton Valley Prospect

Long term production testing continues on the Ross 3H well, as

Range and its partners evaluate the various options available for future

development of the shallow oil discovery. In the meantime, leases within the

project area are being extended or renewed. The intention is to sell the asset

as part of the Texas deal.

Colombia

As previously announced, Range entered into an economic

participation agreement with Petro Caribbean Resources Limited, a private oil

and gas company focussed on the development of petroleum and natural gas

reserves in Colombia ("PCR" the official operator of the blocks), that will

see the Company earn a 65% economic interest (option to move to 75%) in Blocks

PUT-6 and PUT-7 in return for funding (on a cost recoverable basis) the

commitments under the Production Sharing Agreement ("PSA") with the National

Hydrocarbons Agency of Colombia ("ANH"). This includes a 350km2 3D seismic

program across the two blocks followed by one exploration well in each block.

The consulta previa process is nearing completion which involves liaison with the various indigenous communities within the license areas. Once completed, the Company expects to initiate preparations for the seismic program, with planned mobilisation to occur early Q2 2013.

Range has received farm in interest from a number of parties for blocks PUT 6 and PUT 7, and will be considering different potential options to maximise shareholders benefits in the short to medium term.

Corporate

During the quarter the Company entered into a US$15 million Loan

Agreement ("Loan Agreement") backed by Standby Equity Distribution Agreement

("SEDA") for up to GB£20 million with YA Global Master SPV Ltd, an investment

fund managed by Yorkville Advisors ("Yorkville"), with US$5 million having

been drawn down during the quarter. The loan can be drawn down in tranches of

US$5 million (12 month term) at the election of the Company and carries a

coupon of 10%. The tranches may be increased to US$10 million (after an

initial US$5 million drawdown †total facility US$25 million).

In addition to the above, the Company also issued AU$10 million in secured notes to Crede Capital which can be paid back in cash or equity on or before the 12 month term at the Company's election.

Subsequent to Quarter-End

Subsequent to quarter end, the Company secured a strategic stake (19.9%) in Citation Resources Limited ("Citation") (ASX: CTR). Citation holds a farm in right to acquire a 70% interest in Latin American Resources Ltd ("LAR"), which holds an 80-100% interest in two oil and gas development and exploration blocks in Guatemala ("Projects"). LAR is the operator of the blocks. Additionally, Range has acquired a direct 10% equity stake in LAR.

The Projects consist of Block 1-2005 and Block 6-93 in the South Peten Basin in Guatemala ("Guatemalan Blocks"). The Guatemalan Blocks have Canadian NI 51-101 certified proved plus probable (2P) reserves of 2.3 MMBO (with approximately 0.45 - 0.6 MMBO attributable to Range's combined equity interest in Citation and 10% direct interest in LAR), with significant exploration upside potential. In addition, the blocks have had significant previous exploration with the two well appraisal drilling program currently underway with the Atzam #4 well having already been successfully completed and flow testing currently underway. The Projects and drilling/operational infrastructure are owned by LAR together with its minority joint venture partners in a similar set up to Range's Trinidad operations.

The strategic stake in Citation and LAR provides Range with

non-operating exposure to a project with known reserves and significant short

term upside potential, as well as creating the potential spin off vehicle for

the company's Puntland assets.

Transaction Details

Range will acquire its 19.9% strategic interest in Citation, by conversion of existing debt funding provided by Range to Citation into ordinary Citation shares (subject to any necessary Citation shareholder approvals) at $0.02 with a 1 for 2 free attaching listed Citation option ($0.04, June 2015), which is approximately $2m for the 19.9% interest. In addition, Range will pay $2m for the 10% interest in LAR, which is finance carried through the first US$25m spent on the Project.

Concurrently, Range completed a placement of 40m new shares to Citation nominees at A$0.05 per share (being a premium to the current share price) to raise gross proceeds of $2m, along with the issue of 40,000,000 unlisted options ($0.05, 31 January 2016) in facilitation, introduction and corporate advisory fees.

Guatemala Projects Summary - Atzam and Tortugas Formations

The Projects consist of Block 1-2005 and Block 6-93 in the South

Peten Basin in Guatemala ("Guatemalan Blocks"). As reported by Citation, the

Guatemalan Blocks have Canadian NI 51-101 certified proved plus probable (2P)

reserves of 2.3 MMBBL, with significant exploration upside potential. In

addition the blocks have had significant previous exploration with the two

well appraisal drilling program currently underway with the Atzam #4 well

having already been successfully completed and flow testing currently

underway. The projects and drilling / operational infrastructure are owned by

LAR together with its minority joint venture partners in a similar set up to

Range's Trinidad operations.

The first appraisal well Atzam #4, which successfully drilled to

its target depth of 4,500 ft., is currently undergoing flow testing

operations. The intention is for the second well, Atzam #5, to spud following

completion of the flow testing program on the Atzam #4 well. The Atzam #4 well

is being drilled on the same structure that the Atzam #2 well tested at an

initial flow rate of up to 1,200 BOPD of 34°API oil at a depth of 3,850 ft.

Recent mapping of the Atzam structure using existing data from previous operators (Basic, Hispanoil) and MEM, and incorporating reservoir data acquired since production initiated in December 2007, indicate the possibility of a structure of comparable size and orientation to that of the existing Rubelsanto field in Guatemala. To date, the Rubelsanto field has produced more than 30 MMBBL of oil since its discovery in 1976. The field currently continues to produce more than 1,000 BOPD, 36 years after its discovery.

In addition to the Atzam structures on Block 1-2005, the Tortugas structure is a suspended oil field. Originally 17 wells on Tortugas salt dome were drilled by Monsanto looking for sulphur. One well (T9B) had an oil blowout at approx 2,200 ft and most others had oil shows in multiples zones.

The Atzam and Tortugas Fields have had significant previous

exploration and development with 2D seismic and previous production wells. In

2012/13 the planned exit production is approximately 1,000 bbl/d based on

successful production from the two new appraisal wells based on the previous

flow rates of wells drilled on the same structure.

Appendix 5B Summary - Consolidated Statement of Cashflow

Current Year to date

Quarter (6 months)

Cash flows related to operating ($A'000)

activities $A'000

Receipts from product sales and

related debtors 7,344 14,367

Payments for:

(a) exploration & evaluation (7,289) (12,291)

(b) development (3,553) (6,154)

(c) production (4,050) (7,873)

(d) administration (1,951) (3,990)

Dividends received - -

Interest and other items of a similar

nature received 5 34

Interest and other costs of finance

paid (591) (591)

Taxes paid (2,033) (4,084)

Other (provide details if material) - 449

Net Operating Cash Flows (12,118) (20,133)

Cash flows related to investing

activities

Payment for purchases of:

(a) prospects - -

(b) equity investments - -

(c) other fixed assets (571) (1,123)

Proceeds from sale of:

(a) prospects - -

(b) equity investments 528 528

(c) other fixed assets - -

Loans to other entities - -

Loans repaid by other entities - 2,065

Other - net cash acquired on

acquisition of subsidiary - -

Net investing cash flows (43) 1,470

Total operating and investing cash flows (12,161) (18,663)

Cash flows related to financing activities

Proceeds from issues of shares,

options, etc. 1,995 1,995

Proceeds from sale of forfeited

shares - -

Proceeds from borrowings 14,938 14,938

Repayment of borrowings (1,399) (1,399)

Dividends paid - -

Other (provide details if material) - -

Net financing cash flows 15,534 15,534

Net increase (decrease) in cash held 3,373 (3,129)

Cash at beginning of quarter/year to

date 3,891 10,410

Exchange rate adjustments to item

1.20 (60) (77)

CASH AT END OF QUARTER 7,204 7,204

Yours faithfully

Peter Landau

Executive Director

Contacts

Range Resources Limited

Peter Landau

Tel : +61 (8) 9488 5220

Em: [email protected]

PPR (Australia)

David Tasker

Tel: +61 (8) 9388 0944

Em: [email protected]

RFC Ambrian Limited (Nominated Advisor) Old Park Lane Capital (Joint Broker)

Stuart Laing Michael Parnes

Tel: +61 (8) 9480 2500 Tel: +44 (0) 207 493 8188

Fox-Davies Capital Limited (Joint Broker) GMP Securities Europe LLP (JointBroker) Daniel Fox-Davies / Richard Hail

James Pope / Chris

Beltgens

Tel: +44 (0) 203 463 5000 Tel: +44 (0) 207 647

2800

Dahlman Rose & Company (Principal American Liaison)

OTCQX International Market (U.S.)

Christopher Weekes / Stephen Nash

Tel: +1 (212)-372-5766

Range Background

Range Resources Limited is a dual listed (ASX:RRS; AIM:RRL) oil & gas exploration company with oil & gas interests in the frontier state of Puntland, Somalia, the Republic of Georgia, Texas, USA, Trinidad and Colombia.

- In Trinidad Range holds a 100% interest in holding companies with

three onshore production licenses and fully operational drilling subsidiary.

Independently assessed Proved (P1) reserves in place of 17.5 MMBO with 25.2

MMBO of proved, probable and possible (3P) reserves and an additional 81 MMBO

of unrisked prospective resources.

- In the Republic of Georgia, Range holds a 40% farm-in interest in

onshore blocks VIa and VIb, covering approx. 7,000sq.km. Range completed a

410km 2D seismic program with independent consultants RPS Energy identifying

68 potential structures containing an estimated 2 billion barrels of

undiscovered oil-in-place (on a mean 100% basis) with the first (Mukhiani-1)

exploration well having spudded in July in 2011. The Company is focussing on a

revised development strategy that will focus on low-cost, shallow appraisal

drilling of the contingent resources around the Tkibuli-Shaori ("Tkibuli")

coal deposit, which straddles the central sections of the Company's two

blocks.

- In Puntland, Range holds a 20% working interest in two licenses

encompassing the highly prospective Dharoor and Nugaal valleys. The operator

and 60% interest holder, Horn Petroleum Corp. (TSXV:HRN) has completed two

exploration wells and will continue with a further seismic and well program

over the next 12-18 months.

- Range holds a 25% interest in the initial Smith #1 well and a 20%

interest in further wells on the North Chapman Ranch project, Texas. The

project area encompasses approximately 1,680 acres in one of the most prolific

oil and gas producing trends in the State of Texas. Independently assessed 3P

reserves in place (on a 100% basis) of 228 Bcf of natural gas, 18 mmbbls of

oil and 17 mmbbls of natural gas liquids.

- Range holds a 21.75% interest in the East Texas Cotton Valley

Prospect in Red River County, Texas, USA, where the prospect's project area

encompasses approximately 1,570 acres encompassing a recent oil discovery. The

prospect has independently assessed 3P reserves in place (on a 100% basis) of

3.3mmbbls of oil.

- Range is earning a 65% (option to move to 75%) interest in the

highly prospective PUT 6 and PUT 7 licences in Putumayo Basin in Southern

Colombia. The Company will undertake a 350km2 3D seismic program across the

two licences and drill one well per licence, as well as looking to re-enter a

previously suspended well that had a significant historical reserve estimate.

- Range has taken a strategic stake (19.9%) in Citation Resources

Limited (ASX: CTR) which holds a 70% interest in Latin American Resources

(LAR). LAR holds an 80-100% interest in two oil and gas development and

exploration blocks in Guatemala with Canadian NI 51-101 certified proved plus

probable (2P) reserves of 2.3 MMBBL (100% basis). Range also holds a 10%

interest in LAR.

Table of Reserves and Resources

Detailed below are the estimated reserves for the Range project

portfolio.

All figures in Gross Oil Reserves Net Attributable

MMboe Range's

Project 1P 2P 3P Interest 1P 2P 3P Operator

Oil & NGL

Texas - NCR * 16.4 25.2 35.3 20-25% 2.2 3.4 4.8 Western Gulf

Texas - ETCV 1.0 1.6 3.3 22% 0.2 0.3 0.6 Crest Resources

Trinidad 17.5 20.2 25.2 100% 17.5 20.2 25.2 Range

Total Oil & Liquids 34.9 47.0 63.8 19.9 21.3 28.9

Gas Reserves

Texas - NCR * 106.0 162.7 228 20-25% 11.7 18.1 25.4 Western Gulf

Total Gas Reserves 106.0 162.7 228 11.7 18.1 25.4

* Reserves attributable to Range's interest in the North Chapman Ranch asset, which are net of government and overriding royalties as described in the Forrest Garb report.

Detailed below are the estimated resources and oil-in-place delineated across Range's portfolio of project interests.

All figures in Gross Oil Resources Net Attributable

MMboe Range's

Project Low Best/ High Interest Low Best/ High Operator

Mean Mean

Prospective

Resources

Trinidad 8.1 40.5 81.0 100% 8.1 40.5 81.0 Range

Total Prospective 8.1 40.5 81.0 8.1 40.5 81.0

Resources

Undiscovered

Oil-In-Place

Puntland - 16,000 - 20% - 3,200 - Horn Petroleum

Georgia - 2,045 - 40% - 818 - Strait Oil & Gas

Colombia - 7.8 - 65-75% - 5.1 - 5.8 - Petro Caribbean

All of the technical information, including information in relation to reserves and resources that is contained in this document has been reviewed internally by the Company's technical consultant, Mr Mark Patterson. Mr Patterson is a geophysicist who is a suitably qualified person with over 25 years' experience in assessing hydrocarbon reserves and has reviewed the release and consents to the inclusion of the technical information.

The reserves estimate for the Guatemalan Blocks in which LAR (and CTR) have an

interest in is as reported by CTR. CTR has not reported 1P and 3P estimates,

but Range is seeking such information from CTR for future reporting purposes.

The reserves estimates for the 3 Trinidad blocks and update reserves estimates

for the North Chapman Ranch Project and East Texas Cotton Valley referred

above have been formulated by Forrest A. Garb & Associates, Inc. (FGA). FGA is

an international petroleum engineering and geologic consulting firm staffed by

experienced engineers and geologists. Collectively FGA staff has more than a

century of worldâ€wide experience. FGA have consented in writing to the

reference to them in this announcement and to the estimates of oil and natural

gas liquids provided. The definitions for oil and gas reserves are in

accordance with SEC Regulation Sâ€X an in accordance with the guidelines of

the Society of Petroleum Engineers ("SPE"). The SPE Reserve definitions can be

found on the SPE website at spe.org.

RPS Group is an International Petroleum Consulting Firm with offices worldwide, who specialise in the evaluation of resources, and have consented to the information with regards to the Company's Georgian interests in the form and context that they appear. These estimates were formulated in accordance with the guidelines of the Society of Petroleum Engineers ("SPE").

The prospective resource estimates for the two Dharoor Valley prospects are internal estimates reported by Africa Oil Corp, the operator of the joint venture, which are based on volumetric and related assessments by Gaffney, Cline & Associates.

In granting its consent to the public disclosure of this press

release with respect to the Company's Trinidad operations, Petrotrin makes no

representation or warranty as to the adequacy or accuracy of its contents and

disclaims any liability that may arise because of reliance on it.

The Contingent Resource estimate for CBM gas at the Tkibuli project is sourced

from the publically available references to a report by Advanced Resources

International's ("ARI") report in 2009: CMM and CBM development in the

Tkibuli-Shaori Region, Georgia. Advanced Resources International, Inc., 2009.

Prepared for GIG/Saknakhshiri and U.S. Trade and Development Agency. -

.globalmethane.org/documents/toolsres_coal_overview_ch13.pdf. Range's

technical consultants have not yet reviewed the details of ARI's resource

estimate and the reliability of this estimate and its compliance with the SPE

reporting guidelines or other standard is uncertain. Range and its JV partners

will be seeking to confirm this resource estimate, and seek to define

reserves, through its appraisal program and review of historical data during

the next 12 months.

Reserve information on the Putumayo 1 Well published by Ecopetrol 1987.

SPE Definitions for Proved, Probable, Possible Reserves and Prospective Resources

Proved Reserves are those quantities of petroleum, which by

analysis of geoscience and engineering data, can be estimated with reasonable

certainty to be commercially recoverable, from a given date forward, from

known reservoirs and under defined economic conditions, operating methods, and

government regulations.

Probable Reserves are those additional Reserves which analysis of geoscience and engineering data indicate are less likely to be recovered than Proved Reserves but more certain to be recovered than Possible Reserves.

Possible Reserves are those additional reserves which analysis of geoscience

and engineering data indicate are less likely to be recoverable than Probable

Reserves.

1P refers to Proved Reserves, 2P refers to Proved plus Probable Reserves and 3P refers to Proved plus Probable plus Possible Reserves.

Prospective Resources are those quantities of petroleum estimated, as of a

given date, to be potentially recoverable from undiscovered accumulations by

application of future development projects. Prospective Resources have both an

associated chance of discovery and a chance of development. Prospective

Resources are further subdivided in accordance with the level of certainty

associated with recoverable estimates assuming their discovery and development

and may be sub-classified based on project maturity.

Contingent Resources are those quantities of hydrocarbons which are estimated,

on a given date, to be potentially recoverable from known accumulations, but

which are not currently considered to be commercially recoverable.

Undiscovered Oil-In-Place is that quantity of oil which is estimated, on a given date, to be contained in accumulations yet to be discovered. The estimated potentially recoverable portion of such accumulations is classified as Prospective Resources, as defined above.

PR Newswire

February 1, 2013 - 2:03 AM EST

go to top

printemail

Featured News Links

Prophecy’s Drill Results Demonstrates Broad Zones of Continuous PGM Mineralization

Precipitate Collects Rock Grab Samples Up to 11.8 g/t Gold; Expands the Ginger Ridge Target

Company Showcase

View Sectors

Today's Feature View Now

Pacific North West Capital Corp.

Pacific North West Capital Corp. (TSX: PFN; OTCQX: PAWEF; Frankfurt: P7J) is a mineral exploration company focused on the discovery, exploration and development of PGM and nickel-copper sulphide deposits in geologically prospective regions in North America, particularly Canada. The Company's key asset is its 100% owned River Valley PGM Project in the Sudbury region of northern Ontario. The River Valley Project is one of North America's most advanced primary PGM deposits...

read more

Stockhouse.com is owned byStockhouse Publishing Ltd.

Financial Market Data powered by QuoteMedia. All rights reserved. View the Terms of Use.

NYSE/AMEX/NASDAQ and other data delayed 15 minutes unless otherwise indicated.

© 2013 Stockhouse publishing Ltd. All rights reserved. | Sitemap | Help | Disclaimer | Privacy Policy

[Market cap £50m $78m]

[Market cap £50m $78m]50m volume, price reflecting that demand sustained puts RRL back at 6p at a rough estimateRange Resources issues Atzam #4 well update

13 February 2013 | 09:07am

StockMarketWire.com - Range Resources said flow testing operations on the perforated Lower C17/Upper C18 carbonate sections in the Atzam #4 well are continuing, with encouraging results from the well having been received over the past two weeks.

It released the following update on the Atzam #4 well:

Testing continuing on Lower C17/Upper C18 carbonate sections - perforated zones cleaning up with increasing recoveries of oil.

High quality oil (37.0° API) recovered during testing operations.

Estimated flow rates of 300-400 bbl/day with an 85-90% oil cut from Lower C17/Upper C18 carbonates with an operational submersible pump, based on results to date.

Upper C18 carbonates displayed impressive log results with permeability averaging 300 md and porosity averaging 17% - Rubelsanto Field (+30mmbbl produced) is 100md and 3-6% porosity.

Significant moveable oil identified in electric logs over C13 and C14 carbonate sections still untested- remain behind pipe above the current perforated Lower C17/Upper C18 sections.

At 9:07am: [LON:RRL] share price was +0.27p at 3.87p

Story provided by StockMarketWire.com

Kea Petroleum plc (AIM: KEA), the oil and gas exploration company focused on New Zealand, is today pleased to announce that it has made an oil discovery in a new sand reservoir at Puka 2 in the lower Mount Messenger "Mako" Sands.

Puka 2 intersected 4.6m of sand with a vertical thickness of approximately 3.3m in the lower Mount Messenger near 1,700m measured depth. Preliminary petrophysical log analysis indicates that this sand has an average oil saturation of 64%, porosity of 25.6% with MDT permeabilities in the order of 75 to 100millidarcies. These porosity and permeability values are amongst the highest recorded in Mount Messenger reservoirs to date. The fact of there being no indication of free gas or water within the sand package allows Kea to progress to casing the well and then to testing as soon as possible thereafter. Due to the quality of the sand intersected in Puka 2, Kea expects to record higher oil flow rates than those recorded at Puka 1.

The importance of the intersection of the lower Mako sands at Puka 2 cannot be overestimated. Interpretation of the recently acquired 3D seismic survey and further follow up drilling will be required to appraise and develop the upper Puka Sands discovered at Puka 1, the lower Mako Sand package discovered at Puka 2 and determine the ultimate size of the entire Puka field.

The existence and quality of the lower sand package at Puka 2 is significant for the potential field size of the greater Puka field and for potential productivity from both the Puka 2 well and the Pukafield in general.

Ian Gowrie-Smith, Chairman of Kea Petroleum, commented: "We are delighted to have again struck oil at Puka. This new discovery, with its high quality sands, is likely to have much better flow rates than Puka 1. Kea can now look forward with confidence to an early and substantial cash flow."

This release has been approved by non-executive director Peter Mikkelsen FGS, AAPG, who has consented to the inclusion of the technical information in this release in the form and context in which it appears.

sounds goodsand has an average oil saturation of 64%

I'm interested. I may have around £4,000 to invest soon, I know NOTHING about investments, but I do know a little about Bitcoin (very little).

I've seen the recent rise, and now I feel would be a good time to make the most of it.

Is it actually likely to rise to as much as £20 though?

EDIT: Having done search searching the thought of this scares me a bit actually.

I had a 377% gain showing on RRLWill never touch Range again.

currently £17.50 for 1 coin. Did you invest ?

A silver coin might have worked better. Anti bacterial you can keep it in your overclocking water tank to help, almost practical!I suppose I've lost the coin then?