You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Trading the stockmarket (NO Referrals)

- Thread starter mcast123

- Start date

More options

Thread starter's postsSoldato

http://www.stockchallenge.co.uk/site/forms/subform.php

politics and stats, nasty ****

They revised down the previous jobs figure apparently and the jobs created are allegedly part time as new laws like healthcare are expensive but can be circumvented by lowering hours and employing more people hence jobs growth that is not what it seems (allegedly)

The US jobs data was contradictory with less than expected jobs created but unmeployment claims falling.

Plus a lot of the jobs being created are low value jobs.

politics and stats, nasty ****

They revised down the previous jobs figure apparently and the jobs created are allegedly part time as new laws like healthcare are expensive but can be circumvented by lowering hours and employing more people hence jobs growth that is not what it seems (allegedly)

Last edited:

Associate

My first equity trade for a while added today.

Bought 2500 more Aberdeen Asset Management (ADN) @ 380p

I now own 7000 at break even of 383.88p

http://economictimes.indiatimes.com/opinion/interviews/remain-overweight-on-asian-equities-hugh-young-aberdeen-asset-management-asia/articleshow/21618049.cms

Bought 2500 more Aberdeen Asset Management (ADN) @ 380p

I now own 7000 at break even of 383.88p

http://economictimes.indiatimes.com/opinion/interviews/remain-overweight-on-asian-equities-hugh-young-aberdeen-asset-management-asia/articleshow/21618049.cms

I wanted to look into this company:

http://www.highwinds.com/services/highwinds-network-group.php?gclid=CPPS6t3-7bgCFX***AodxQUAJw

I couldn't find anything about them on any stock exchange - maybe they do not trade on it?

http://www.highwinds.com/services/highwinds-network-group.php?gclid=CPPS6t3-7bgCFX***AodxQUAJw

I couldn't find anything about them on any stock exchange - maybe they do not trade on it?

Soldato

I couldnt see Highwinds, what size revenue are they. Most companies are not publicly traded, it costs money to list

Big commodities boom today ? As it should be. HOC went up like 25% and the chart is classic breakout setup

I bought some Her which is no spring chicken but might yield results eventually. I have some hope silver may stop falling so badly here

Previously ordered FRES and POG but FRES took the money first. Both reasonable near term recovery, not sure we may see all these shares reverse down yet again. Pog already did that once.

and I bought KAZ and I see its up 9%, makes a nice change and I hope often repeated

I wanted to buy SXX Siruius potash but its looking so awful I had to hold off a bit. I will probably buy some next week in any case. Now dramatically unpopular due to both local reg problems and global oversupply is perceived imminent

Questor likes them and I also think they will get planning permission one day, a surer bet then many aim stocks.

http://www.youtube.com/watch?v=GcB_-VGTLI4&feature=em-uploademail

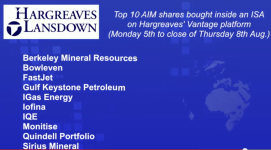

AIM goes in ISA now:

LMI is a bonkers stock, 200 to 3000 potentially? Like XTA was, 375 to hurdle and 500 feasible would be my guess this year

Big commodities boom today ? As it should be. HOC went up like 25% and the chart is classic breakout setup

I bought some Her which is no spring chicken but might yield results eventually. I have some hope silver may stop falling so badly here

Previously ordered FRES and POG but FRES took the money first. Both reasonable near term recovery, not sure we may see all these shares reverse down yet again. Pog already did that once.

and I bought KAZ and I see its up 9%, makes a nice change and I hope often repeated

I wanted to buy SXX Siruius potash but its looking so awful I had to hold off a bit. I will probably buy some next week in any case. Now dramatically unpopular due to both local reg problems and global oversupply is perceived imminent

Questor likes them and I also think they will get planning permission one day, a surer bet then many aim stocks.

http://www.youtube.com/watch?v=GcB_-VGTLI4&feature=em-uploademail

AIM goes in ISA now:

LMI is a bonkers stock, 200 to 3000 potentially? Like XTA was, 375 to hurdle and 500 feasible would be my guess this year

Last edited:

LMI is a bonkers stock, 200 to 3000 potentially? Like XTA was, 375 to hurdle and 500 feasible would be my guess this year

There could be some real upside in LMI. I am sitting on 27% profit on quite a large sum of money. Do you think I should hold out for more?

Soldato

Trim and trail

LMI has a risk of nationalisation ? I thought about it at year start, been good especially if traded and I guess that will continue as 200 is a strong price to buy

Tons of upside and more accurately downside in sterling most likely. I think in general a lot of these commodity stocks are short term trade and long term hold.

Im looking at a few of them and they dont strike me as strong enough to not take profits on. Fres is showing +20% since Wed which is great but after such a big fall thats more appearance then performance in total. I will write down sell and hope for more

The autumn is more likely to lead in a consistent direction then now, thats just how it goes I think. Xmas and new year tends to be a low pressure gap of volume. For example cree go back to xmas 11 and that was great, thought as much too but was already holding

LMI has a risk of nationalisation ? I thought about it at year start, been good especially if traded and I guess that will continue as 200 is a strong price to buy

Tons of upside and more accurately downside in sterling most likely. I think in general a lot of these commodity stocks are short term trade and long term hold.

Im looking at a few of them and they dont strike me as strong enough to not take profits on. Fres is showing +20% since Wed which is great but after such a big fall thats more appearance then performance in total. I will write down sell and hope for more

The autumn is more likely to lead in a consistent direction then now, thats just how it goes I think. Xmas and new year tends to be a low pressure gap of volume. For example cree go back to xmas 11 and that was great, thought as much too but was already holding

VGM is up 35% today, 90% earlier. pop and drop is how it goes, gold is a heartbreaker#Petropavlovsk up 15.32% on recovering gold prices, squeezing out short sellers as POG is one of the most shorted companies within the FTSE

Associate

I decided to sell my remaining 1500 in Gulf Keystone Petroleum this morning ( that I bought back in May) on the rumours it may be a takeover target.

Bought at 130.50 and sold at 188.20p

Wish I hadn't sold the other 1500 at 157p now but never mind.

Bought at 130.50 and sold at 188.20p

Wish I hadn't sold the other 1500 at 157p now but never mind.

Caporegime

CNR on its way back up

Associate

Sold my 3000 Essar Energy today for a small profit as I'm fed up with them not going anywhere.

Nice to see Kazakhmys back above 300p (If they carry on climbing I might even see profit this year)

Nice to see Kazakhmys back above 300p (If they carry on climbing I might even see profit this year)

Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

CNR on its way back up

Yes it is.

Yes it is. ORE stirring as well as well earlier this week, about time. Hope it's not too little too late though with the end of the summer approaching.

CNR definitely has a sparkling couple of months ahead. Woo!

Caporegime

Yes it is.

ORE stirring as well as well earlier this week, about time. Hope it's not too little too late though with the end of the summer approaching.

CNR definitely has a sparkling couple of months ahead. Woo!

Yep!

Watched my shares tick all the way down to sub 90p, knew we had an upside as somepoint, time to ride the wave, won't be making the mistake of not selling this time!

Caporegime

Soldato

- Joined

- 1 Oct 2006

- Posts

- 14,060

Yep!

Watched my shares tick all the way down to sub 90p, knew we had an upside as somepoint, time to ride the wave, won't be making the mistake of not selling this time!

When are you thinking of getting out? £4 next year might be a way off, but I'm thinking if it goes north of £2 then I'll hop out and stick a slice into ORE given it's low levels.

Dunno at the moment, see how high the wave gets...

Caporegime

When are you thinking of getting out? £4 next year might be a way off, but I'm thinking if it goes north of £2 then I'll hop out and stick a slice into ORE given it's low levels.

Dunno at the moment, see how high the wave gets...

Anything north of 190, depends how long i can hold my nerve for after missing out last time.

Would be nice to see 250+ but we will see, am in no rush for the money so could hold on.